/Expeditors%20International%20Of%20Washington%2C%20Inc_%20logo%20on%20screen-by%20madamF%20via%20Shutterstock.jpg)

Expeditors International of Washington, Inc. (EXPD) is a Fortune 500 logistics powerhouse based in Seattle that specializes in customized, tech-enabled supply chain solutions. Leveraging a seamlessly integrated global network of 331 locations across 109 countries, the company supports businesses with end-to-end logistics coordination across six continents.

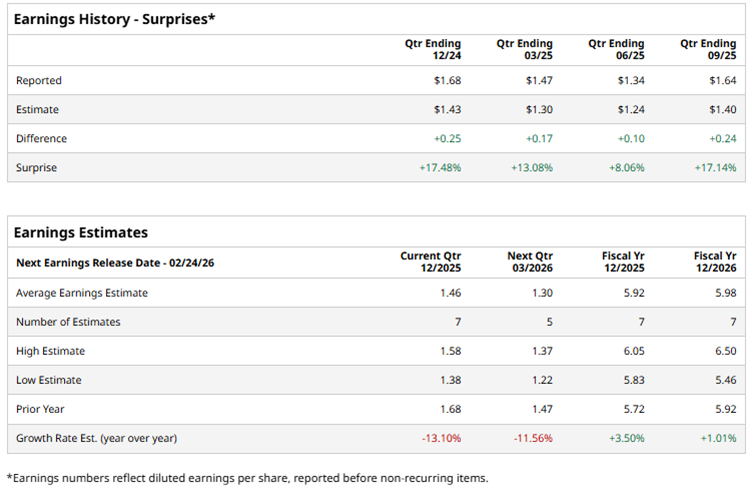

Currently standing at a market capitalization of about $22 billion, Expeditors is scheduled to report its fiscal 2025 fourth-quarter earnings by the end of February. And ahead of this event, Wall Street is projecting a 13.1% year-over-year drop in Q4 earnings to $1.46 per share.

Still, the company enters the results with credibility, having beaten analysts’ bottom-line estimates in each of the past four quarters. Looking further ahead, analysts expect the company’s full-year 2025 EPS to come in at $5.92, up 3.5% year over year, followed by another 1% rise to $5.98 in 2026.

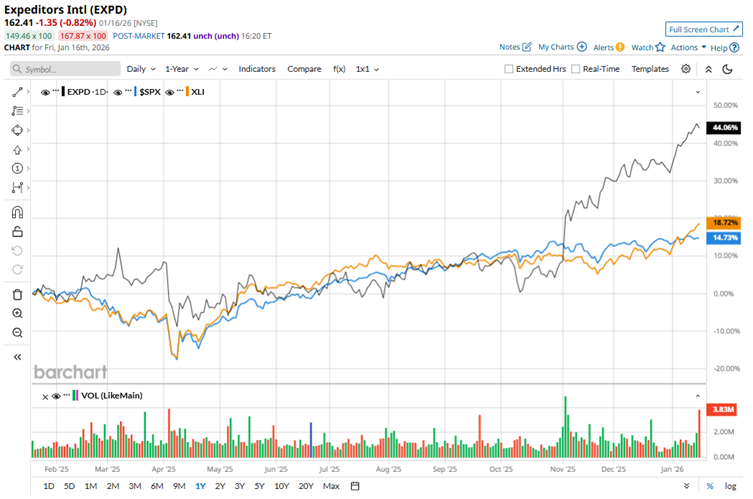

Expeditors captured investors’ attention in 2025 with a powerful rally, benefiting from continued optimism around global freight and logistics demand. Shares have skyrocketed 46% over the past year, delivering a commanding performance compared to the broader S&P 500 Index’s ($SPX) 16.9% return and the Industrial Select Sector SPDR Fund’s (XLI) 21.9% gain over the same period.

Expeditors’ latest quarterly report, posted last year in November, delivered a tale of contrasts. While Q3 revenue fell 4% annually to $2.9 billion, it still managed to beat forecasts of $2.7 billion, signaling resilient demand. Profitability stood out even more. EPS edged higher to $1.64, crushing expectations by over 17%. Adding to the positives, airfreight volumes climbed 4%. The company also rewarded shareholders with $725 million via buybacks and dividends.

Even after its strong price performance, Expeditors has failed to win over most analysts, earning a consensus “Hold” rating. Of the 15 analysts covering the stock, sentiment is split. Two recommend a “Strong Buy,” seven take a neutral “Hold” stance, one suggests a “Moderate Sell,” and five are more bearish with a “Strong Sell” rating.

Although EXPD is already trading above its average analyst price target of $138.85, the Street’s most bullish estimate of $179 implies that the stock could still have roughly 10.2% upside from current levels, leaving room for further gains

.jpg?w=600)