REIT Classifications: When investing in real estate investment trusts (REITs), it is important to understand the two main types: mortgage REITs and equity REITs. Mortgage REITs generate income by underwriting or purchasing mortgages for the operators of the real estate. While equity REITs typically earn income through the rents of their tenants on their real estate assets.

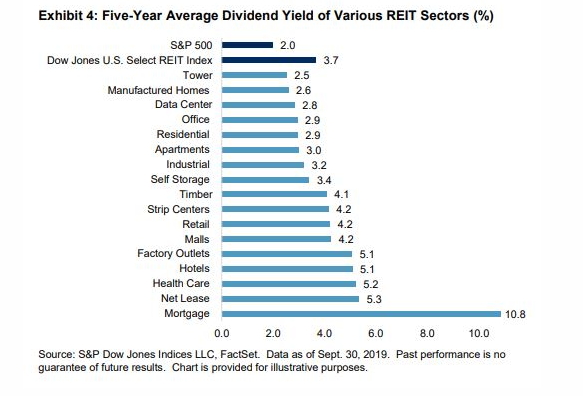

A benefit to investing in mortgage REITs is that they typically have higher yields than equity REITs, with a five-year average dividend yield of 10.8% amongst the various REIT sectors, as reported by S&P Global.

As the cannabis REIT space has exploded over the past few years, this new emerging market will now be tested as rising interest rates pose the possibility of tenants failing to meet payments as well as increasing the cost of capital for lenders.

If legislation such as the SAFE Banking Act were to be passed, then lenders would find it easier to reduce their cost of capital, issue bonds at a lower cost, as well as see their lines of credit come down.

As cannabis legislation is expected to ease, the total legal cannabis market is estimated to grow by a 14% compounded annual growth rate through 2025, Pelorus Equity Group reported.

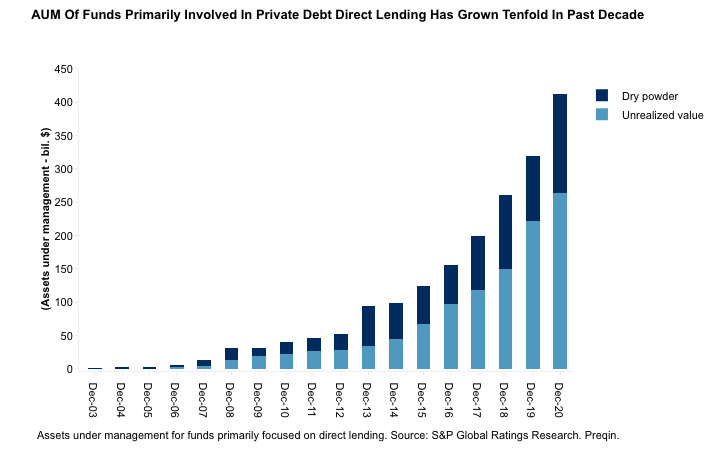

Private Mortgage REIT: Over the past ten years, the private debt market has received a massive allocation of capital with assets under management involved in direct lending of $412 billion as of 2020, since investors are in search of higher yields, according to S&P Global. Although not in the spotlight of the public markets, Pelorus Equity Group is the first dedicated cannabis-use commercial real estate lender to exclusively lend to the cannabis sector since 2016, structured as a private mortgage REIT.

Since 2014 Pelorus has underwritten more than 2,000 loans in the cannabis sector, then in 2016 the firm began originating loans in the sector, completing 72 transactions with 37 payoffs.

Pelorus has deployed $513 million in the cannabis lending sector since 2016, and is projected to have more assets under management than the top three cannabis REITs in the market. The private firm offers monthly distributions, achieving an annualized yield of 12% to 15% internal rate of return every year it's been in full operation.

Pelorus takes a more conservative approach when issuing new debt, as the firm looks for operators with a high level of experience and superior sponsors, with its initial lease terms being 18 months to 5 years. It is important to note Pelorus earns its income through its loans, while having a less restrictive covenant policy than its peers, and investing in locations with unlimited licenses since it is easier to replace tenants.

Many cannabis REITs in the market are following more of a Business Development Company (BDC) model, as they structure loans comparable to the corporate lending model except they also have elements similar to venture capital-like investments. This gives investors exposure to the debt or equity and sometimes both in primarily smaller firms. These specialty finance companies can make investments in financially distressed firms or emerging markets, that are often iliquid and not investment grade.

Another reason why Pelorus is more risk averse than its peers in the public sector is because it lends its money based on the cost basis of the real estate, instead of giving value to the tenants' future cash flows and licenses.

