EpicQuest Education Group International Limited (NASDAQ:EEIQ) shares skyrocketed 113.71% in after-hours trading to $1.16 following the release of first-half fiscal results that exceeded investor expectations with robust revenue growth and reduced losses.

Check out the current price of EEIQ stock here.

Revenue Growth Drives Performance

The education services provider reported revenues of $5.37 million for the first half, marking a 29.1% increase from $4.16 million in the prior-year period. The revenue surge was primarily driven by expanded international foundational and collaborative programs offered through Davis University and EduGlobal College.

“We are pleased to announce a 29% increase in revenue for the first half of our 2025 fiscal year,” said CEO Jianbo Zhang in the earnings announcement. The company’s gross margin improved to 63.7% from 57.7% year-over-year, reflecting operational efficiency gains.

Dramatic Loss Reduction

EEIQ achieved a remarkable 95.5% reduction in net loss to $0.16 million compared to $3.52 million in the first half of 2024. Net loss per share improved to $0.02 from $0.26 in the comparable period. Operating loss decreased 52.7% to $1.96 million from $4.14 million year-over-year.

The improvement stemmed from higher revenue, reduced cost of services relative to revenue, and a 17.9% decrease in operating expenses to $5.38 million.

International Expansion Strategy

The Ohio-based education facilitator continues expanding its global recruitment initiatives across China, Southeast Asia, and LATAM markets, with new agreements to boost enrollment from Africa and the Middle East. Zhang emphasized that “internationalization continues to be a key catalyst of our strategic growth plan.”

Liquidity Concerns Persist

Despite operational improvements, EEIQ faces liquidity challenges with cash and cash equivalents declining 71.3% to $0.33 million as of March 31. The company maintains a negative working capital of $3.96 million and a current ratio of 0.57.

The strong after-hours performance reflects investor optimism about the company’s turnaround efforts and international growth strategy, though liquidity concerns remain a key risk factor for the $7.23 million market cap company.

Price Action: According to Benzinga Pro data, EEIQ closed at $0.54 on Thursday, down 0.15% during the regular trading session. The stock traded between a 52-week low of $0.42 and a high of $1.17.

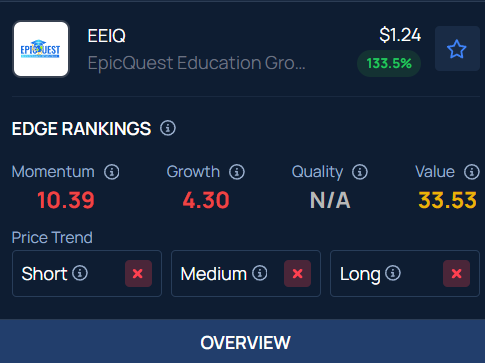

Benzinga’s Edge Stock Rankings indicate that EEIQ has a negative price trend across all time frames. Here is how the stock fares on other parameters.

Read Next:

Photo Courtesy: MMD Creative on Shutterstock.com

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.