The story so far:

The Supreme Court order dated March 2, 2023 led to two parallel inquiries into contraventions of the Adani group of companies, alleged by Hindenburg Research. The U.S.-based investment research firm had alleged in January that the Adani Group was engaged in brazen stock manipulation and money laundering through shell companies; charges denied by the company. The Security and Exchange Board of India (SEBI), which was asked to investigate whether there was a violation of Rule 19A of the Securities Contracts (Regulation) Rules, 1957, sought an extension after the two-month deadline was over, and will now have to report to the apex court by August 14. In addition, a separate Expert Committee was constituted to inter alia investigate whether there has been regulatory failure in dealing with the alleged flouting of laws by the Adani Group or other companies.

The status of the SEBI probe

The SEBI was directed to probe whether the Securities Contracts (Regulation) Rules, 1957, were violated. The court wanted SEBI to find out whether Rule 19A, which stipulates that every company listed in the stock market has to maintain at least 25% public shareholding, was ignored. It was also asked to find out whether there was a failure to disclose transactions and other relevant information concerning “related parties” to SEBI, in accordance with the law; and also whether there was any manipulation of stock prices in contravention of existing laws. When SEBI sought an extension, citing complexity of the transactions it was investigating, the court granted it more time. Meanwhile, the six-member, court-appointed Expert Committee, submitted a 173-page report to the court on May 6. It has been widely reported that the expert committee has found “no regulatory failure” on the part of SEBI. A perusal of the expert committee report, however, reveals several facts as well as a sequence of events, which not only point towards regulatory failure, but regulatory capture and collapse.

What did the expert panel state?

In the committee’s findings on SEBI’s regulatory performance contained in the fourth chapter of the report, there is an indication of a gigantic scam involving serious economic offences perpetrated by the Adani group.

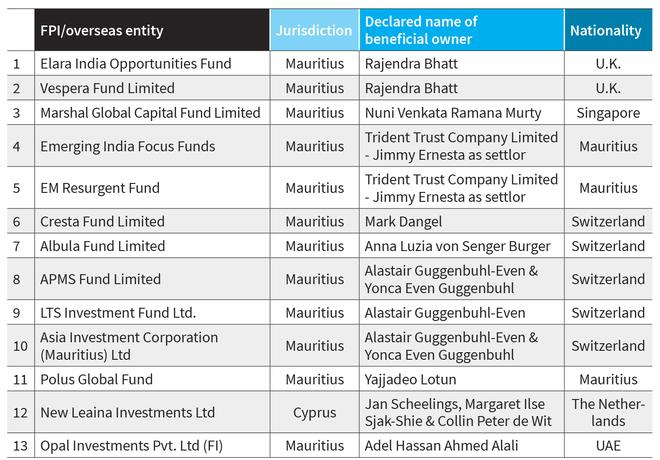

The expert committee report states that SEBI had begun investigating the Adani group companies in October 2020, following complaints received in June-July 2020. However, regulatory proceedings like the issuance of show-cause notices have not been initiated by SEBI under the ruse of being unable to establish a prima facie case. SEBI has been investigating 13 suspected overseas entities, mostly foreign portfolio investors (FPIs), based in tax havens like Mauritius, which they suspect are front companies of the Adani promoters.

This Table names the 13 overseas entities being investigated by SEBI with respect to the Adani Group.

These FPIs together held significant shares in five listed Adani group companies as on March 2020 — 15.5% in Adani Enterprises Limited/AEL, 18% in Adani Transmission Limited/ATL, 17.9% in Adani Total Gas/ATG, 20.3% in Adani Green Energy Limited/AGEL and 14.1% in Adani Power Limited/APL, as per SEBI’s compilation.

The promoter group shareholding in the five listed Adani Group companies till March 2020 was above 74%, as per their own disclosures. These listed companies would, therefore, be in violation of Rule 19A of the SCRR, 1957 if the 13 suspected overseas entities were/are front companies for the Adani Group promoters.

SEBI, despite its suspicion and investigation, however, has been unable to unearth the “ultimate beneficial owner” of these overseas entities till date. This inability to establish prima facie contraventions, however, has been effected by successive amendments to SEBI regulations related to FPIs as well as Listing Obligations and Disclosure Requirements (LODR regulations), as described in the expert committee report. A vital restriction on FPIs having an “opaque structure” was repealed and the definitions of “beneficial owners” in FPI regulations and “related party”/”related party transactions” in the LODR regulations were diluted through successive amendments in 2018 and 2019. These amendments opened regulatory loopholes, enabling the Adani Group promoters, especially Vinod Shantilal Adani, to conceal the ultimate beneficiary owner of the suspected FPIs while claiming regulatory compliance.

