Houston, Texas-based EOG Resources, Inc. (EOG) explores, produces, and markets crude oil, natural gas liquids, and natural gas. With a market cap of approximately $57.9 billion, EOG Resources’ operations span the United States, the Republic of Trinidad and Tobago, and internationally.

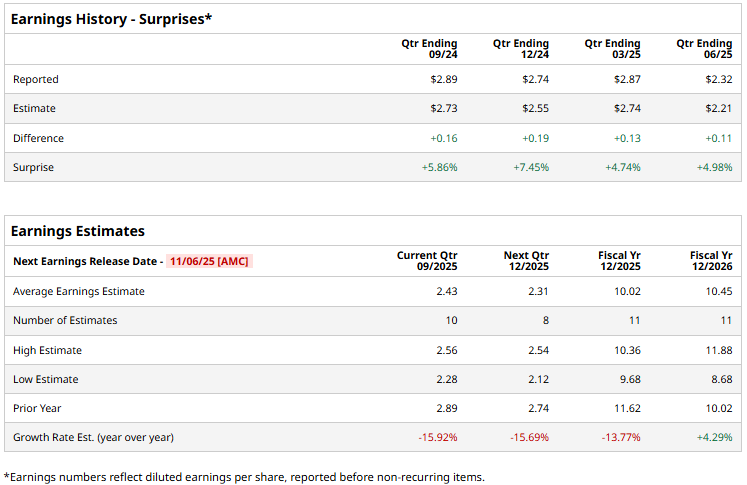

The energy sector giant is gearing up to announce its third-quarter results after the market closes on Thursday, Nov. 6. Ahead of the event, analysts expect EOG to report an adjusted profit of $2.43 per share, down 15.9% from $2.89 per share reported in the year-ago quarter. On a positive note, the company has surpassed Street’s bottom-line projections in each of the past four quarters.

For the full fiscal 2025, EOG is expected to deliver an adjusted EPS of $10.02, down 13.8% from $11.62 reported in 2024. While in 2026, its adjusted earnings are expected to grow 4.3% year-over-year to $10.45 per share.

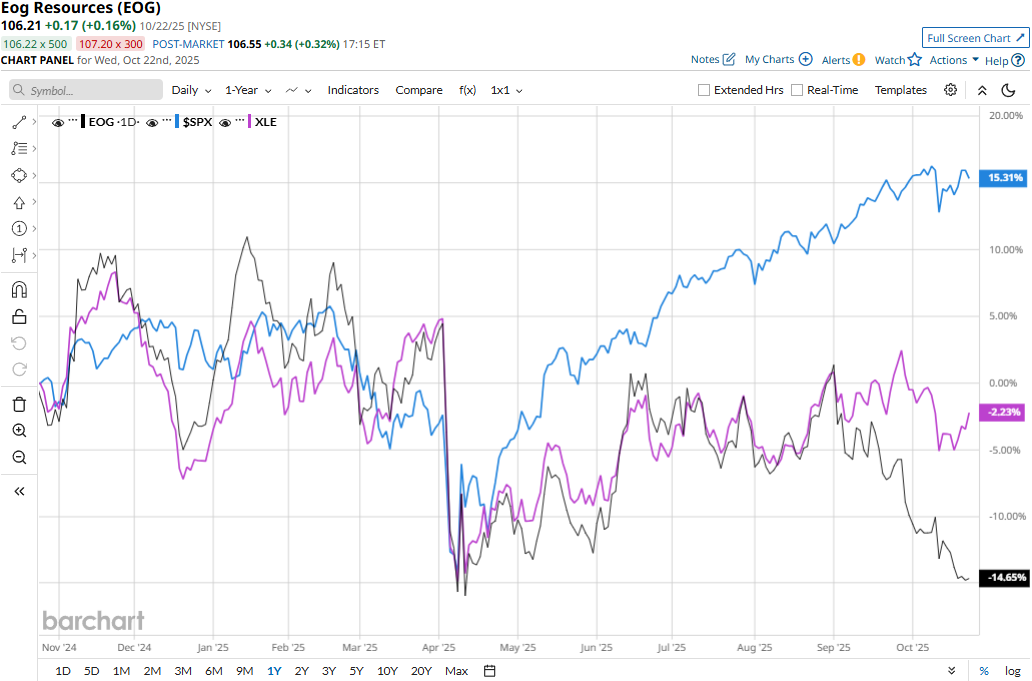

EOG stock prices have plunged 15.1% over the past 52 weeks, notably underperforming the Energy Select Sector SPDR Fund’s (XLE) 2.8% decline and the S&P 500 Index’s ($SPX) 14.5% returns during the same time frame.

EOG Resources’ stock prices observed a marginal uptick in the trading session following the release of its better-than-expected Q2 results on Aug. 7. The company’s Oil, natural gas liquids, and natural gas production remained above guidance midpoints. Its overall topline for the quarter dropped 9.1% year-over-year to $5.5 billion, but surpassed the Street’s expectations by 30 bps. Meanwhile, its adjusted EPS declined 26.6% year-over-year to $2.32, but exceeded the consensus estimates by almost 5%.

The consensus opinion on EOG remains cautiously optimistic, with a “Moderate Buy” rating overall. Of 32 analysts covering the stock, opinions include 12 “Strong Buys,” two “Moderate Buys,” and 18 “Holds.” Its mean price target of $138.97 represents a 30.8% premium to current price levels.