With a market cap of $45.4 billion, Exelon Corporation (EXC) is one of the nation’s largest electric utility companies, specializing in energy distribution and transmission. Through its six fully regulated utilities, Exelon delivers electricity and natural gas to a wide range of customers while investing in grid modernization and clean energy solutions.

Shares of the Chicago, Illinois-based company have outperformed the broader market over the past 52 weeks. EXC stock has returned 16.7% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 14.5%. Moreover, shares of Exelon are up 18.6% on a YTD basis, compared to SPX's nearly 6% gain.

Looking closer, the energy company stock has also outpaced the Utilities Select Sector SPDR Fund's (XLU) 15.6% rise over the past 52 weeks.

Despite reporting weaker-than-expected Q2 2025 revenue of $5.4 billion, shares of Exelon rose 1.5% on Jul. 31, largely due to EPS of $0.39, beating the analyst consensus. Investors were also encouraged by Exelon reaffirming its full-year 2025 profit forecast of $2.64 to $2.74 per share, in line with the analyst expectations. Additionally, optimism grew around Exelon’s potential expansion into power generation to meet 33 gigawatts of data center demand.

For the fiscal year ending in December 2025, analysts expect EXC's EPS to grow 7.6% year-over-year to $2.69. The company's earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

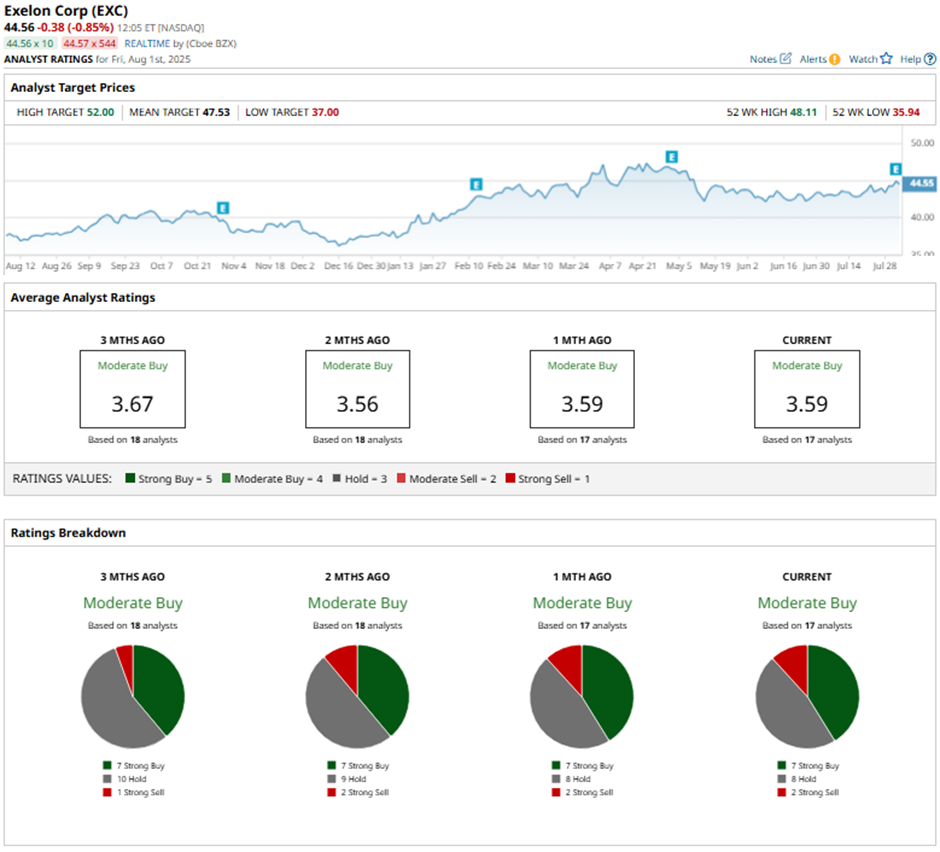

Among the 17 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on seven “Strong Buy” ratings, eight “Holds,” and two “Strong Sells.”

On Jul. 16, KeyBanc lowered its price target on Exelon to $37, maintaining an “Underweight” rating.

As of writing, the stock is trading below the mean price target of $47.53. The Street-high price target of $52 implies a potential upside of 16.7%.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.