SEBI has approached the Enforcement Directorate (ED) and Central Board of Direct Taxes (CBDT) to further investigate in order to establish a prima facie case against the suspected FPIs. But both the ED and CBDT have formally stated that they cannot undertake investigation unless SEBI registers a case under the Prevention of Money Laundering Act, 2002 (PMLA 2002) and tax law violations, respectively. The expert committee report has characterised this investigative paralysis as a “chicken-and-egg” problem.

The intent of the amendments brought in the FPI and LODR regulations by SEBI in 2018 and 2019, seem mala fide from the subsequent amendments made in November 2021. These amendments, which sought to partially plug the regulatory loopholes opened by the earlier amendments, were made with a deferred prospective effect, when the SEBI investigation was already underway. The PMLA (Maintenance of Records) Rules, 2005 were also amended by the Department of Revenue on March 7, that is, after the SC order setting up inquiries, to amend the definition of beneficiary ownership of FPIs.

These amendments to SEBI regulations have resulted in a complete subversion of Section 12A of the SEBI Act, 1992, which explicitly prohibits contrivances and devices that are structured to bypass the law, enabling securities fraud and insider trading. The expert committee has noted: “SEBI’s pursuit of investigations is based on the premise that it is pursuing the ‘spirit of the law’, which flies in the face of the prospective amendments with deferred effect that SEBI has made on the legislative side.”

Has there been a price manipulation?

A notable aspect in the price movement of the Adani scrips is that their sharpest rise occurred when the five listed Adani companies were already under the SEBI scanner, since October 2020.

The below Table shows the indicative price movement of Adani Scrips since January 2021.

The price of an AEL share went up from ₹491 on January 1, 2021 to peak at ₹4,190 on December 21, 2022 implying an increase of 753% in almost two years. The price increase of ATL shares from January 2021 to its September 2022 peak was by 874%. ATG shares witnessed a price appreciation of 960% between January 2021 and January 2023. The BSE Sensex had risen from 47868 on January 1, 2021 to reach an all-time peak of 63583 on December 1, 2022, an appreciation of around 32% in 23 months. Thus, Adani scrips had outperformed the market by several times for a period of over two years, from January 2021 to January 2023.

The expert committee report reveals that 849 alerts were generated vis-a-vis the shares of Adani group companies through SEBI’s automated surveillance systems (ASM) between April 1, 2018 and December 31, 2022. Of these alerts, 603 were related to price volume movements, while the remaining 246 alerts were related to suspected insider trading. While SEBI has reported that the 603 alerts were closed after “processing the same as per approved (sic) standard operating procedures”, “work is in progress” on 246 alerts related to suspected insider trading.

While the large number of ASM alerts were clear signals of excess volatility in Adani scrips, SEBI did not find them “unusual” as long as their prices were rising. It is only when the Adani stock prices crashed post-Hindenburg that SEBI observed “unusual price movement” in a public statement issued on February 4, 2023. The Adani Group promoters have a history of regulatory violations, with the SEBI having indicted them for price manipulation of AEL shares in league with convicted/debarred trader Ketan Parekh; the case was settled “upon payment of certain amounts” in April 2008.

Given this history, SEBI’s public silence on the unprecedented rise in Adani scrips since October 2020, even when the companies were under investigation following complaints; alongside its unwillingness to register a case of regulatory non-compliance and legal violations against the Adani Group promoters till date, comprise prima facie evidence of regulatory failure and SEBI’s complicity in these contraventions.

The expert committee has reported that most of the price rise of AEL scrips occurred between April 1, 2021, when AEL share price was ₹1,031 and December 31, 2022, when the share price reached ₹3,859. The largest buyer of AEL shares during this period was the Life Insurance Corporation of India (LIC), buying around 4.8 crore shares. The 13 suspected FPIs were among the top net sellers during this period, having sold around 8.6 crore shares. The price movement of AEL shares was, therefore, mainly contributed by LIC and the 13 suspected FPIs, and yet the SEBI has so far concluded that it is “impossible to conclude that they (suspected FPIs) had a hand in the price rise” because they were “net sellers” during this patch.

SEBI seems to be operating under the belief that stock prices can only be manipulated through net buying and not net selling, but these large transactions — the FPIs selling 8.6 crore shares of AEL, and LIC picking up around 4.8 crore shares — should be investigated.

What were the final remarks?

Despite collating and presenting a large body of evidence of regulatory failure, as summarised above, the expert committee has drawn ambivalent conclusions like: “at this stage, taking into account the explanations provided by SEBI, supported by empirical data, prima facie, it would not be possible for the Committee to conclude that there has been a regulatory failure around the allegation of price manipulation.” It is now for the apex court bench to study the voluminous report and draw its own conclusions. Given the large body of evidence of regulatory improprieties and subversion contained in the expert committee report, the court’s focus should be on SEBI’s conduct.

Prasenjit Bose is an economist and activist based in Kolkata.