Founder of EMJ Capital, Eric Jackson, drew attention to a recent stock purchase by Rep Cleo Fields (D-La.) with a social media post reading, "Paging Nancy Pelosi about OPEN," referencing the Congressman's new investment in Opendoor Technologies Inc. (NASDAQ:OPEN).

Eric Jackson Wants Nancy Pelosi’s Attention On OPEN

The comment alludes to Jackson’s ongoing campaign on the social media platform X, about the OPEN stock. He gained significant attention in 2025 for spearheading a massive rally in Opendoor, an online real estate platform that buys and sells homes directly from consumers, often called an “iBuyer”.

This also comes amidst the intense public scrutiny often given to the trading activities of prominent politicians. Nancy Pelosi, known for her profitable trades, was the center of Jackson's remark, which was based on a newly public Periodic Transaction Report detailing a flurry of trading activity by Rep. Fields throughout September 2025.

The disclosure reveals over 20 stock purchases, many of which were significant investments in major technology corporations.

See Also: Nancy Pelosi’s Portfolio Crushed Wall Street Hedge Funds With Jaw-Dropping Returns Last Year

Other Prominent Trades By Rep. Fields

However, OPEN was one of the smaller investments disclosed in the report, valued between $1,001 and $15,000. Rep. Fields made several larger purchases on September 3, 2025, including investments in Alphabet Inc. Class C Shares (NASDAQ:GOOG), Amazon.com Inc. (NASDAQ:AMZN), and Apple Inc. (NASDAQ:AAPL), with each transaction valued between $100,001 and $250,000.

On the same day, Fields also acquired between $50,001 and $100,000 worth of stock in Nvidia Corp. (NASDAQ:NVDA).

The Congressman's buying activity continued throughout the month. Other notable technology and blue-chip stock purchases in September included Oracle Corp. (NYSE:ORCL), Meta Platforms Inc. (NASDAQ:META), Broadcom Inc. (NASDAQ:AVGO), and McDonald's Corp. (NYSE:MCD).

Multiple purchases were made in the same companies on different dates, including three separate transactions for Oracle stock and four for Alphabet. The largest single purchase of Oracle stock was valued between $50,001 and $100,000.

The transactions were officially reported to the Clerk of the House of Representatives, as required by the STOCK Act. The report, which covers transactions from September 3 to September 23, was digitally signed by Rep. Fields on Sept. 30, 2025.

| Company Name | Date | Transaction | Amount |

| Alphabet Inc. Class C (NASDAQ:GOOG) | 09/03/2025 | Purchase | $100,001 – $250,000 |

| Alphabet Inc. | 09/17/2025 | Purchase | $15,001 – $50,000 |

| Alphabet Inc. | 09/17/2025 | Purchase | $1,001 – $15,000 |

| Alphabet Inc. | 09/17/2025 | Purchase | $15,001 – $50,000 |

| Amazon.com, Inc. (NASDAQ:AMZN) | 09/03/2025 | Purchase | $100,001 – $250,000 |

| Amazon.com, Inc. | 09/10/2025 | Purchase | $50,001 – $100,000 |

| Amazon.com, Inc. | 09/17/2025 | Purchase | $15,001 – $50,000 |

| Apple Inc. (NASDAQ:AAPL) | 09/03/2025 | Purchase | $100,001 – $250,000 |

| Apple Inc. | 09/10/2025 | Purchase | $50,001 – $100,000 |

| Broadcom Inc. (NASDAQ:AVGO) | 09/17/2025 | Purchase | $15,001 – $50,000 |

| Figma Inc. (NYSE:FIG) | 09/10/2025 | Purchase | $1,001 – $15,000 |

| McDonald’s Corporation (NYSE:MCD) | 09/10/2025 | Purchase | $15,001 – $50,000 |

| Meta Platforms, Inc. (NASDAQ:META) | 09/10/2025 | Purchase | $50,001 – $100,000 |

| Meta Platforms, Inc. | 09/17/2025 | Purchase | $15,001 – $50,000 |

| NVIDIA Corporation (NASDAQ:NVDA) | 09/03/2025 | Purchase | $50,001 – $100,000 |

| Opendoor Technologies Inc (NASDAQ:OPEN) | 09/19/2025 | Purchase | $1,001 – $15,000 |

| Oracle Corporation (NYSE:ORCL) | 09/17/2025 | Purchase | $50,001 – $100,000 |

| Oracle Corporation | 09/18/2025 | Purchase | $15,001 – $50,000 |

| Oracle Corporation | 09/23/2025 | Purchase | $15,001 – $50,000 |

| Qualcomm Incorporated (NASDAQ:QCOM) | 09/10/2025 | Purchase | $15,001 – $50,000 |

| Uber Technologies, Inc. (NASDAQ:UBER) | 09/10/2025 | Purchase | $1,001 – $15,000 |

Price Action

Open closed 1.13% higher on Wednesday at $8.06 per share, and it was up 0.14% in after-hours. The stock has advanced 406.92% on a year-to-date basis and 324.21% over the last year.

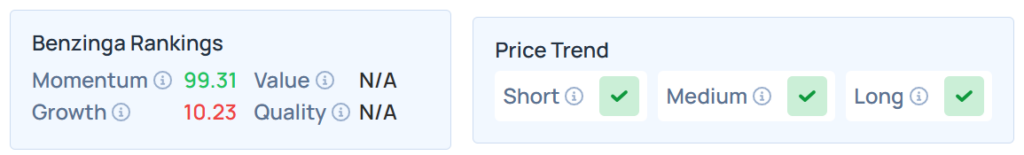

Benzinga’s Edge Stock Rankings indicate that OPEN maintains a stronger price trend in the short, medium, and long terms, with a poor growth ranking. Additional performance details are available here.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, rose on Wednesday. The SPY was up 0.34% at $668.45, while the QQQ rose 0.48% to $603.25, according to Benzinga Pro data.

The futures of the S&P 500, Dow Jones, and Nasdaq 100 indices were mixed on Thursday.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Shutterstock