Ethereum (CRYPTO: ETH) trades near $4,100 on Tuesday as price action shows signs of exhaustion at a key resistance zone. Technical indicators and flow data now warn of a possible bearish setup forming below $4,250.

ETH Tests Apex Of Triangle At Resistance

ETH 2-Hour Chart Analysis (Source: TradingView)

The 2-hour chart shows Ethereum consolidating inside a symmetrical triangle capped by resistance between $4,200 and $4,250.

This zone aligns with the descending trendline from August highs and has already triggered one rejection.

Immediate support sits near $4,064 at the 100-EMA and $4,020 at the 50-EMA.

A close below these levels could expose $3,900, where structural demand held firm earlier this month. Losing that base opens a measured decline toward $3,700.

RSI has slipped to 48, signaling waning strength.

The short-term EMA ribbon is flattening, showing that upward momentum is slowing before Ethereum can reclaim a broader uptrend.

Daily Chart Adds Weight To Bearish Case

ETH Daily Outlook (Source: TradingView)

Ethereum trades below the mid-Bollinger band at $4,312, with firm resistance near $4,546 where the supertrend indicator caps upside.

This area marks a strong rejection zone unless volume expands sharply.

While the ascending trendline from April remains intact, short-term charts suggest a likely retracement before any new breakout attempt.

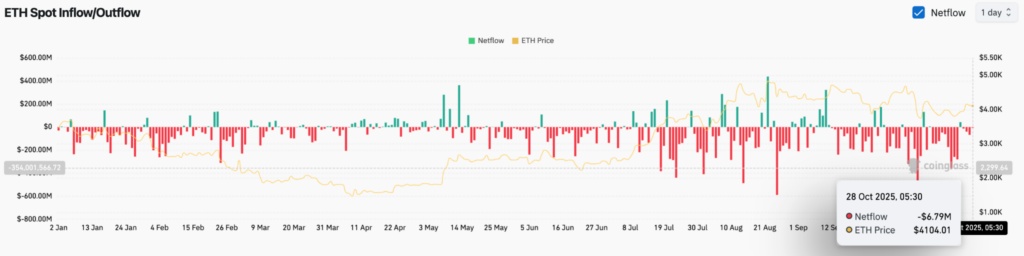

Muted On-Chain Flows Reflect Uncertainty

ETH Netflows (Source: Coinglass)

According to Coinglass, Ethereum recorded outflows of nearly $7 million on October 28, modest compared with earlier monthly prints.

The past week has shown limited inflows or distribution, pointing to reduced institutional participation.

This lack of conviction leaves near-term direction driven primarily by technical patterns rather than strong on-chain catalysts.

Outlook: Bulls Need $4,250 Break To Regain Control

A daily close above $4,250 would invalidate the bearish setup and could trigger recovery toward $4,500.

Until then, risk remains skewed to the downside, with $3,900 and $3,700 serving as key support zones.

If sentiment improves following the Federal Reserve meeting or easing macro signals, Ethereum could retest $4,500 in a relief rally.

Failure to defend $4,020 would confirm breakdown bias and shift focus toward $3,700.

Read Next:

Image: Shutterstock