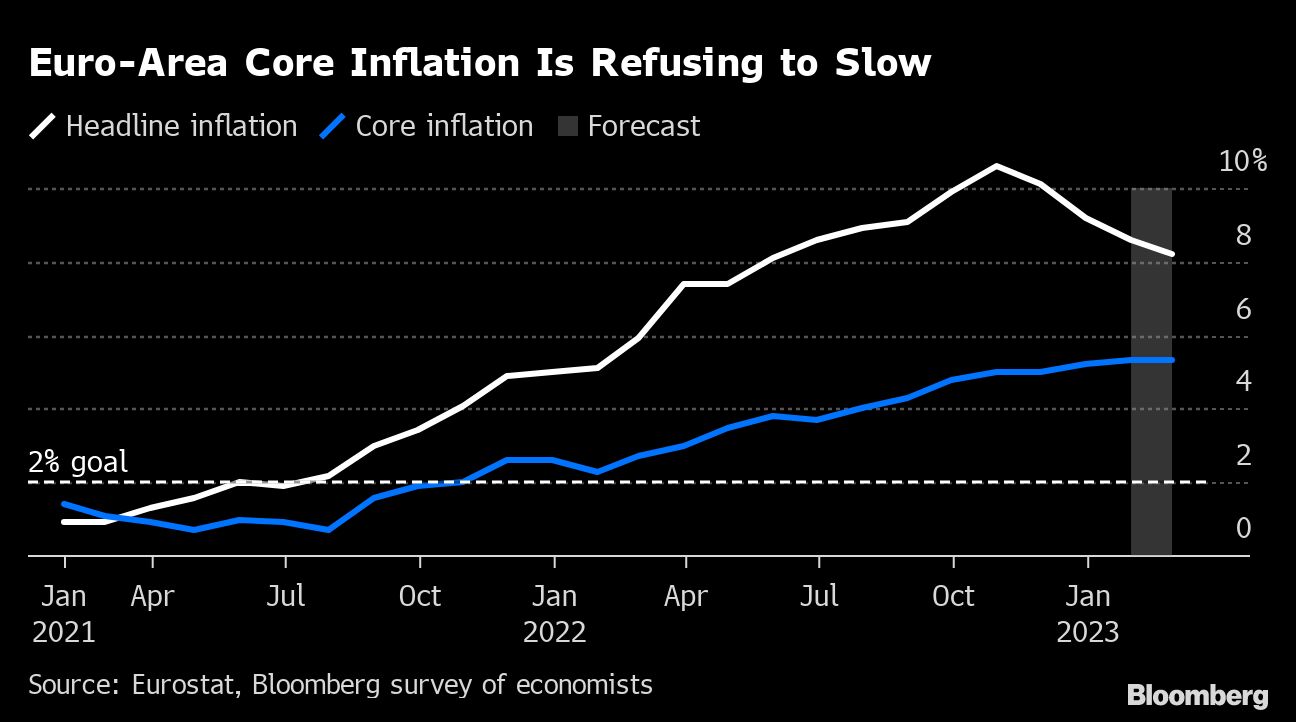

Fresh data from the euro zone are set to highlight why European Central Bank officials are hanging onto their hawkish tone, even as the region’s worst-ever spike in prices recedes.

Economists polled by Bloomberg reckon headline inflation eased for a fourth month in February after warm winter weather sent natural gas prices tumbling. But the core gauge that strips out such volatile items will probably hold at a record 5.3%, its stickiness resembling the worrying picture in the US.

The reading, scheduled for Thursday, will remain significantly above the ECB’s 2% target. Alongside national data from the bloc’s top economies earlier in the week, it will frame comments by half the Governing Council — including Chief Economist Philip Lane — due to speak in the coming week.

While another half-point hike in interest rates is all but certain at the ECB’s next decision on March 16, what happens beyond that is the subject of an intense debate.

What Bloomberg Economics Says:

“Another likely energy-driven decline in the euro area’s headline inflation rate may do little to comfort the hawks at the ECB. With underlying price pressures still elevated, policymakers might be pushed to keep hiking rates until the start of the summer.”

—Maeva Cousin, senior economist. For full analysis, click here

Financial markets have recently raised their wagers on how much borrowing costs will have to rise following hawkish remarks from key policy makers and more bullish signals on the euro-area economy. Deutsche Bank analysts now project a peak of 3.75%, in June — similar to investor bets.

