Based in New Orleans, Louisiana, Entergy Corporation (ETR) delivers electric power to roughly 3 million customers across Arkansas, Louisiana, Mississippi, and Texas through its utility subsidiaries.

The company runs a mix of generating facilities, including natural gas, nuclear, coal, hydroelectric, oil, and renewables, totaling about 24,000 megawatts in capacity. With a market capitalization of $42.73 billion, Entergy operates extensive transmission and distribution networks.

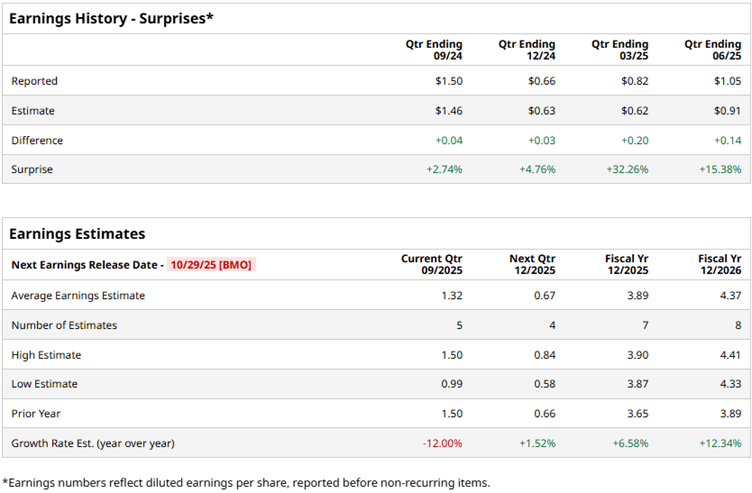

Entergy is set to report its third-quarter results for fiscal 2025 on Oct. 29 before the market opens. Ahead of the results, Wall Street analysts have a mixed view of the company’s bottom-line growth trajectory.

For the third quarter, analysts expect Entergy’s profit to decline by 12% year-over-year (YOY) to $1.32 per diluted share. However, for the current year, its profit is projected to improve by 6.6% annually to $3.89 per diluted share. The company has a solid history of surpassing consensus bottom-line estimates, topping them in each of the trailing four quarters.

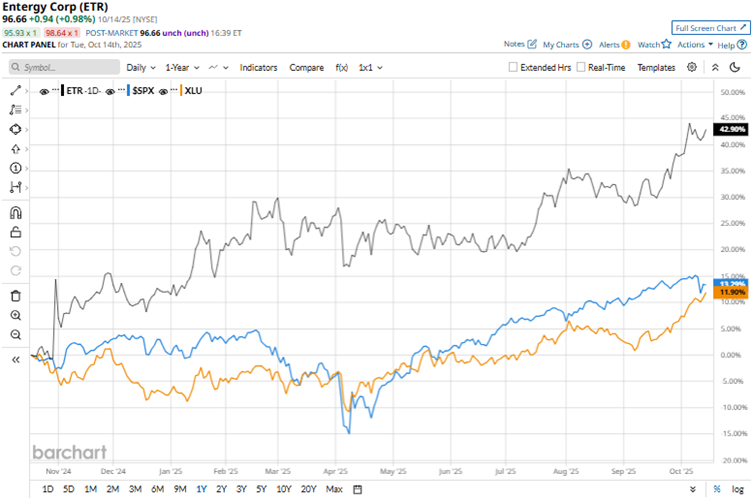

Entergy’s stock has held up well over the past year. Over the past 52 weeks, the stock has gained 46.6%, while it is up 27.5% year-to-date (YTD). Comparing this to the broader S&P 500 Index ($SPX), which has gained 13.4% and 13% over the same periods, respectively. Therefore, we see a clear outperformance.

Entergy has also outperformed its sector over these periods, as the Utilities Select Sector SPDR Fund (XLU) has increased by 14.3% over the past 52 weeks and 21.2% YTD.

On July 30, Entergy reported better-than-expected second-quarter results. The company’s total revenue increased by 12.7% YOY to $3.33 billion, with most of the topline coming from electric utilities. This also exceeded the $3.22 billion expected by Wall Street analysts. The company’s adjusted earnings also grew 9.4% from the prior year’s period to $1.05 per share, surpassing the expected $0.91 per share. Based on these robust results and the earnings beat, the stock surged 1.2% on July 30 and an additional 1.3% the next day.

Wall Street analysts have been bullish about Entergy’s future. Among the 19 analysts covering the stock, the consensus rating is “Moderate Buy.” The ratings configuration is more bullish than it was a month ago, with 13 “Strong Buy” ratings now, up from 12. The ratings are completed by six “Holds.”

The mean price target of $96.03 indicates a marginal downside from current levels, while the Street-high price target of $109 implies a 12.8% upside.