As analysts expect electric vehicle sales to cool in the coming months due to the expiration of the $7,500 federal tax credit, a new technology might give the market a shot in the arm: extended range electric vehicles (EREVs).

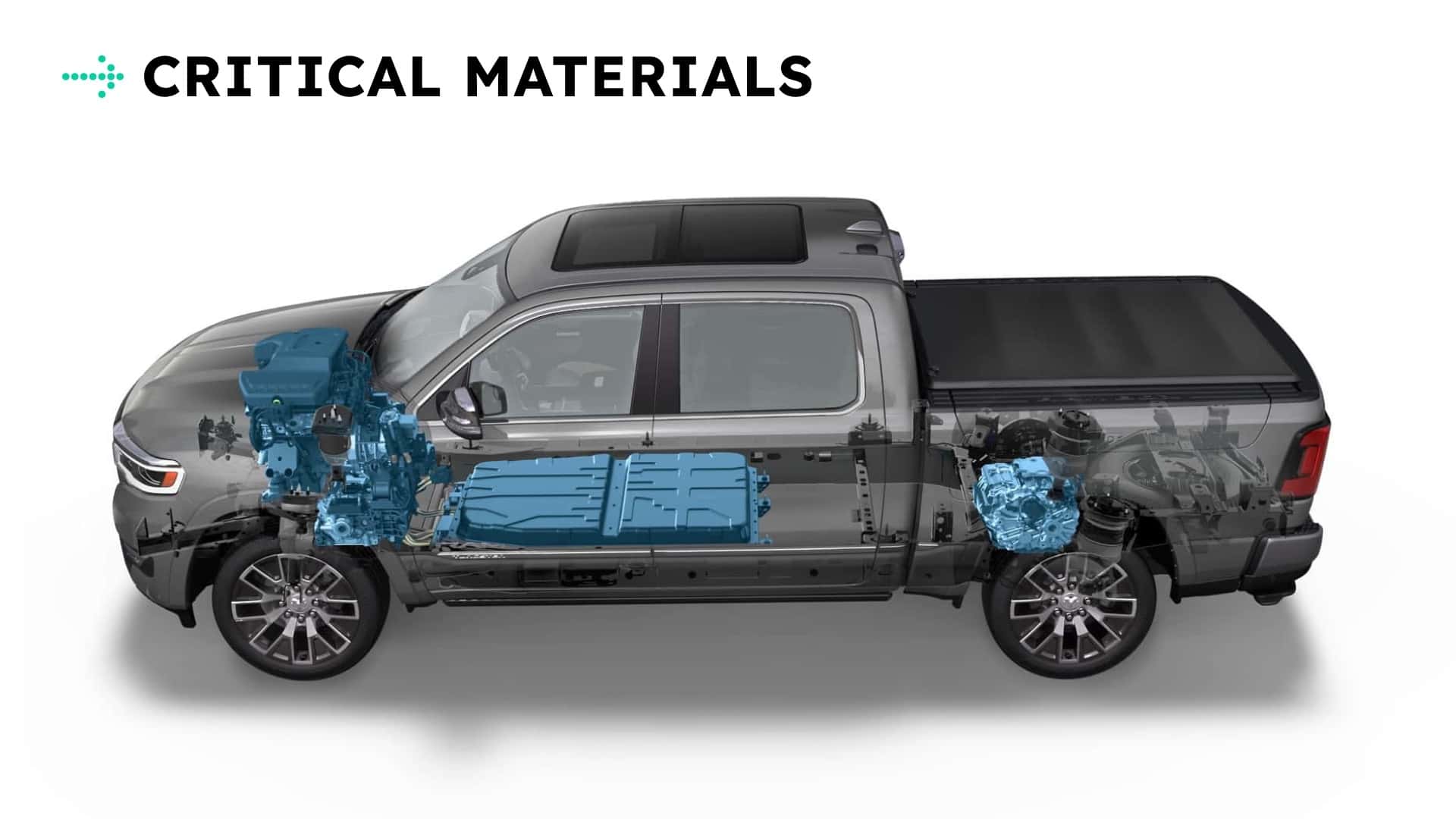

These are vehicles that have an electric powertrain, including a battery and a traction motor, along with a backup gasoline engine. The engine can charge the high-voltage battery to extend the vehicle’s range, but doesn't power the wheels directly. That job still belongs to the electric motors only.

Not everyone is happy with EREVs. A European clean transportation advocacy group has said that prolonging the life of combustion technologies would lead the auto industry nowhere, pointing towards some of the shortfalls of plug-in hybrids (PHEVs) as an example.

Welcome to the Friday edition of Critical Materials, your daily round-up of news and events shaping the world of electric cars and technology.

Also on my radar today: A huge tariff relief might be on the cards for the U.S. auto industry after the Trump administration signaled a change of course on Friday. Plus, China is making progress with solid-state batteries but doesn’t want to share that technology with the rest of the world.