Bank of France chief Francois Villeroy de Galhau has tried to push back against such expectations. But his German counterpart, Joachim Nagel, said Friday that he doesn’t rule out further “significant” rate increases beyond March.

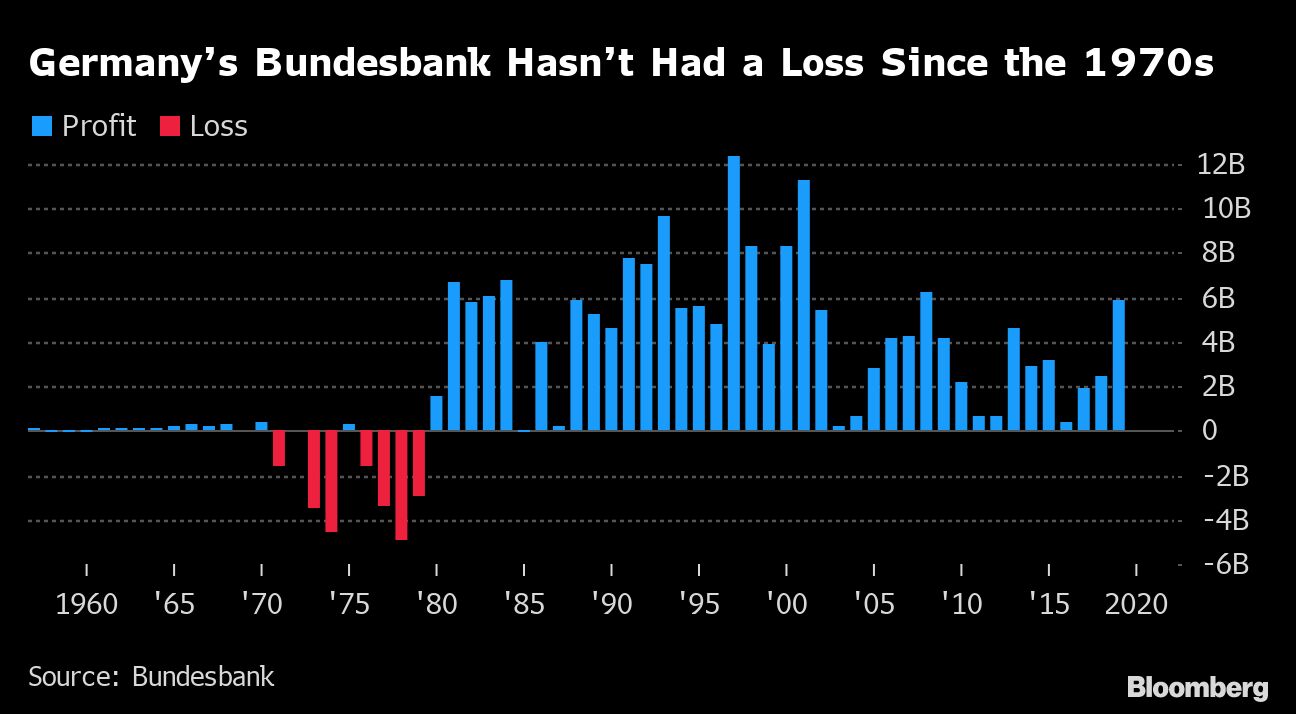

He’s unlikely to be deterred by news of a 2022 loss for the Bundesbank, which releases last year’s financial results on Wednesday. The ECB, which reported its own numbers last week, only dodged a similar shortfall by releasing €1.6 billion ($1.7 billion) of risk provisions.

Elsewhere, investors will be watching US sentiment gauges and global manufacturing PMI readings. The Bank of Japan’s nominee for governor faces another hearing, while Hungary and Sri Lanka are among the few central banks with scheduled rate decisions.

Click here for what happened last week and below is our wrap of what’s coming up in the global economy.

