/EPAM%20Systems%20Inc%20logo%20on%20phone-by%20IgorGolovniov%20via%20Shutterstock.jpg)

Newtown, Pennsylvania-based EPAM Systems, Inc. (EPAM) operates as a digital platform engineering and software development services provider. Its offerings also include business and experience consulting to numerous global enterprises and ambitious startups. With a market cap of $8.6 billion, EPAM’s operations span the Americas, Indo-Pacific, and the EMEA region.

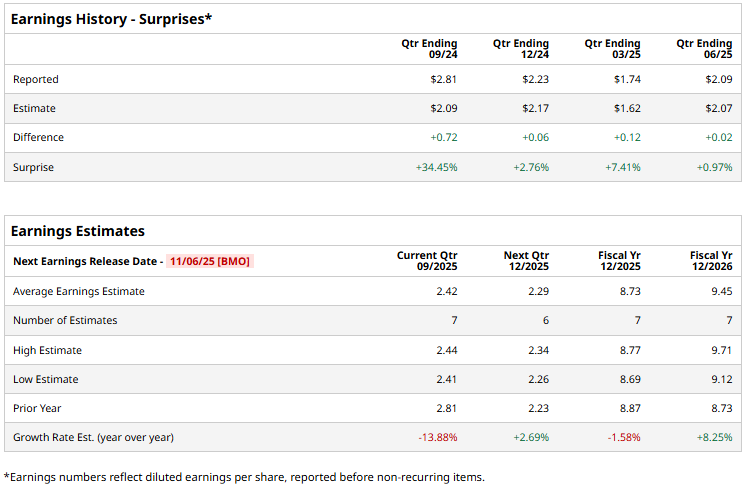

The IT services provider is set to unveil its third-quarter results before the market opens on Thursday, Nov. 6. Ahead of the event, analysts expect EPAM to report non-GAAP profit of $2.42 per share, down 13.9% from $2.81 per share reported in the year-ago quarter. On a positive note, the company has surpassed Wall Street’s earnings projections in each of the past four quarters.

For the full fiscal 2025, EPAM is expected to deliver an adjusted EPS of $8.73, down 1.6% from $8.87 in fiscal 2024. While in fiscal 2026, its earnings are expected to surge 8.3% year-over-year to $9.45 per share.

EPAM stock prices have plunged 21% over the past 52 weeks, notably underperforming the Technology Select Sector SPDR Fund’s (XLK) 23.2% gains and the S&P 500 Index’s ($SPX) 14.5% returns during the same time frame.

EPAM Systems’ stock prices gained 4.3% in the trading session following the release of its impressive Q2 results on Aug. 7. Companies are flocking towards AI-readiness and increasingly focusing on building out their data and AI foundation, which has boosted the demand for EPAM’s services. Driven by the organic growth and AI momentum, the company’s topline for the quarter grew 18% year-over-year to $1.4 billion, beating the Street’s expectations by 1.5%. Further, its adjusted net income grew 10.2% year-over-year to $156.8 million, beating the consensus estimates by 6.1%.

The consensus opinion on EPAM stock is moderately bullish, with an overall “Moderate Buy” rating. Out of the 15 analysts covering the stock, nine recommend “Strong Buy,” one advises “Moderate Buy,” and five suggest a “Hold” rating. Its mean price target of $206.69 indicates a 32.1% upside potential from current price levels.