On the surface, recent news that the Trump administration has been collaborating with Russia to devise a new peace plan for Ukraine potentially offers hope. Steve Witkoff, serving as Trump’s envoy, is spearheading the drafting of the agreement and has held extensive talks with Russian envoy Kirill Dmitriev, according to an Axios report.

Based on available information, the proposal involves following the principles that Trump and Russian President Vladimir Putin agreed to during their August meeting in Alaska. Specifically, the terms are structured around four pillars: peace in Ukraine, security guarantees, European security and the future of U.S. relations with Russia and Ukraine.

Still, the discussions don't seem to adequately address key contentious issues, particularly territorial control in eastern Ukraine. It's also not clear how such an agreement about ending the Ukraine war can ever materialize without the embattled nation's involvement.

According to the Charter of the United Nations, a war cannot be ended by two outside powers negotiating over the fate of a third state. Plus, the U.S. cannot legally sign away Ukrainian territory, security guarantees or obligations. Thus, any treaty without Kyiv's signature is meaningless.

If that wasn't enough of a geopolitical crisis, world power structures are rapidly shifting. Essentially, the global system no longer features a single dominant entity. Such a dynamic means that investors can no longer rely on prior assumptions and paradigms that shaped most of recent history. Specifically, many experts argue that a shift toward a multipolar world — one where American hegemony is no longer taken for granted — may spark deeply consequential outcomes.

What's even more startling is that geopolitical tensions and conflicts might not just represent a temporary aberration but a structural feature of the new incoming paradigm. Indeed, while the Ukraine war consumes much (if not most) of the media's attention, armed conflicts themselves have surged since 2011, with no sign that circumstances are improving.

Amid a difficult environment, individual nations must remain vigilant about their security needs. As such, the defense sector may be thrust into a glaring but critical spotlight.

The Direxion ETF: With the arms industry poised for sustained and even rising demand, the arena may attract bullish investors. One mechanism to exercise speculation while sidestepping exotic products is through financial service provider Direxion's exchange-traded funds.

Specifically, those who are aggressively optimistic on the sector may consider Direxion Daily Aerospace & Defense Bull 3X Shares (NYSE:DFEN). This ultra-leveraged fund tracks 300% of the performance of the Dow Jones U.S. Select Aerospace & Defense Index. Among the top holdings are heavyweights like RTX (NYSE:RTX), Boeing (NYSE:BA) and Lockheed Martin (NYSE:LMT), thus offering a diverse grouping of top-tier enterprises.

At the core, Direxion ETFs offer convenience. Usually, those seeking leveraged exposure must engage the options market, which can impose its own set of unique complexities. With leveraged funds, the products can be bought and sold, much like any other publicly traded security.

Another taken-for-granted convenience of Direxion ETFs is that they are debit-based transactions. Essentially, the loss that one suffers from market volatility is limited to whatever was put into the fund. This eliminates the fear of tail risk or the threat of an ever-rising obligatory payment as the underwritten event gets realized to the extreme ends of the distribution — a common concern for credit-based transactions.

That said, Direxion ETFs aren't devoid of downside dangers. For one thing, leveraged funds — especially the 300% variety — are extremely volatile. Without care, unitholders can quickly incur losses. Even with caution, the intense volatility means that circumstances can change rapidly. Second, these funds are designed for exposure lasting no longer than one day. Holding units longer than that may result in positional decay due to the daily compounding effect.

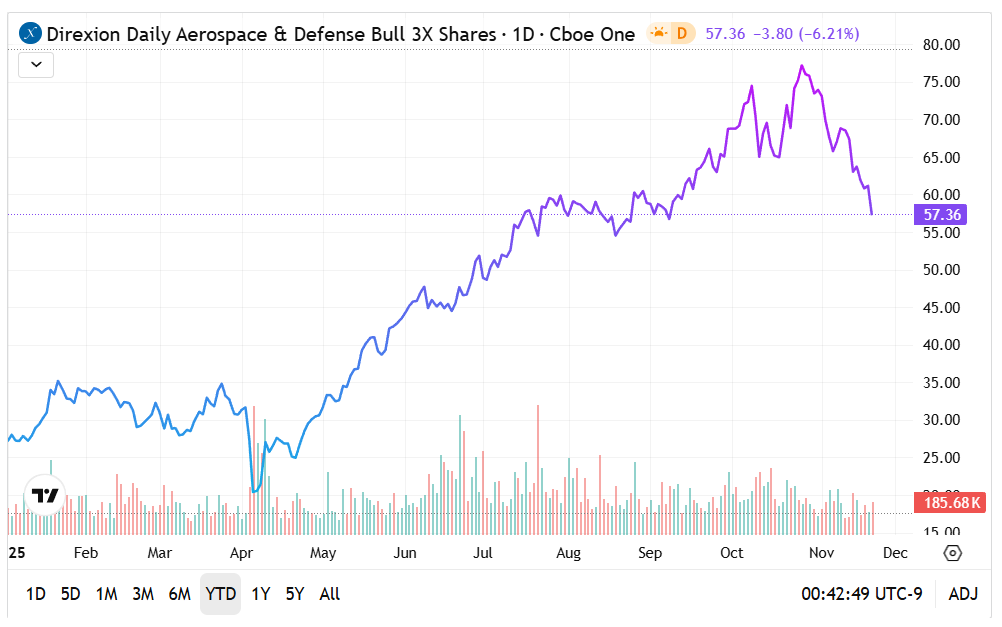

The DFEN ETF: Since the start of the year, the DFEN ETF has gained roughly 109%. In the trailing half-year period, DFEN gained about 47%.

- Currently, momentum has recently faltered for the DFEN ETF, which is now sandwiched between the 50-day moving average at top and the 200 DMA at bottom.

- While volume has been relatively consistent, in November, accumulations of DFEN have decreased modestly, raising some concerns.

- DFEN has been volatile throughout the trailing month, down more than 20%. Still, much of this could be tied to broader risk-off sentiments associated with December rate cut questions.

Featured image from Shutterstock