Europe, Middle East, Africa

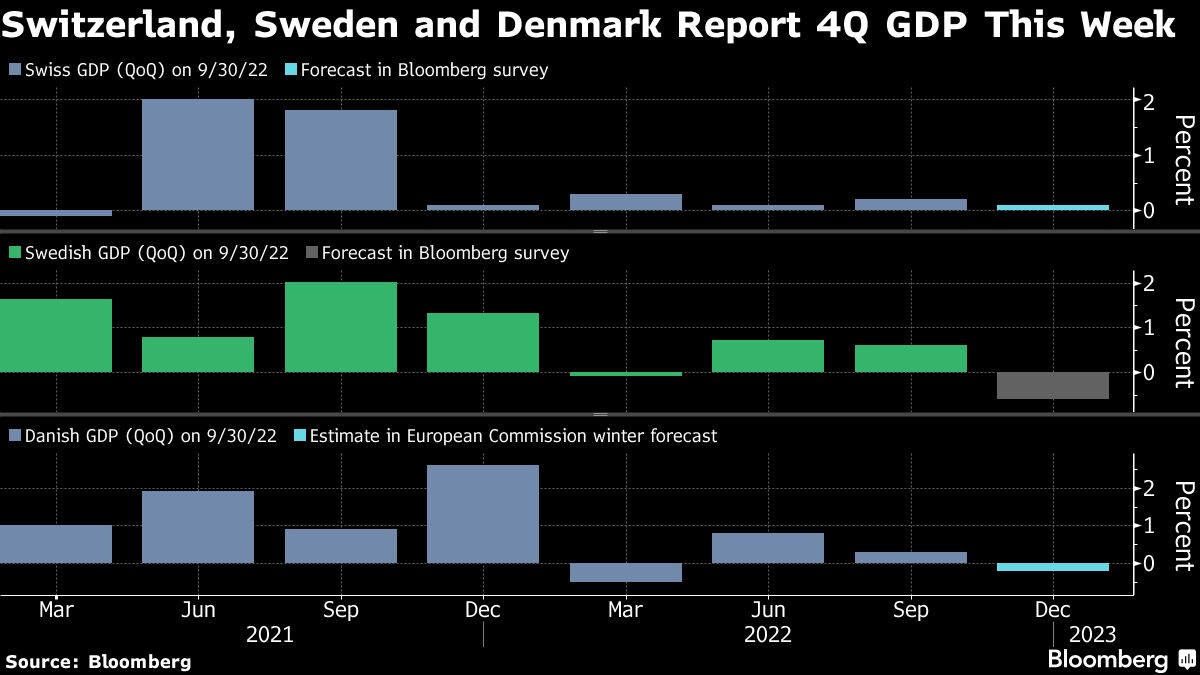

Beyond the euro area, Switzerland, Sweden and Denmark are among countries publishing fourth-quarter GDP, and data from the UK will provide more evidence that the housing market is undergoing a correction.

Hungary’s central bank, which has held rates at 13% at its last four meetings, is likely to do so again on Tuesday.

Data the same day will probably show that almost a third of South Africa’s workforce remained unemployed in the fourth quarter, as record power cuts constrained businesses’ ability to expand, invest and create jobs.

Turkish data is expected to show the economy grew about 5.2% in 2022, a figure which is being closely watched as elections draw near. President Recep Tayyip Erdogan, who seeks to hold on to power, has prioritized growth over other indicators.

- For more, read Bloomberg Economics’ full Week Ahead for EMEA

US Economy

In the wake of the latest government figures showing accelerating inflation and a sharp rebound in consumer spending, US economic data this week are primarily survey-based.

On Tuesday, investors will get another read on February consumer confidence. Economists project the Conference Board’s gauge to pick up slightly, consistent with results of the latest University of Michigan sentiment survey. The Institute for Supply Management will issue its February survey of manufacturers on Wednesday, followed by service providers on Friday.

Kicking off the relatively quiet week will be the government’s report on January durable goods orders. Total bookings are expected to have dropped, reflecting fewer orders for commercial aircraft. Excluding transportation equipment, orders for durables are likely to remain soft.

Fed speakers are mostly absent ahead of Chair Jerome Powell’s semi-annual testimony to Congress the following week. The most closely-watch event will likely be Governor Chris Waller’s economic outlook speech on Thursday. New Chicago Fed President Austan Goolsbee, who took office in January and has since had his name floated as a possible candidate to be the next vice chair, speaks on Tuesday. Powell is expected to appear before the Senate Banking Committee on March 7.

- For more, read Bloomberg Economics’ full Week Ahead for the US

Asia

Global investors will continue scouring for clues about the trajectory of Bank of Japan policy, with Kazuo Ueda, the nominee for governor, to get another grilling in parliament on Monday. That’ll be followed later in the week by speeches by two current board members.

India’s GDP report on Tuesday is expected to show a slowdown in growth in the Oct-Dec quarter.

In China, purchasing managers surveys released mid-week will give an indication of how the economy’s reopening is taking shape, with early signs showing a rebound in consumer activity after the Lunar New Year holidays. China is also gearing up for its annual parliamentary gathering, to start on March 5, at which officials will disclose new economic targets, including for GDP.

