Texas-based Exxon Mobil Corporation (XOM) is a global oil and gas giant involved in exploration, production, refining, and chemicals. With a market cap of $480.3 billion, the company operates through Upstream, Energy Products, Chemical Products, and Specialty Products segments.

Shares of the oil and gas corporation have underperformed the broader market over the past 52 weeks. XOM has slumped 2.8% over this time frame, while the broader S&P 500 Index ($SPX) has gained 16.6%. Moreover, shares of XOM are up 4.9% on a YTD basis, lagging behind $SPX’s 8.3% rise.

Looking closer, Exxon Mobil has slightly trailed the Energy Select Sector SPDR Fund's (XLE) 2.7% dip over the past 52 weeks but has surpassed the ETF’s 3.8% rise on a YTD basis.

Exxon Mobil shares rose over 2% on Jul. 8 as energy stocks rallied alongside a 2-week high in WTI crude oil prices.

For the current fiscal year, ending in December 2025, analysts expect XOM's adjusted EPS to decline 15.5% year-over-year to $6.58. On the bright side, the company's earnings surprise history is solid as it beat the consensus estimates in each of the last four quarters.

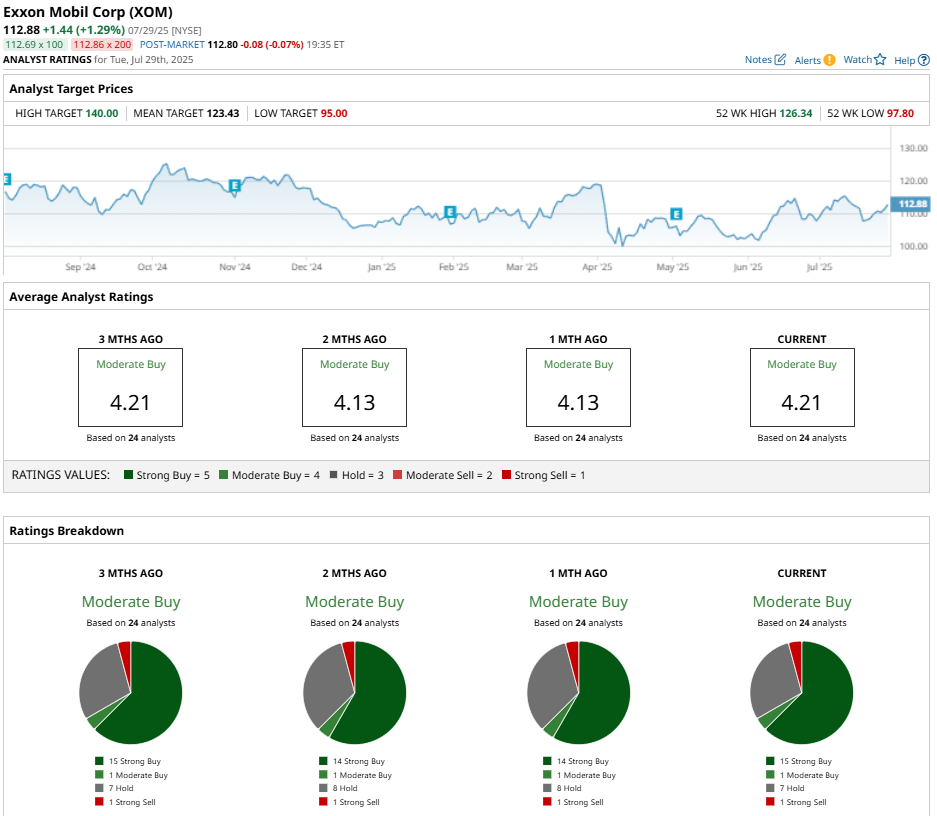

Among the 24 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 15 “Strong Buy” ratings, one “Moderate Buy,” seven “Holds,” and one “Strong Sell.”

This configuration is slightly more bullish than a month ago, with 14 “Strong Buy” ratings on the stock.

On July 11, Scotiabank raised its price target on Exxon Mobil from $115 to $125 while maintaining an “Outperform” rating. The adjustment is part of a broader update to the firm's price targets for U.S. Integrated Oil, Refining, and Large Cap E&P stocks.

XOM’s average price target of $123.43 implies an upswing of 9.3% from the current market prices. The Street-high price target of $140 implies a modest potential upside of 24% from the current price levels.