KEY POINTS

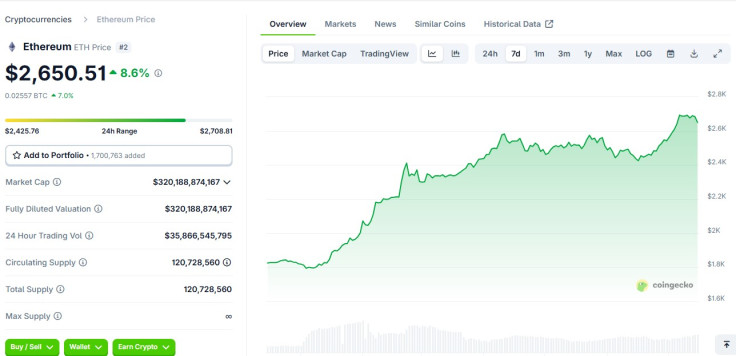

- $ETH is up by 44% in the past week, while $BTC posted a 7% increase in the last 7 days

- The Ethereum blockchain completed its Pectra upgrade early last week, powering Layer 2 scalability

- Some Ethereum holders believe the token is ready for a potential price 'breakout'

Ethereum, the world's second-largest cryptocurrency by market cap, has outpaced Bitcoin and most of its altcoin peers in the last 30 days, sustaining momentum most especially in the past week amid positive developments around the Ethereum blockchain and developments in the Trump trade war.

Data from CoinGecko showed that ETH is up by over 44% in the last seven days and has had a month-long spike of more than 61%. It increased over 6% in the day.

In comparison, BTC logged a 7% increase in the past week and recorded a 22% pump in the last 30 days.

Why are $ETH Prices Up?

Cryptocurrency prices are often driven by hype around communities, but in the case of major coins such as Bitcoin and Ethereum, they may also be affected by the movements of global financial markets and even geopolitical developments.

The Ethereum token's latest rally comes on the heels of the blockchain's Pectra upgrade early last week, which added a powerful suite of Ethereum Improvement Proposals (IEPs) designed to improve staking activities and Layer 2 scalability.

Pectra is live on Ethereum mainnet!

— Ethereum.org (@ethereum) May 7, 2025

- Smart account wallet UX features now active

- L2 scaling data storage blobs increased by 2x

- Validator UX improvements live

Community members will continue to monitor for any issues over the next 24 hours.

Also, BTC and ETH have reacted positively to news around the global trade war initiated by U.S. President Donald Trump.

When Trump announced that he will scale back some of the massive tariffs on Chinese goods, crypto prices moved in tandem with stock markets, providing relief for some coins that were suffering weeks-long volatility due to trade-related fears.

There is also increasing institutional accumulation around the ETH token, as proven by growing activity around Ethereum exchange-traded funds (ETFs).

On Tuesday alone, ETH ETFs hauled in a collective $13.5 million, thanks to the Grayscale and Franklin Templeton Ethereum ETFs.

$ETH Users Optimistic of Potential Breakout

On Crypto Twitter, traders and prominent figures in the space are expecting something much bigger from the world's second most valuable crypto coin.

Mister Crypto, a well-followed account in the crypto community, said he is expecting the digital asset "to explore this year," given its similar movement in recent weeks to how Bitcoin moved in 2020.

The bottom is in.

— Mister Crypto (@misterrcrypto) May 13, 2025

Ethereum will explode this year! pic.twitter.com/4TARJNDULS

Kamran Asghar, another crypto trader, projected that Ethereum has started its journey to $10,000, given it maintains its uptrend and makes the necessary "bounce."

$ETH is about to bounce here.🔥

— 𝐊𝐚𝐦𝐫𝐚𝐧 𝐀𝐬𝐠𝐡𝐚𝐫 (@Karman_1s) May 13, 2025

The journey to $10,000 Ethereum has begun! 🚀

Massive for $ETH 🔥 pic.twitter.com/0H8Bajxgel

Crypto Rover, a highly-followed crypto YouTuber, said the token has now returned "in the range where it belongs." Notably, ETH prices were playing between $2,400 and $2,600 when the coin kicked off the road to its all-time highs above $4,800 in November 2021.

Ethereum is back in the range where it belongs.

— Crypto Rover (@rovercrc) May 13, 2025

Send $ETH to $4,000! pic.twitter.com/opZsqHZO6H

As of early Wednesday, Ethereum is trading at around $2,600.