As Nvidia Corp. (NASDAQ:NVDA) turned the most valuable publicly traded company on Thursday, inching closer to a $4 trillion market capitalization, this multinational technology company, nicknamed ‘Big Blue,’ has outperformed the Magnificent 7 and the Jensen Huang-led tech giant in 2025.

What Happened: International Business Machines Corp. (NYSE:IBM) has quietly outpaced the gains in Magnificent 7 stocks on a year-to-date basis, emerging as one of the most profitable artificial intelligence plays this year.

IBM’s generative AI book of business has surpassed $5 billion since its inception, a clear indicator of customer demand. The stock has returned 32.75% YTD, higher than Nvidia’s 15.20% gains and also much higher than all the other Magnificent 7 stocks.

Even on a five-year basis, IBM has outperformed four out of seven Mag 7 components.

Moreover, the stock has also gained more than the exchange-traded fund tracking the Magnificent 7 stocks, Roundhill Magnificent Seven ETF (BATS:MAGS).

| Stocks | YTD Performance | One-Year Performance | Five-Year Performance |

| Nvidia Corporation (NASDAQ:NVDA) | 15.20% | 26.63% | 1558.06% |

| Apple Inc. (NASDAQ:AAPL) | -12.43% | -5.65% | 134.59% |

| Microsoft Corp. (NASDAQ:MSFT) | 19.17% | 6.69% | 141.85% |

| Amazon.com Inc. (NASDAQ:AMZN) | 1.45% | 11.70% | 54.60% |

| Alphabet Inc. (NASDAQ:GOOG) | -5.29% | -5.94% | 146.52% |

| Meta Platforms Inc. (NASDAQ:META) | 19.99% | 33.17% | 208.03% |

| Tesla Inc. (NASDAQ:TSLA) | -16.86% | 25.38% | 291.35% |

| Roundhill Magnificent Seven ETF (BATS:MAGS) | 3.27% | 14.47% | 123.1% (Since 2023) |

| International Business Machines Corp. (NYSE:IBM) | 32.75% | 65.87% | 155.37% |

Why It Matters: Apart from AI, IBM also emerged as one of the top investors alongside Alphabet Inc. (NASDAQ:GOOG) (NASDAQ:GOOGL), making significant investments in the quantum computing space on a year-to-date basis.

According to the data shared by Martin Shkreli in mid-June, there was a steep drop in the number of quantum computing patents issued after IBM and Google, suggesting that other companies are either smaller players or not prioritizing quantum computing as heavily.

Meanwhile, highlighting the tariff impact during the first quarter earnings call, IBM's CFO and Senior Vice President, James Kavanaugh, said that the company was exploring alternatives to mitigate any indirect effects because the direct tariff impact was "minimal."

"Goods imported to the U.S. represent less than 5% of our overall spend, and under current U.S. tariff policy, the impact to IBM is minimal. While we have limited direct exposure outside the United States, we are tactically evaluating alternative sources and other strategies to mitigate tariffs," he said.

Talking about the impact of DOGE-related initiatives, its Chairman, President, and CEO, Arvind Krishna, highlighted that its consulting business was "susceptible to discretionary pullbacks and DOGE-related initiatives."

The company is set to report its second-quarter earnings on July 24. -.

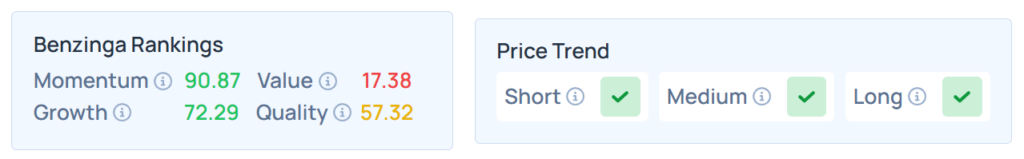

Benzinga Edge Stock Rankings shows that IBM had a stronger price trend over the short, medium, and long term. Its momentum ranking was solid, and its value ranking was poor at the 17.38th percentile. The details of other metrics are available here.

Price Action: On the truncated trading day of July 3rd, the SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, scaled fresh records and ended higher. The SPY was up 0.79% at $625.34, while the QQQ advanced 0.98% to $556.22, according to Benzinga Pro data.

Read Next:

Photo courtesy: MacroEcon / Shutterstock.com