30%: EREVs May Not Be That Good For The Planet

In the second quarter of this year, EREVs reached 10% of China’s new energy vehicle (NEV) market, which consists mainly of EVs and PHEVs. We’ve even tested one here at InsideEVs, when Patrick George and Kevin Williams went to China and got behind the wheel of the very impressive Lynk & Co 900.

But European clean transportation advocacy group Transport & Environment said in a new study published Thursday that EREVs in China pollute just as much as gasoline vehicles when their batteries are depleted.

Just like PHEVs, the main pro-EREV argument is that owners will regularly charge them, which will then allow them to cover the majority of their distance using battery power, reducing emissions and lowering their gas costs.

With PHEVs in Europe, studies have shown that owners barely charge them, driving mainly on gas power, which leads to equal or worse vehicle emissions and more money spent on gas.

T&E argues there’s no guarantee EREVs in Europe will be any different.

Here’s an excerpt from the study:

EREVs have technical advantages over European PHEVs thanks to their longer range, more powerful e-motors and fast-charging capability. However, current EREV models have similar drawbacks, such as a large fuel tank that allows users to predominantly drive in combustion mode.

Given the competition from European PHEVs and the fact that EREV technology is controlled by Chinese carmakers, the adoption of this transition technology in Europe remains highly uncertain.

Prolonging the life of combustion technology would push the industry into a dead end. To build a future for Europe’s car industry, the EU must stay the course, confirm the EU car CO2 targets and confidently enter the EV age.

EREVs in China are mostly large, plush models with big batteries, which won’t be ideal for Europe. But the study isn’t necessarily advocating against EREVs. Rather, the group wants a better implementation of the technology that would encourage more electric-only driving and less reliance on the dirty combustion engine.

One way to do that would be to shrink the size of the fuel tank so that drivers don’t over-rely on gasoline. Similarly, equipping them with massive engines, like the 3.6-liter V6 on the new Jeep Grand Wagoneer EREV, also won’t encourage drivers to charge these vehicles regularly—if the combustion engine can do all the heavy lifting all the time.

Chinese EREVs have been successful because their “utility factor,” which is the percentage of driving in electric mode, is more than 70%. That reaps real benefits for the climate and drivers’ wallets, minus the range anxiety. But China also has the world’s best charging network, and EV driving is baked into its social fabric, meaning drivers use EREVs as intended.

In the U.S. and Europe, we’re about to find out if that formula will actually deliver any meaningful, tangible outcome.

60%: TACO Comes For The Auto Tariffs

The U.S. government’s tariffs on imported cars and vehicle parts have rattled the auto industry, hurting carmakers’ profits and increasing prices for American consumers. But the Trump administration might announce some tariff relief measures on Friday.

Here’s what Bloomberg reported:

The Commerce Department is slated to announce a five-year extension for an arrangement that allows automakers to reduce what they pay in tariffs on imported car parts, according to people familiar with the matter. Previously, that provision was scheduled to sunset after two years.

U.S. automakers seemed to have lobbied hard for this. For the likes of Ford, General Motors, and Stellantis, the electrification transition is already hurting their bottom lines due to capital-intensive investments in battery plants and new production facilities.

With tariffs in the mix, it’s a perfect storm that automakers were navigating with great difficulty. Now they’ll welcome these relief measures with open arms.

90%: What China’s Battery Export Restrictions Mean For The World

China’s export controls on critical materials and battery technology will go into effect next month, the South China Morning Post reported, citing China’s Ministry of Commerce. This is a blow to the rest of the world. Because not only is China the world's primary source for lithium-ion batteries, but it's also leading the charge into new and improved battery tech.

The country has reportedly cracked the code for solid-state batteries that can deliver up to 600 watt-hours per kilogram of energy density, with potential for mass production by the end of the decade. The vast majority of current lithium-ion batteries have an energy density of between 200 and 300 Wh/kg.

The tech will not only allow EVs to cover longer distances, but also make them charge as fast as refueling a gas car, while making them safer and more durable.

These batteries will also have other applications, such as drones and military equipment—so the export controls make all the more sense, helping China consolidate power and extend its lead in this energy transition.

100%: Will EREVs Succeed In Western Countries?

Automakers are gearing up for an onslaught of EREVs in the coming years. Volkswagen-backed Scout Motors plans to launch not one but two extended-range electric vehicles—an SUV and a pickup truck—by 2027. Volvo, Ram, Hyundai, Nissan and Ford also have their own EREV models in development.

But will this so-called “transition technology,” as described by the T&E study, actually fulfill its purpose? Or will consumers find these systems too confusing, leading to more gasoline use and less time spent driving on battery power?

Have a tip? Contact the author: suvrat.kothari@insideevs.com