The story so far: Telecom Minister Ashwini Vaishnaw, during the recently-concluded Budget session of the Parliament, had said the state-owned telecom operator, BSNL, was now a stable entity and making operating profits. Further, the Telecom Minister informed the House that the telecom services provider would soon be able to roll out its home-grown radio and core 4G network.

Operating profit refers to the revenue remaining with a business after subtracting its variable and fixed operating costs. In contrast to net profit, it accounts for debt, one-time costs, and taxes.

In 2019, the Union Cabinet had approved a proposal to revive BSNL and MTNL which included measures such as a merger of the two entities, reducing employee-related costs, restructuring debt by raising bonds through sovereign guarantees, monetisation of assets, and administrative allotment of spectrum for providing 4G services throughout India.

Earlier this month, Minister of State for Communications Devusinh Chauhan had informed the Rajya Sabha that the merger of the state-owned telecom operators had been deferred owing to financial reasons including high debt of MTNL. Additionally, he said there was no proposal for disinvesting the two public sector undertakings (PSUs).

Specifics of the 2019 package

Merger: Former Minister of State for Communications Sanjay Dhotre had said in Lok Sabha in 2020 that a merger would help the entities acquire a pan-India footprint, create synergy in operations, reduce fixed costs and overheads, enable conditions for sharing of technical infrastructure, and enhanced enterprise business.

“Since MTNL is operating in metros of Delhi and Mumbai and BSNL operates in rest of India, merger will help in Pan-India footprint and synergy in operations,” the then Minister of Communications Ravi Shankar Prasad had said in the Rajya Sabha earlier.

The merger was expected to be completed in 18-24 months.

Allotting spectrum: The move was aimed at enabling the PSUs to provide high-speed broadband and other data services throughout the country, become competitive, and spur their average revenue per user (ARPU). The spectrum was funded by the Central government with a capital infusion of Rs 20,140 crore. In addition, the ensuing GST of Rs 3,674 crore related to the spectrum was also borne by the Centre.

U.S.-based CTIA explains that spectrums are the invisible radio frequencies on which wireless signals travel, facilitating phone calls and Internet usage. Depending on their capacity and ability to travel distances, they are categorised under ‘bands’.

At present, BSNL and MTNL together hold 116 MHz spectrum in the 900 MHz band, 6 MHZ in 1800 MHz band, 110 MHz spectrum in 2100 MHz band and 280 MHz spectrum in 2500 MHz band. The figures were put forth by Mr. Chauhan in Rajya Sabha earlier this month.

Employee cost reduction: The 2019 package offered voluntary retirement to all employees of the telecom operators aged 50 years and above through the Voluntary Retirement Scheme (VRS). As per the government’s release from the Press Information Bureau (PIB), the ex-gratia component of the scheme required an additional Rs 17,169 crore. It was informed that the Centre would bear the expenses pertaining to pension, gratuity and commutation.

It was informed in March 2020 in the Upper House that 78,569 employees of BSNL and 14,387 employees of MTNL had taken VRS.

Separately, as per the Ministry’s statement a year after the implementation of the revival package in January 2021, there was a sharp reduction in the wage bill owing to VRS, with nearly 50% of BSNL and 75% of MTNL staff reduced.

Monetising assets: This was aimed at raising resources for retiring debt, network upgradation, expansion, servicing of bonds, and meeting the operational funding requirements. MTNL identified 52 properties with a tentative value of Rs 22,581 crore, whilst BSNL identified 20 properties with a tentative value of Rs 24,980 crore for monetisation. The figures were tabled by Mr. Dhotre in Rajya Sabha in 2020.

The Dept of Investment and Public Asset Management (DIPAM) facilitating the entire asset monetisation process explains that many public sector assets are sub-optimally utilised and could be appropriately monetised for greater financial leverage and value for the companies and of the government’s equity invested in them. It states the objective is to, “... create hitherto unexplored sources of income for the company and its shareholders, and contribute to a more accurate estimation of public assets which would help in better financial management of government/public resources over time.”

Current Minister of State for Communications Devusinh Chauhan informed the Upper House earlier this month that DIPAM had approved monetisation of six land and building assets of MTNL, with a tentative value of Rs 5,158 crore in Phase 1. He added that International Property Consultants (IPCs) have been appointed for the same. Of the six properties, two had been taken for e-auction at a reserved price of Rs 290 crores.

Restructuring debt: The proposal said the two PSUs would raise long-term bonds of Rs 15,000 crore for which the Centre would provide sovereign guarantee. Using the same, the two entities would restructure their existing debt and also partly meet their capital expenditure, operational expenditure and other requirements.

“BSNL and MTNL have very successfully raised money from the bond route. In the recent bond-offer of MTNL, the issue was subscribed more than 3 times and for BSNL more than 2 times,” the Communications Ministry stated in January 2021.

Where are we now?

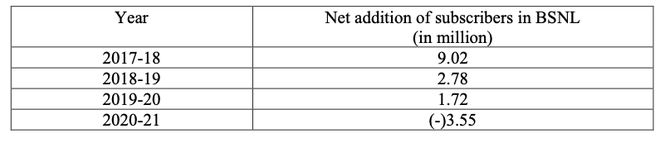

As on December 31, as per figures laid in Rajya Sabha, BSNL had approximately 12.2 crore telephone subscribers whilst MTNL had more than 60.1 lakh telephone subscribers. BSNL’s market share among telephone subscribers stood at 10.15% on the same date. Segment-wise, its market share in wireless subscription stood at 9.69%, wireline subscription at 32.48% and broadband at 2.93%.

The Dept of Telecommunications (DoT) had classified BSNL as ‘incipient sick’ in September 2017. It was incurring losses since 2009-10. The Centre informed in January 2021 that both entities had turned positive EBITDA (earnings before interest, taxes, depreciation and amortisation) in the first six months of that financial year. BSNL’s EBITDA rose to positive Rs 602 crore in the mentioned period from negative Rs 3,596 crore for half year ending September 2019. MTNL’s EBITDA rose to positive Rs 276 crore for the mentioned period compared to negative Rs 549 crore in the comparative period.

BSNL narrowed its losses to Rs 7,441 crore in 2020-21 from Rs 15,500 crore in 2019-20. Its total expenditure stood at Rs 26,036 crore as revenues came to Rs 18,595 crore in 2020-21. The figures were tabled in Rajya Sabha earlier this month.

MTNL’s total revenue was Rs 1,788 crore. Its total expenditure stood at Rs 4,243 crore.