Exxon Mobil Corp (NYSE:XOM) shares were little changed Thursday afternoon as the market paused ahead of the energy giant's third-quarter earnings release, scheduled for before the opening bell on Friday. Here’s what investors need to know.

- Get the inside scoop on XOM stock here.

What To Know: Analysts are anticipating a strong quarter, with consensus estimates projecting earnings of $1.81 per share on revenues of $84.87 billion. A conference call with executives is set for 9:30 a.m. ET.

The company enters its earnings report with several positive tailwinds. The stock benefited recently from a sector-wide rally after U.S. sanctions against Russian oil producers helped push crude prices higher, which directly boosts Exxon's profitability.

Strategically, Exxon has been expanding its global footprint, recently securing its first-ever sale of Guyanese crude oil to refiners in India, a key growth market.

Wall Street sentiment remains largely positive, with firms such as Wells Fargo and UBS recently issuing or maintaining bullish ratings. Investors now await Friday's results and management's outlook for further direction.

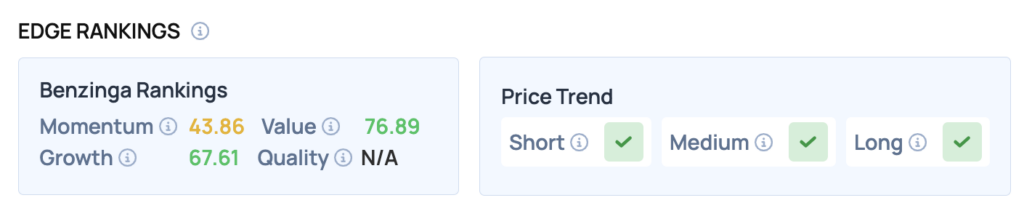

Benzinga Edge Rankings: Benzinga Edge Rankings highlight the stock’s strong fundamentals, giving it a high Value score of 76.89 and a solid Growth score of 67.61.

XOM Price Action: Exxon shares were down 1.57% at $114.69 at the time of publication on Thursday, according to data from Benzinga Pro. The stock is trading within its 52-week range of $97.80 to $123.21. Despite this pullback, Exxon has shown a solid year-to-date performance, up 7.7%, indicating resilience in a fluctuating market.

Currently, Exxon is trading approximately 2.3% above its 50-day moving average of $112.96 and about 5% above its 200-day moving average of $110.01. These moving averages suggest a bullish trend in the medium to long term, providing a supportive backdrop for the stock.

The relative strength index (RSI) stands at 61.31, signaling a neutral position, which may indicate that the stock is neither overbought nor oversold at this time.

Read Also: Meta Tumbles 10%, Google Marks Historic Rally: What’s Moving Markets Thursday?

How To Buy XOM Stock

Besides going to a brokerage platform to purchase a share — or fractional share — of stock, you can also gain access to shares either by buying an exchange traded fund (ETF) that holds the stock itself, or by allocating yourself to a strategy in your 401(k) that would seek to acquire shares in a mutual fund or other instrument.

For example, Exxon Mobil is in the Energy sector. An ETF will likely hold shares in many liquid and large companies that help track that sector, allowing an investor to gain exposure to the trends within that segment.

Image: Shutterstock