Travis Goad, Managing Partner of Pelorus Equity Group mentioned that the firm, “Is close to a true real estate model as it gets lending based on 60% to 75% of the value of the real estate, while its peers are lending based on 150% to 180% of its real estate value.”

Furthermore, Pelorus has the ability to foreclose directly which gives them the advantage of holding the asset until it can be repositioned for a profit, while firms such as Chicago Atlantic Real Estate Finance Inc. (NASDAQ:REFI) forfeited the ability to foreclose directly when listing on the NASDAQ. Firms such like Chicago Atlantic will typically sell the note at a discount to an arm's length third party, and will lose some of the rights to the asset.

Even though the firm takes a conservative approach when assessing the market, they are still aggressively raising capital, “averaging $10 to $20 million raised per month, has raised $265 million in equity, and never dilutes its investors,” said Rob Sechrist, President of Pelorus Equity Group.

As Pelorus investors are also able to receive equity on the upside without paying for it, its equity kickers can be realized in the form of warrants or options on the operator of the loan.

Pelorus has an accessible pipeline, “north of $500 million, and is expecting another robust year for 2023,” commented Goad.

Public REITs: Moving forward, Chicago Atlantic is a commercial real estate finance company that manages a diversified portfolio of real estate credit investments primarily in the cannabis space and is actively investing across the value chain, primarily generating revenues through its mortgages. Chicago Atlantic closed $1.4 billion in loans since platform inception, and has deployed $357.1 million across 22 portfolio companies as of June 30, 2022.

Chicago Atlantic has closed 46 cannabis loans and has an $850 million near-term pipeline under evaluation, with a gross portfolio yield of 17.7%. Additionally, Chicago Atlantic also offers an 8.5% equity incentive plan with 0.5% granted at the completion of the IPO and 8% granted at the discretion of the board based on company performance after its IPO, and a 1.5% annual management fee on equity.

When evaluating its loan portfolio, Chicago Atlantic not only gives value to the real estate, but the firm also issues additional collateral to the licenses and accounts receivable of its operators, along with the equipment. What investors need to know is that although the license is being evaluated for additional collateral, it is typically being written off and passed onto the balance sheets within a few years.

The strategy for Chicago Atlantic focuses on loans with shorter durations with an initial term of three years, while automatically renewing every year for an additional one-year period, unless Chicago Atlantic or the manager elects not to renew.

Furthermore, Chicago Atlantic prefers to lend to borrowers in limited-license states with vertically integrated operations. Limited-license states such as Florida tend to have higher barriers to entry than unlimited-license states, as the premiums of their licenses tend to be higher in their first sale. Investors should consider that limited-license states will eventually extend or issue new licenses as regulations change.

“In order to protect book value while remaining conservatively leveraged, we have elected to limit additional growth in the REIT portfolio that would require funding from a dilutive equity or debt offering and rather meet the strong demand in our large loan pipeline through the Chicago Atlantic platform for the time being,” commented John Mazarakis, Executive Chairman of Chicago Atlantic.

What About Equity REITs?: Now let's take a look at equity REITs. Innovative Industrial Properties Inc. (NYSE:IIPR) which was founded in 2016, and was the first publicly traded company on the New York Stock Exchange to provide real estate capital to the regulated cannabis industry. Although the classification of Innovative Properties is different, the cannabis REIT industry is still very much fragmented, as no firm has a majority market share.

The firm is focused on acquiring well-capitalized industrial and retail properties leased to state-licensed cannabis operators under long-term, net lease agreements. When conducting a sale-leaseback, Innovative Industrial buys property from an existing cannabis operator, then leases it back to them over the long-term. Although sale-leasebacks can offer significant cash flows and tax benefits for cannabis operators, they no longer own the real estate.

When underwriting a sale-leaseback, Innovative Industrial Properties evaluates the financial projections using historical knowledge of the industry. Therefore, the firm analyzes the financial statements, strategic initiatives, and growth plans of its operators, before giving enterprise value to the firm.

Innovative Industrial currently owns 110 properties, accounting for 88 leases, with 15 to 20-year initial lease terms and 5 years for traditional industrial leases. Innovative Industrial has also committed $2.4 billion in capital as of the second quarter, and has approximately $2.5 billion in total gross assets, as of August 3, 2022.

The Last Word: When investing in the world of cannabis REITs, investors must be wary since the classifications and strategies vary amongs these firms. At the end of the day, investors should consider their risk tolerance and goals, in deciding when and where to invest their capital.