Alex Mashinsky, the ex-CEO of bankrupt crypto lender Celsius, insisted publicly that he was clinging to his share of the company’s CEL tokens. But according to the Justice Department, he netted millions of dollars by offloading coins at inflated prices.

The DOJ claims that Mashinsky, with the help of the company's former chief revenue officer, Roni Cohen-Pavon, manipulated the price of CEL by buying millions of dollars worth of the tokens—to help keep it afloat—without revealing it publicly. In some cases, Mashinsky and Cohen-Pavon also caused Celsius to dip into its customer deposits to buy CEL and prop up its price, the DOJ alleges.

At one point, Cohen-Pavon admitted to Mashinsky that the company made up most of the purchases of CEL. “[T]he issue is that people are selling [CEL] and no one is buying except for us,” he said in a private message to Mashinsky, according to the DOJ. “[T]he main problem was that the value was fake and was based on us spending millions (~8M a week and even more until February 2020) just to keep it where it is.”

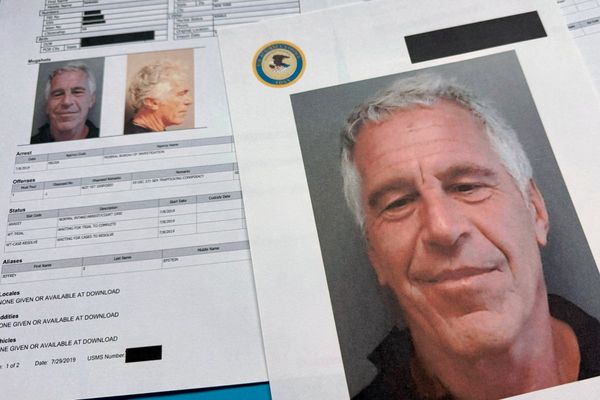

By selling tokens at inflated prices, Mashinsky took home about $42 million, while Cohen-Pavon reaped $3.6 million. Mashinsky was arrested Thursday and charged with seven counts that include wire fraud and securities fraud. He could face up to 65 years in prison if convicted.

“It's such a flagrant abuse,” said Steven Lubka, head of Swan Private at Swan Bitcoin, a financial services firm.

But a company manipulating its own cryptocurrency isn't a new idea. In December, the Securities and Exchange Commission accused Caroline Ellison, the former CEO of FTX’s trading arm, Alameda Research, of fixing the price of the now-bankrupt crypto exchange’s native coin, FTT. Ellison, at the direction of ex-FTX CEO Sam Bankman-Fried, allegedly purchased large quantities of FTT on the open market to help it maintain its price. FTT was important for FTX because it accepted the coin as collateral for loans of customer funds provided to Alameda Research, and the inflated value of FTT made it seem like the company’s exposure to risk was less than it was, according to the SEC.

The fact that Celsius and Mashinsky were manipulating CEL was not surprising to Lubka. Releasing a crypto token is an effective way for crypto firms to raise money and reward executives and investors, but these coins are also prone to manipulation.

“It's just extremely vulnerable to abuse,” Lubka told Fortune. “All the incentives line up in favor of these companies abusing the unaccountable issuance of tokens.”

Yet these types of tokens remain common. Crypto companies often provide coins to investors or executives in a manner similar to awarding stock options or equity grants in the traditional business world.

The motivation behind sharing TradFi securities is to incentivize employees to work hard to create a viable business, which in theory would increase the value of their shares. With crypto markets, Lubka continued, token grants don’t create the same type of incentive. And tokens, unlike an equity stake, can be offloaded immediately in the open market, generating massive windfalls regardless of that crypto company's success.

“The incentive," Lubka added, "is just to drive a bunch of f****** marketing hype and pump up the value of the token, and then just start selling your tokens as fast as you can."