Exxon Mobil Corporation (NYSE:XOM) will release earnings results for the second quarter before the opening bell on Friday, Aug. 1.

Analysts expect the Spring, Texas-based company to report quarterly earnings at $1.56 per share, down from $2.14 per share in the year-ago period. Exxon Mobil is projected to report quarterly revenue of $80.5 billion, compared to $93.06 billion a year earlier, according to data from Benzinga Pro.

Chevron Corporation's (NYSE:CVX) has won a dispute with Exxon Mobil over Hess Corp's (NYSE:HESS) offshore oil assets in Guyana. Exxon CEO Darren Woods confirmed the latest news in an interview with CNBC on July 18.

Exxon Mobil shares fell 0.2% to close at $111.64 on Thursday.

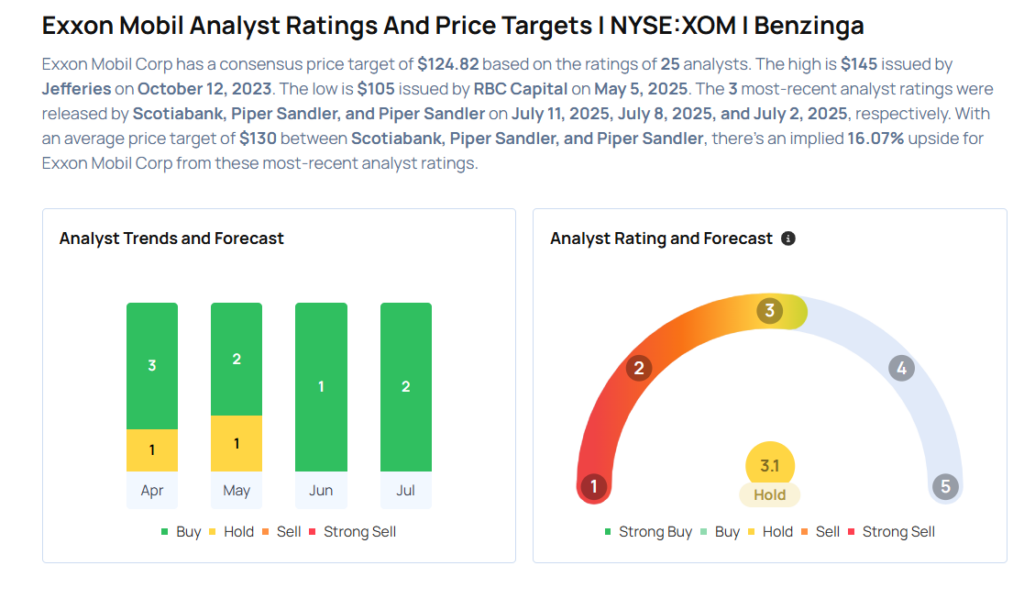

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- Piper Sandler analyst Ryan Todd maintained an Overweight rating and raised the price target from $131 to $134 on July 8, 2025. This analyst has an accuracy rate of 68%.

- Wells Fargo analyst Roger Read maintained an Overweight rating and raised the price target from $126 to $127 on June 26, 2025. This analyst has an accuracy rate of 62%.

- Morgan Stanley analyst Devin McDermott maintained an Overweight rating and cut the price target from $141 to $138 on March 27, 2025. This analyst has an accuracy rate of 78%.

- JP Morgan analyst John Royall maintained an Overweight rating and cut the price target from $130 to $125 on Dec. 16, 2024. This analyst has an accuracy rate of 61%.

- TD Cowen analyst Jason Gabelman maintained a Buy rating and raised the price target from $127 to $132 on Nov. 19, 2024. This analyst has an accuracy rate of 66%

Considering buying XOM stock? Here’s what analysts think:

Read This Next:

- Wall Street’s Most Accurate Analysts Spotlight On 3 Financial Stocks Delivering High-Dividend Yields

Photo via Shutterstock