Expion360 Inc. (NASDAQ:XPON) shares jumped 62.6% to $2.13 in after-hours trading on Wednesday.

Record Revenue Growth Drives Investor Optimism

The surge in the Oregon-based company follows the release of impressive second-quarter results. The Expion360 reported record quarterly revenue growth that significantly exceeded market expectations.

According to the Benzinga Pro data, XPON closed regular trading at $1.31, representing an 11.02% gain, before extending those gains substantially in the extended trading session. This after-hours movement reflects strong investor confidence in the company’s growth trajectory and operational improvements.

Sixth Consecutive Quarter of Growth Powers Results

The second-quarter net sales totaled $3 million, up 134% from the second quarter of 2024 and up 46% from the first quarter of 2025, marking the company’s sixth consecutive quarter of sales growth. CEO Brian Schaffner highlighted that the quarter featured “two of the most successful sales months in our history.”

See Also: Dow Surges More Than 400 Points: Investor Sentiment Improves, Fear Index Remains In ‘Greed’ Zone

The revenue surge was primarily driven by strong organic sales within Expion360’s customer base of dealers, distributors, OEMs, and private label clients. First half 2025 net sales of $5 million increased 124% from the first half of 2024, demonstrating consistent momentum across multiple quarters.

Margin Pressures Offset by Volume Gains

Despite the strong revenue performance, gross margins faced headwinds. Gross margin decreased from 24% in the first quarter to 21% in the second quarter, primarily due to ongoing tariff uncertainty and increased volume of lower-margin and pass-through product sales.

Management has implemented several mitigation strategies, including adding 6-12 months of inventory before new tariffs were introduced and transitioning certain products to U.S.-based manufacturers. These efforts have begun showing results, particularly for steel and aluminum accessories, where costs have decreased in the current tariff environment.

NASDAQ Compliance and Strategic Initiatives

The lithium iron phosphate battery manufacturer also achieved a significant milestone by regaining compliance with NASDAQ minimum bid price, ensuring its continued listing on the NASDAQ Capital Market. The Company’s common stock closed above $1.00 per share for more than ten consecutive trading days, satisfying the minimum bid price requirement.

Expion360 is also advancing its Home Energy Storage Solutions (HESS), with one product achieving UL9540 certification and a second in final approval stages. This certification is crucial for qualifying for tax credits in states like California, opening new market opportunities in the residential and small business sectors.

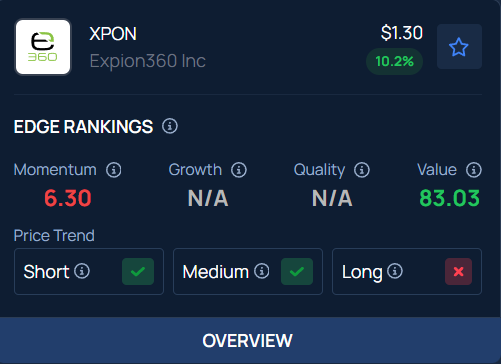

XPON Value score stands at 83.03, with an upward price trend in the short and medium term as indicated by Benzinga’s Edge Stock Rankings. Here is how the stock fares on other parameters.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo Courtesy: insta_photos on Shutterstock.com