Ever wanted to own an autograph from the Oracle of Omaha Warren Buffett? While you may not be able to afford your own autograph to display at your home, you can buy shares of an autograph from the legendary investor thanks to an alternative investment platform.

The Buffett Autograph: Alternative investment platform and fractional investing company Rally is debuting a Buffett autograph Thursday.

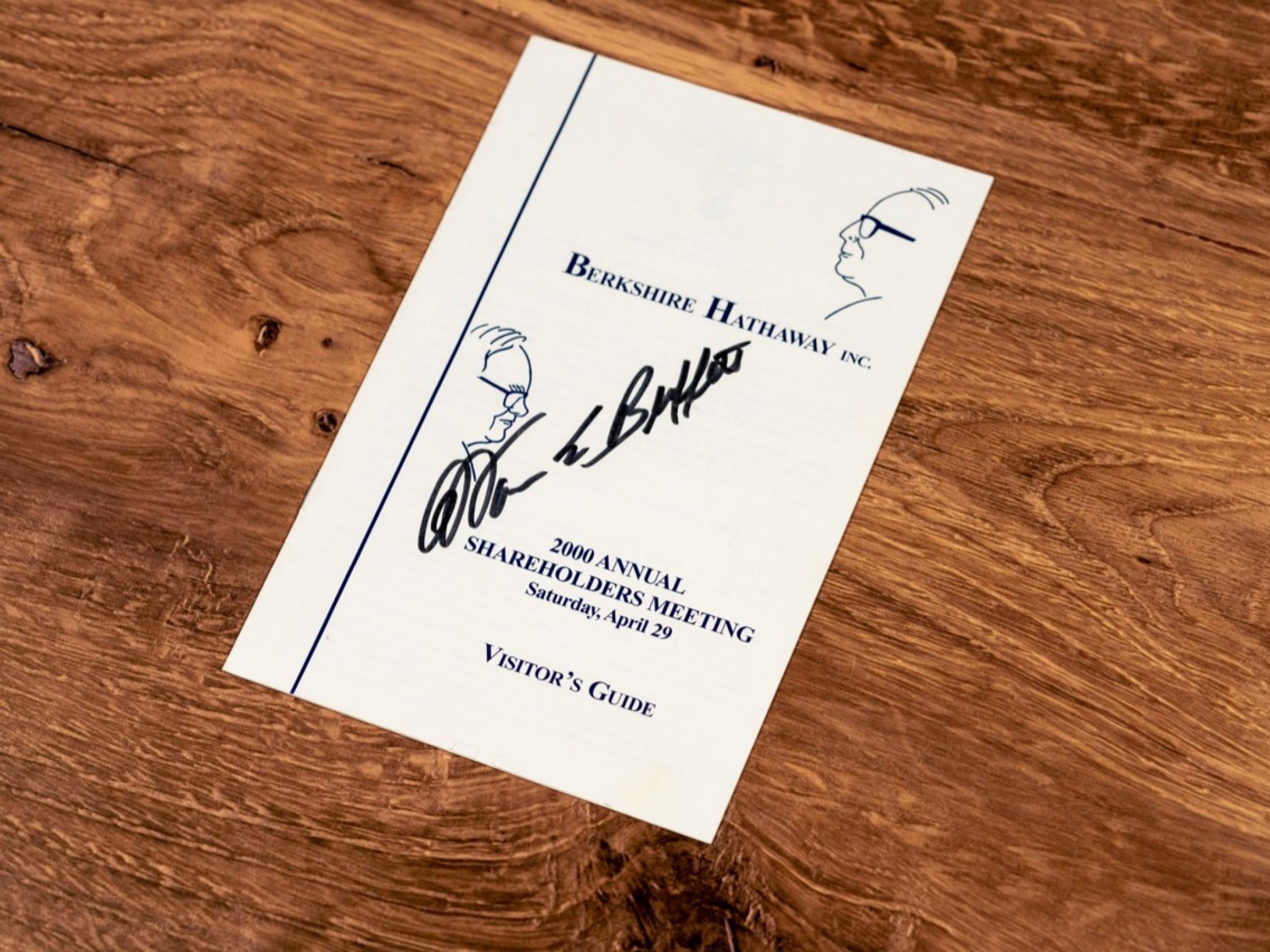

The autograph from Buffett is on the 2000 annual shareholder meeting guide for Berkshire Hathaway Inc (NYSE: BRK-A) (NYSE: BRK-B).

On Rally, investments are traded similar to stocks, with shares offered in an initial offering. The asset then trades months from its IPO with users being able to submit bids and asks to acquire shares.

The autograph is valued at $15,000 and will be sold in 5,000 shares at $3 each.

“We’ve been looking for Warren Buffett assets and collectibles for some time,” Rally co-founder and Chief Product Officer Rob Petrozzo told Benzinga.

The autograph is on a Berkshire Hathaway annual shareholder meeting pamphlet, which represents the “Woodstock for capitalism.”

Petrozzo called the event a “moment in time, something that he’s known for,” adding that Buffett is "somebody that people always want to hear from."

Petrozzo said the annual shareholder meeting is symbolic and has served as a barometer for the market, which makes the autograph important for financial history.

Related Link: Exclusive: Rally Rd Founder On Video Games, Apple Assets And Growth Of Fractional Investing

Buffett Autograph History: Petrozzo told Benzinga that autographs from Buffett are increasingly rare.

“There are assets signed by Warren Buffett that will pop up on eBay,” Petrozzo said of the auction and marketplace site eBay Inc (NASDAQ:EBAY).

Petrozzo said it’s hard to know where the autographs come from and most are unauthenticated. The asset on Rally is authenticated by JSA with the autograph receiving a “10” grade.

The Rally co-founder said Buffett autographs that do pop up can be on items like a baseball or a $1 bill, but are rarely on a Berkshire Hathaway meeting pamphlet.

Petrozzo said there aren’t a ton of Buffett autographs entering the market, something that isn’t likely to change with his typical very structured daily routine.

At 91 years of age, Buffett’s public appearances might slow down, making autographs more rare and leading to the question of whether the autograph could go up in value when the unfortunate event of Buffett’s death comes.

“It’s hard not to look at someone’s age and think inevitably the story that they’re writing will come to an end,” Petrozzo said.

Petrozzo said he doesn’t foresee Buffett's passing having a huge impact on the price due to the already low number of autographs in circulation.

Autograph Market: Over the years, Rally has expanded its offerings on its platform. Along with trading cards, books, wine, cars, tickets and NFTs, Rally also offers autographs from presidents, athletes and business leaders.

The company has several Apple Inc (NASDAQ:AAPL) related products that feature autographs from co-founders Steve Wozniak and Steve Jobs.

Rally also recently offered an autographed $1 bill from Tesla Inc (NASDAQ:TSLA) CEO Elon Musk, which sold out in its first day.

Petrozzo said Buffett’s name is up there with other top names in their respective fields and he has spanned multiple generations, multiple decades and provided value to shareholders.

“It’s hard to say Warren Buffett’s legacy doesn’t match up to some of the biggest names at the top of their game,” Petrozzo said.

Petrozzo said Rally is always looking to add more autographs to the platform, including some top names in the business world.

The Rally co-founder sees an overlap between Rally users and the stock market, with many of the users on the platform taking finance seriously and always tracking the business market.

This has led to demand for autographs from top names like Jobs, Musk and Buffett.

“I think if it’s a relevant name, it's going to be relevant in the future.”