Spring, Texas-based Exxon Mobil Corporation (XOM) operates as the largest American oil & gas company. It engages in the exploration and production of crude oil and natural gas in the U.S. and internationally. Valued at $489 billion by market cap, Exxon operates through Upstream, Energy Products, Chemical Products, and Specialty Products segments.

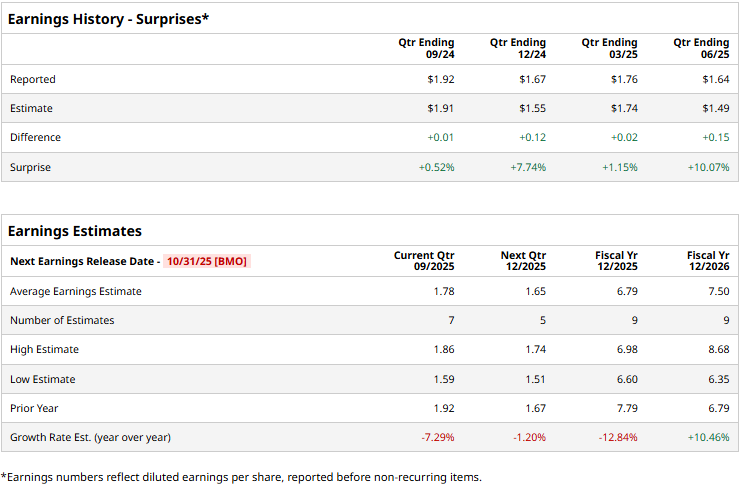

The energy giant is set to release its third-quarter results before the markets open on Friday, Oct. 31. Ahead of the event, analysts expect Exxon to deliver a non-GAAP profit of $1.78 per share, down nearly 7.3% from $1.92 per share reported in the year-ago quarter. On a positive note, the company has surpassed the Street’s bottom-line estimates in each of the past four quarters.

For the full fiscal 2025, analysts project Exxon to deliver a non-GAAP EPS of $6.79, down 12.8% from $7.79 in fiscal 2024. However, in fiscal 2026, its earnings are expected to rebound 10.5% year-over-year to $7.50 per share.

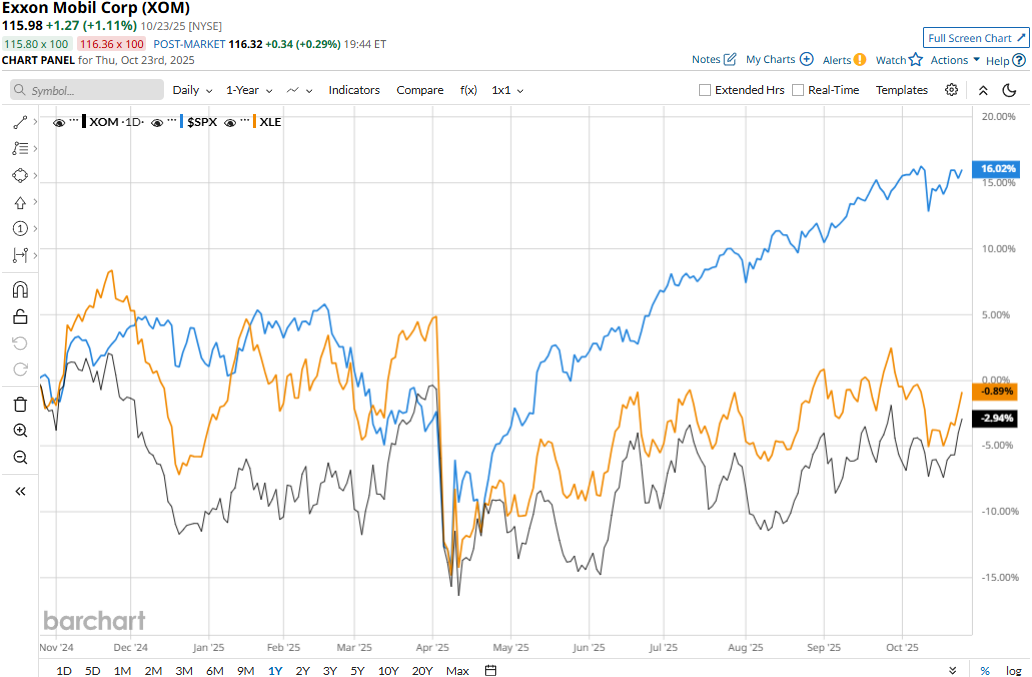

XOM stock prices have declined 3.6% over the past 52 weeks, notably lagging behind the Energy Select Sector SPDR Fund’s (XLE) marginal 94 bps dip and the S&P 500 Index’s ($SPX) 16.2% gains during the same time frame.

Exxon Mobil’s stock prices dropped 1.8% in the trading session following the release of its mixed Q2 results on Aug. 1. The quarter was marked by the highest Q2 upstream production since the merger of Exxon and Mobil more than 25 years ago. It was also the company’s best quarter yet for high-value product sales volumes in product solutions. However, due to lower commodity prices, the company’s topline for the quarter dropped 12.4% year-over-year to $81.5 billion, missing the consensus estimates by 1.6%. Meanwhile, its adjusted EPS dropped 23.4% year-over-year to $1.64, but surpassed the Street’s expectations by 10.1%.

Nonetheless, analysts remain optimistic about the stock’s longer-term prospects. XOM maintains a consensus “Moderate Buy” rating overall. Of the 27 analysts covering the stock, opinions include 15 “Strong Buys,” one “Moderate Buy,” 10 “Holds,” and one “Strong Sell.” Its mean price target of $126.12 suggests an 8.7% upside potential from current price levels.