Valued at a market cap of $17.2 billion, Essex Property Trust, Inc. (ESS) is a leading residential real estate investment trust (REIT) that owns, develops, redevelops, and manages multifamily apartment communities. Founded in 1971 and based in San Mateo, California, its footprint is mostly concentrated in supply-constrained coastal markets in California and the Seattle area.

Companies valued at $10 billion or more are generally classified as “large-cap” stocks, and Essex Property Trust Energy fits this description perfectly. Its portfolio is concentrated in high-barrier markets with limited land availability, which supports strong supply-demand fundamentals and enhances its long-term pricing power.

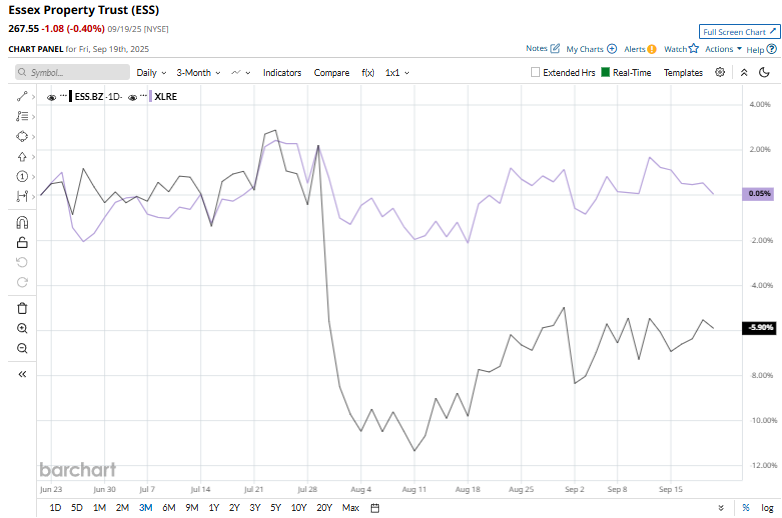

Essex Property Trust’s stock dropped 15.4% from its 52-week high of $316.29. Shares of ESS have declined 5.8% over the past three months, lagging behind the Real Estate Select Sector SPDR Fund’s (XLRE) marginal rise.

Shares of Essex Property have decreased 14.4% over the past 52 weeks, underperforming XLRE’s 2.9% rise over the same time frame. Additionally, ESS stock has dropped 6.3% on a YTD basis, compared to XLRE’s 6.5% drop over the same time period.

The stock has been trading below its 50-day and 200-day moving averages since early April, implying a downtrend.

Essex Property Trust released its Q2 results on Jul. 29, and its shares fell 7.6% in the following trading session. Its revenue climbed 6.2% year-over-year to $469.83 million, slightly above the $469.2 million analysts had projected. Core FFO increased 2.3% to $4.03 per share, surpassing the $3.99 consensus, driven by higher same-property revenue growth and Washington property taxes.

In contrast, rival Invitation Homes Inc. (INVH) has underperformed ESS, declining 17.8% over the past year and 7.3% in 2025.

With 27 analysts covering the stock, the consensus rating is “Hold,” and the mean price target of $294.12 represents a premium of 9.9% from the current market prices.