Bitcoin (CRYPTO: BTC) has surged above $114,000 on Monday after Eric Trump promoted the cryptocurrency on Fox Business, calling it "the way of the future" and a clear replacement for traditional finance.

Fox Business Remarks Spotlight Bitcoin Utility

Eric Trump contrasted Bitcoin's efficiency with slow hotel wire transfers, saying, "Why can I send hundreds of millions of dollars worth of Bitcoin overseas instantly or receive it instantly with virtually no fees?"

He added that his firm, American Bitcoin Corp. (NASDAQ: ABTC), would be "one of the great Bitcoin companies anywhere in the world."

He described cryptocurrency adoption as advancing faster than the internet in the 1990s, adding that he had "never been so clear about something" in his life.

$1 Million Bitcoin? Trump Doubles Down

At the Bitcoin Asia conference in Hong Kong last month, Eric Trump predicted Bitcoin would reach $1 million within several years, citing rising institutional demand and fixed supply.

He also praised China's role in digital assets, calling it "a hell of a power," while highlighting that both Washington and Beijing understand cryptocurrency better than most.

In a separate interview with the New York Post, Trump forecast an "unbelievable" Q4 for crypto, noting that historically, Bitcoin has delivered strong gains in the final quarter of the year.

Wall Street Bets Big As Shorts Get Crushed

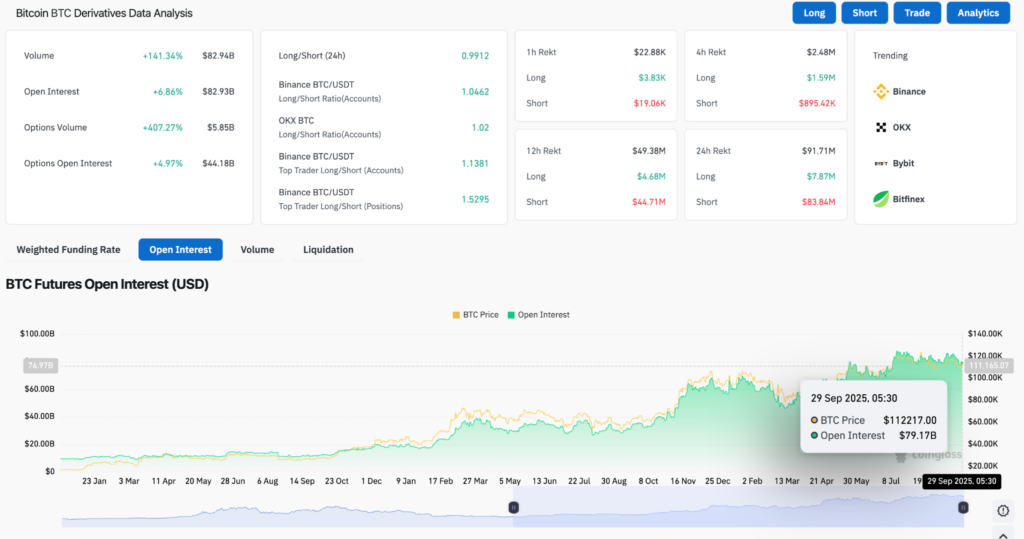

BTC Derivative Analysis (Source: Coinglass)

BTC futures volume jumped 141% to $82.9 billion, while open interest climbed nearly 7% to the same level.

Options activity also spiked, with volume up 407% and open interest at $44.1 billion, reflecting heightened institutional hedging and directional bets.

Liquidation data shows shorts absorbed heavier losses, with $83 million wiped out in the past 24 hours compared to $8 million in longs, suggesting pressure remains tilted against bearish positions.

Why It Matters

BTC Domiance Outlook (Source: TradingView)

Eric Trump's $1 million Bitcoin call arrives as the cryptocurrency steadies near $114,000 with market dominance firm around 59%.

The defense of long-term structural support underscores Bitcoin's role as the market's anchor, even as capital shifts across altcoins.

With institutional positioning climbing and Q4 historically a season of strength, the durability of Bitcoin's dominance will be a key test of whether Trump's forecast for an "unbelievable" quarter takes shape.

Image: Shutterstock

Read Next: