/Equifax%2C%20Inc_%20logo%20on%20phone-by%20viewimage%20via%20Shutterstock.jpg)

Equifax Inc. (EFX), based in Atlanta, Georgia, is a leading provider of credit reporting, data analytics, and technology solutions. Operating in several countries, the company delivers essential insights for businesses, governments, and consumers through credit risk assessment, identity verification, and fraud prevention services.

Equifax’s offerings help clients make informed decisions in areas like lending, insurance, and hiring. Focused on innovation and data protection, Equifax plays a crucial role in supporting the financial infrastructure and enabling more intelligent risk management across various industries worldwide. The company has a market capitalization of $31.57 billion.

Equifax’s stock has had a volatile time on Wall Street. Over the past 52 weeks, the stock has declined by 17%, while it is down by 1.6% year-to-date (YTD). The stock has broadly underperformed the S&P 500 Index ($SPX), which has gained 14.3% and 9.5% over the same periods, respectively. The stock reached a 52-week low of $199.98 in April 2025, but is up 25.4% from this low.

Narrowing our focus, we see that the overall industrial sector has also been performing better than the stock. The Industrial Select Sector SPDR Fund (XLI) has been up 17.3% over the past 52 weeks and 15.1% this year.

On July 22, shares of Equifax took an 8.2% hit even after the company reported better-than-expected second-quarter results. Despite headwinds from U.S. hiring and mortgage markets, the company’s operating revenue increased 7.4% year-over-year (YOY) to $1.54 billion, surpassing the $1.51 billion that Wall Street analysts had expected. Adjusted EPS increased 9.9% from its year-ago value to $2.00, which was higher than the $1.92 that Wall Street analysts were expecting.

Although results topped expectations, lingering tariff uncertainty and its potential impact on interest rates and hiring have weighed on the company’s top-line outlook. Management maintained full-year local currency revenue guidance, citing “uncertainties in the economy,” while foreign exchange trends are expected to lift revenues by about $35 million. Even so, the cautious tone may have dampened investor sentiment toward the stock.

For the fiscal year 2025, ending in December 2025, Wall Street analysts expect Equifax’s EPS to increase by 3.8% YOY to $7.57 on a diluted basis, followed by a growth of 20.6% to $9.13 in fiscal 2026. The company has a history of surpassing consensus estimates in each of the trailing four quarters.

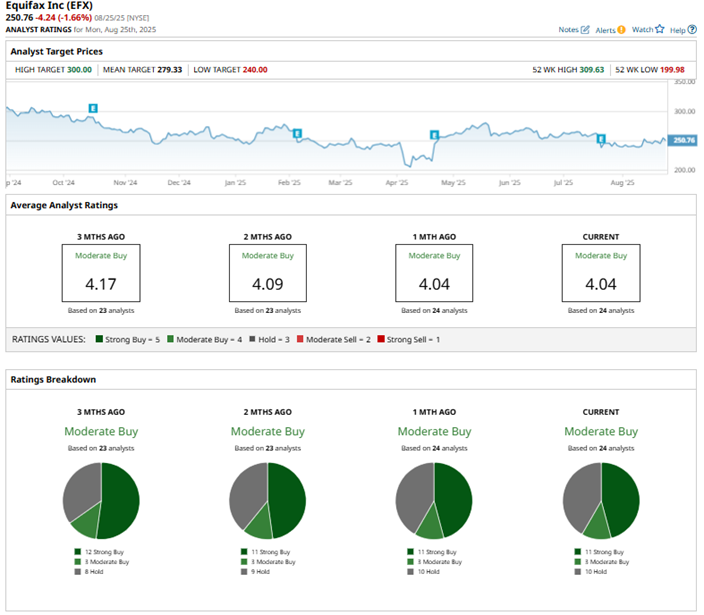

Among the 24 Wall Street analysts covering Equifax’s stock, the consensus is a “Moderate Buy.” That’s based on 11 “Strong Buy” ratings, three “Moderate Buy” ratings, and 10 “Hold” ratings.

The configuration of the ratings is less bullish than it was three months ago, with 11 “Strong Buy” ratings now, down from 12 previously.

Although the company’s Q2 results drew a muted reaction from investors, Wall Street analysts were quick to reaffirm their ratings, signaling confidence in the company's longer-term outlook. Analysts at Citi reduced the price target on the stock from $294 to $290, but maintained a “Buy” rating. UBS analysts also maintained their “Buy” rating on the stock, with a target price of $278.

Equifax’s mean price target of $279.33 indicates an 11.4% upside over current market prices. The Street-high price target of $300 implies a potential upside of 19.6% from here.

On the date of publication, Anushka Mukherjee did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.