Exelon Corporation (EXC) is headquartered in Chicago, Illinois and stands out as a major player in the utility sector, focusing on energy distribution and transmission. Its main operations involve delivering electricity and natural gas to millions of customers while managing regulated utility subsidiaries and offering a wide array of support services, from engineering to supply management.

With a market capitalization of $47.32 billion, the company emphasizes efficient service delivery and innovation across its network, maintaining a strong reputation for reliability and customer focus.

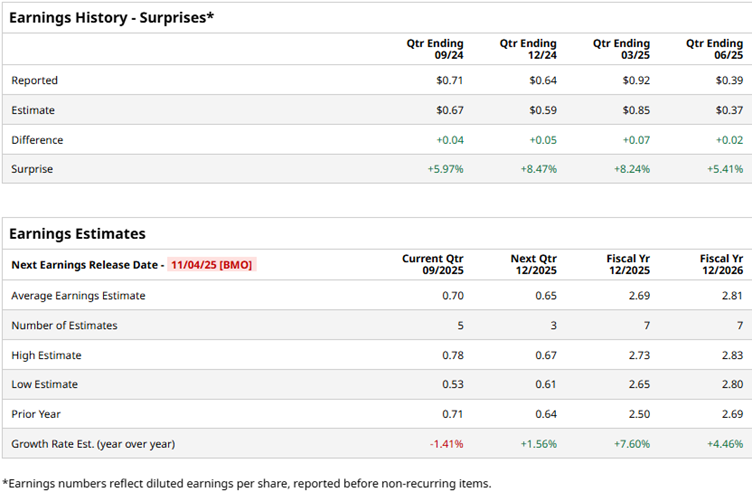

Exelon is set to report its third-quarter results on Nov. 4, before the market opens. Ahead of the results, Wall Street analysts have a mixed view of the company’s bottom-line growth trajectory. For the third quarter, they expect its profit to decline by 1.4% year-over-year (YOY) to $0.70 per diluted share. On the other hand, for the current fiscal year, its profit is expected to grow by 7.6% annually to $2.69 per diluted share.

The company has a solid history of surpassing consensus estimates, topping them in each of the trailing four quarters.

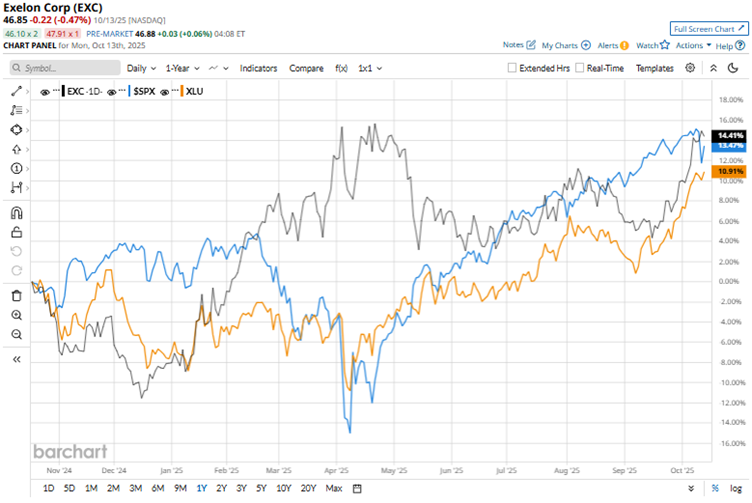

Exelon’s stock has outperformed the broader market over the past year, although not without fluctuations. Over the past 52 weeks, the stock has gained 17.9%, while it is up by 24.5% year-to-date (YTD). Comparing this to the broader S&P 500 Index ($SPX), which has gained 14.4% and 13.1% over the same periods, respectively, we see a clear outperformance.

Exelon has also outperformed its sector over these periods, as the Utilities Select Sector SPDR Fund (XLU) has increased by 14.7% over the past 52 weeks and 20.1% YTD.

On July 31, Exelon reported mixed second-quarter results. The company’s operating revenues increased 1.2% YOY to $5.43 billion, below Wall Street analysts’ expected $5.53 billion. However, the stock gained 1.5% intraday. This was probably because, despite a 17% YOY drop due to lower utility earnings, its adjusted EPS was reported at $0.39, above the expected $0.37.

Exelon also reaffirmed its full-year 2025 adjusted operating earnings guidance in the range of $2.64 per share to $2.74 per share, and operating EPS compounded annual growth in the 5% to 7% range from 2024 to 2028.

Wall Street analysts have been soundly bullish about Exelon’s future. Among the 18 analysts covering the stock, the consensus rating is “Moderate Buy.” That’s based on seven “Strong Buys,” nine “Holds,” and two “Strong Sells.” The current setup is more bullish than it was a month ago, with seven “Strong Buy” ratings now, up from six.

The mean price target of $48.07 indicates a 2.6% upside from current levels, while the Street-high price target of $57 implies a 21.7% upside.