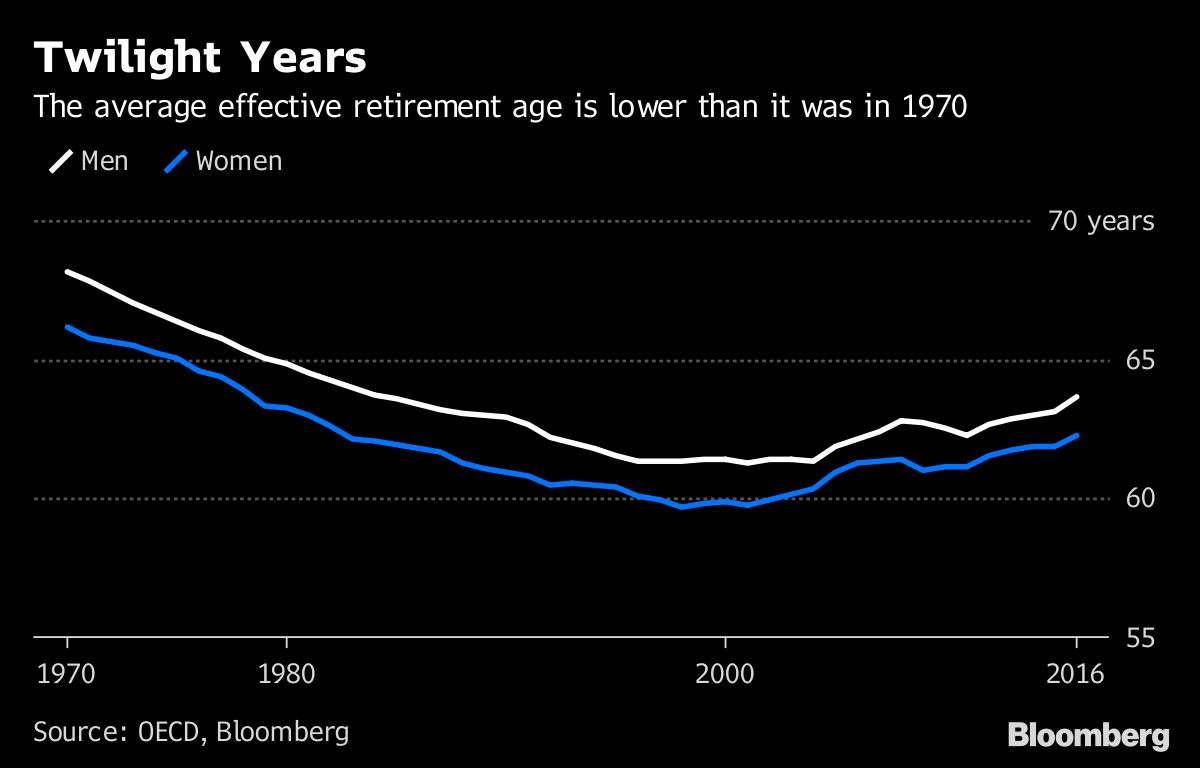

Europe’s failure to reform out-dated pension systems has created a “ticking time bomb” for the region’s public finances, accord to HSBC Holdings Plc.

Those nations with the highest debt levels are the most at risk, while political U-turns on recent reforms threaten to compound the situation, the London-based bank said. Italy could see its borrowings rise to 150 percent of economic output by 2040, even without the populist government’s proposed rollbacks.

“Pension systems across the eurozone still pose a significant threat to the future sustainability of public finances of some countries within the monetary union,” European economist Fabio Balboni wrote in a note to clients. “This is likely to put huge pressure on governments to cut other spending or raise taxes.”

European Central Bank monetary stimulus and waning market pressure has helped damp attempts to increase retirement ages and reduce pension entitlements, according to HSBC. While Italy is most at risk, countries such as Greece, Belgium, Spain and Portugal are also facing challenging situations, it added.

‘Tough Decisions’

Italy’s Five Star Movement-League coalition has pledged to unwind the so-called “Fornero Law,” which linked the retirement age with the country’s life expectancy, alongside proposals to cut taxes and introduce a basic income for the poorest. It is set to publish its spending plan later this month.

Even small tweaks to Fornero, “could increase the risk of an already tough fiscal situation getting worse,” wrote HSBC’s Balboni. “To prevent the debt from blowing up, future Italian governments will have tough decisions to make.”

Fitch lowered the nation’s credit outlook to negative from stable Friday, keeping its rating two notches above a junk. Measures planned by the new Italian government may cost as much as 75 billion euros ($87 billion) yearly, La Repubblica said, citing a separate Fitch report.

To contact the reporter on this story: John Ainger in London at jainger@bloomberg.net

To contact the editors responsible for this story: Ven Ram at vram1@bloomberg.net, Andrew Atkinson, Jana Randow

©2018 Bloomberg L.P.