Valued at a market cap of $75.7 billion, Equinix, Inc. (EQIX) is a leading global real estate investment trust (REIT) specializing in digital infrastructure. The Redwood City, California-based company operates one of the world’s largest networks of data centers, providing colocation, interconnection, and cloud infrastructure services to enterprises, network providers, and hyperscale cloud companies.

Companies valued at $10 billion or more are typically classified as “large-cap stocks,” and Equinix fits the label perfectly. By enabling secure, high-performance connections across more than 70 markets worldwide, the company plays a critical role in powering digital transformation and supporting the growth of the global internet economy.

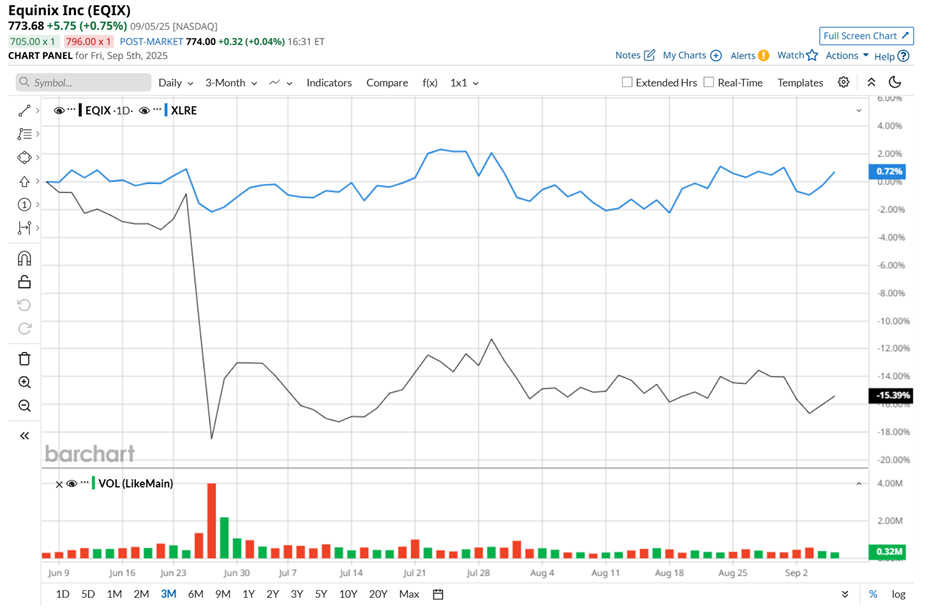

Shares of this digital infrastructure REIT have dipped 22.2% from its 52-week high of $994.03. Moreover, shares of EQIX have declined 15% over the past three months, underperforming the Real Estate Select Sector SPDR Fund’s (XLRE) 1% rise during the same time frame.

In the longer term, Equinix has fallen 5.9% over the past 52 weeks, lagging behind XLRE's 3.3% downtick over the same time period. Moreover, on a YTD basis, shares of EQIX are down 18%, compared to XLRE’s 3.7% return.

EQIX stock has been trading below its 50-day and 200-day moving averages since late June.

On Jul. 30, EQIX released its Q2 2025 results, and its shares plunged 1.5% in the following trading session. The company’s revenue advanced 4.5% year-over-year to $2.3 billion, meeting consensus estimates. Moreover, its AFFO per share of $9.91 improved 7.5% from the year-ago quarter and came in 7.8% above the analyst expectations. Looking ahead, EQIX raised its fiscal 2025 guidance, expecting AFFO per share in the range of $37.67 to $38.48, and revenue to be between $9.2 billion and $9.3 billion.

Additionally, EQIX stock has also underperformed its rival, Digital Realty Trust, Inc.’s (DLR) 8.9% rise over the past 52 weeks and 8% drop on a YTD basis.

Despite EQIX’s underperformance, analysts remain highly optimistic about its prospects. The stock has a consensus rating of "Strong Buy” from the 30 analysts covering it, and the mean price target of $962.08 suggests a 24.4% premium to its current price levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.