Australia’s current account data on Tuesday will feed into fourth quarter economic growth figures the following day as fears grow about the possibility of a recession sparked by higher interest rates. Monthly inflation data will also come under scrutiny after December’s blowout figure.

South Korean trade numbers on Wednesday will give further insight into the severity of the global economic slowdown in February.

The focus then returns to Japan, with capital spending figures to give a hint at how GDP is likely to be revised. Tokyo inflation figures are expected to show a sharp cooling on subsidized electricity bills, a peaking out that will support the BOJ’s view that prices aren’t spiraling upward.

- For more, read Bloomberg Economics’ full Week Ahead for Asia

Latin America

At the top of the week, the Brazilian central bank’s Focus survey of market expectations is keenly anticipated.

Economists have raised their 2023 inflation forecasts in 14 of the 16 weekly surveys taken since leftist Luiz Inacio Lula da Silva won the presidential election in late October.

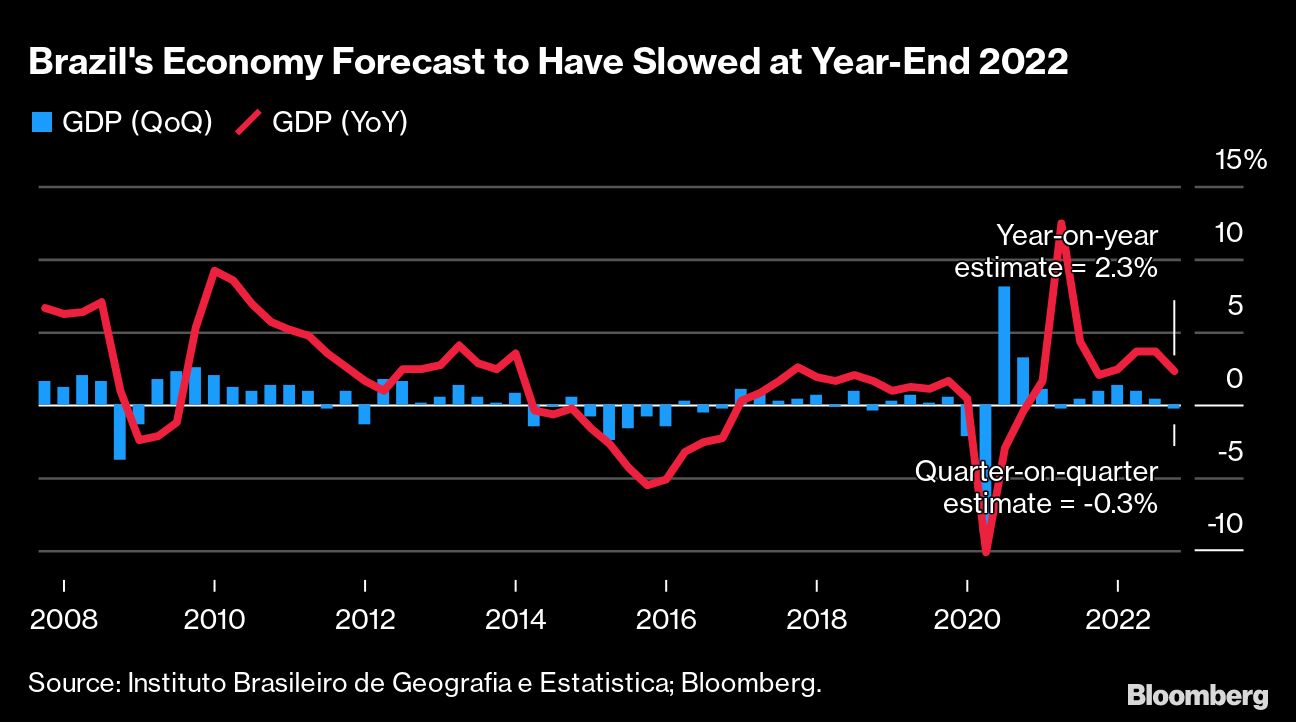

In the region’s major indicator for the week, Brazil’s fourth-quarter output report is all but certain to show Latin America’s largest economy shrank for the first time since April-June 2021, with prospects now dim for 2023-2024.

Sticky, above-target inflation, along with double-digit borrowing costs that are boxing in the new government’s ambitious growth agenda, suggest a fragile truce between Lula and central bank chief Roberto Campos Neto over monetary policy and inflation targets will soon come under strain again.

