Valued at a market cap of $15 billion, Erie Indemnity Company (ERIE) is a publicly traded entity based in Pennsylvania, serving as the managing attorney-in-fact for the Erie Insurance Exchange. Established in 1925, Erie Indemnity provides essential services such as sales, underwriting, policy issuance, and claims handling on behalf of the Exchange, a Pennsylvania-domiciled reciprocal insurer. The company operates under a unique business model where it earns revenue primarily through management fees, calculated as a percentage of the Exchange's premiums.

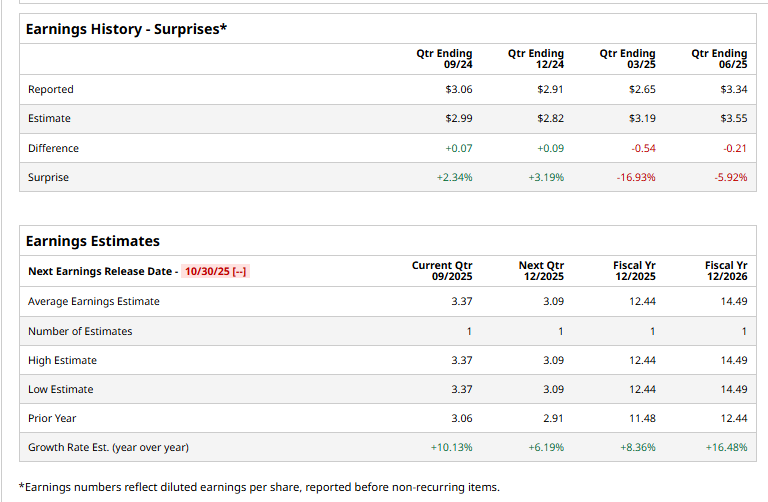

It is expected to announce its fiscal Q3 earnings soon. Ahead of this event, analysts expect this insurance company to report a profit of $3.37 per share, up 10.1% from $3.06 per share in the year-ago quarter. The company has surpassed Wall Street’s earnings estimates in two of the last four quarters while missing on two other occasions.

For fiscal 2025, analysts expect ERIE to report a profit of $12.44 per share, up 8.4% from $11.48 per share in fiscal 2024. Its EPS is expected to further grow 16.5% year over year to $14.49 in fiscal 2026.

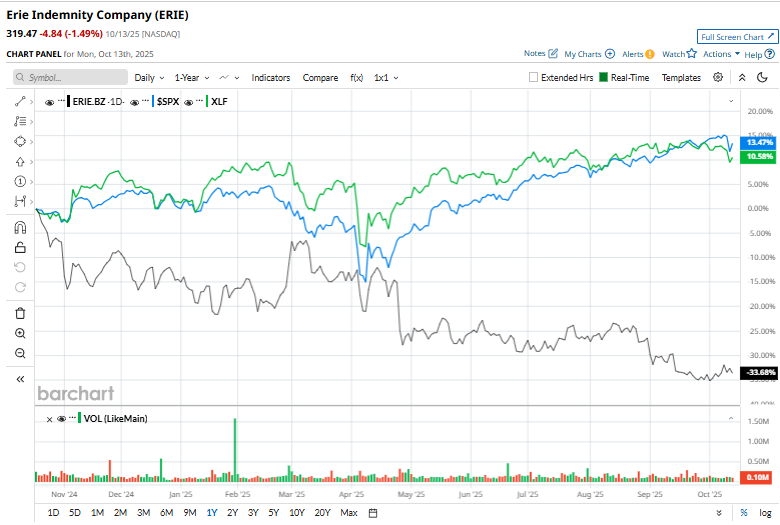

Shares of ERIE have declined 40.3% over the past 52 weeks, lagging behind both the S&P 500 Index's ($SPX) 14.4% return and the Financial Select Sector SPDR Fund’s (XLF) 13.2% uptick over the same time frame.

On Aug. 7, Erie announced its second-quarter earnings, and its shares rose 1.3% in the following trading session. Its net income rose 6.6% year-over-year to $174.7 million, or $3.34 per share, though slightly below analyst expectations. Revenue grew 7% to $1.06 billion, driven by higher management fees and administrative services revenue, but fell just short of forecasts.

Wall Street analysts are moderately optimistic about ERIE’s stock, with a "Moderate Buy" rating overall. Among three analysts covering the stock, one recommends a "Strong Buy," and two advise a “Hold” rating.