Seven separate January indicators from Chile should underscore the drag exerted there by double-digit interest rates and inflation. Economists surveyed by Bloomberg forecast the economy to contract 1% in 2023.

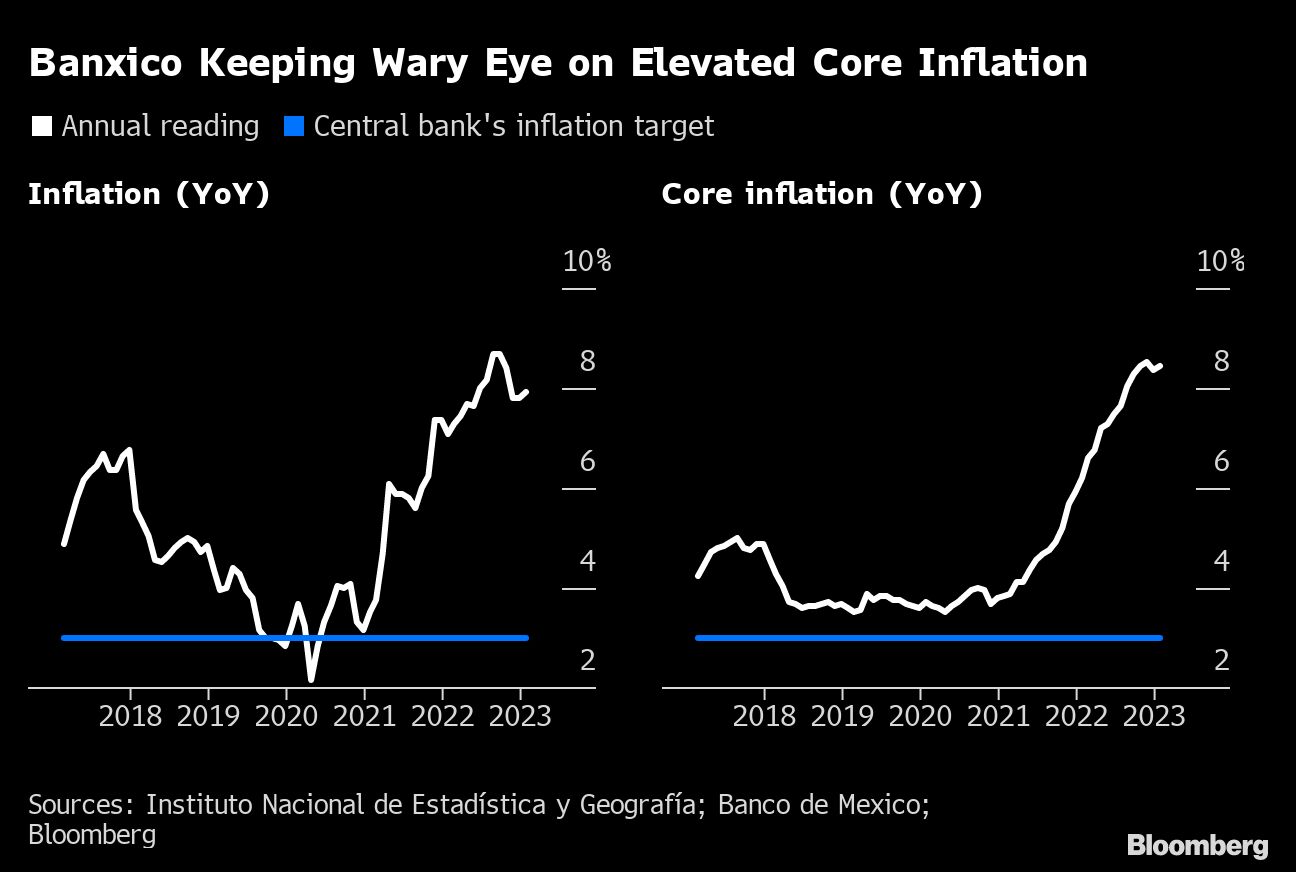

A raft of data is also on tap in Mexico, but all eyes will be on the Mexican central bank’s quarterly inflation report, especially regarding high core inflation.

Policy makers have explicitly signaled that additional tightening from the current 11% can be expected, and some economists don’t see any easing until 2024.

- For more, read Bloomberg Economics’ full Week Ahead for Latin America

--With assistance from Alister Bull, Vince Golle, Robert Jameson, Ros Krasny, Nasreen Seria and Sylvia Westall.

©2023 Bloomberg L.P.