/Enphase%20Energy%20Inc%20-%20solar%20panels-by%20anatoliy_gleb%20via%20Shutterstock.jpg)

With a market capitalization of $4.1 billion, Enphase Energy, Inc. (ENPH) is a global leader in energy technology, renowned for its cutting-edge solar microinverters, energy storage systems, and intelligent energy management solutions. Headquartered in Fremont, California, Enphase has transformed the solar industry by pioneering microinverter technology, which enables the conversion of direct current (DC) to alternating current (AC) at each individual solar panel.

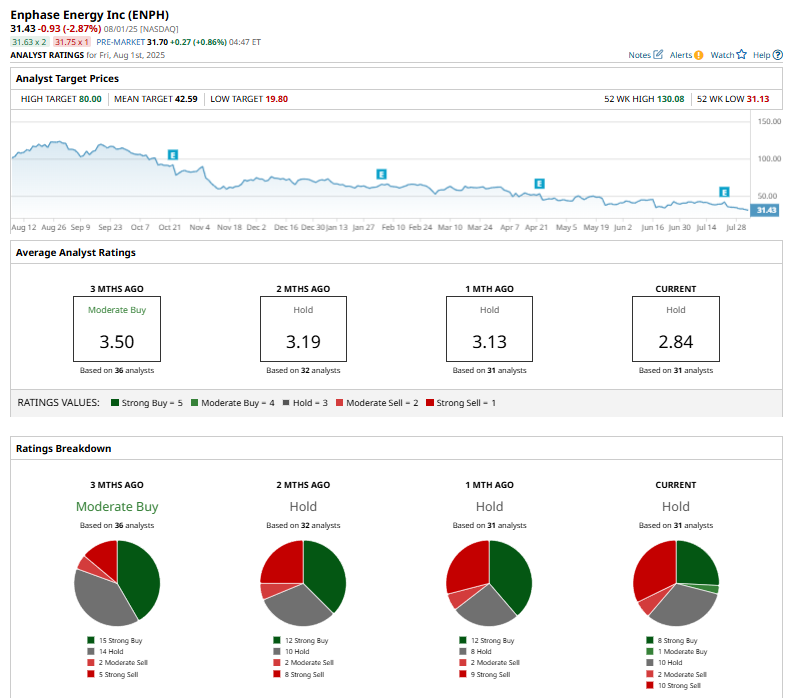

Shares of ENPH have trailed the broader market over the past 52 weeks. ENPH has declined 71.3% over this time frame, while the broader S&P 500 Index ($SPX) has gained 14.5%. In 2025, ENPH stock declined 54.2%, compared to SPX's 6.1% YTD rise.

Narrowing the focus, ENPH stock has also underperformed the Invesco Solar ETF’s (TAN) 12% fall over the past year and 10.1% return in 2025.

On July 22, Enphase Energy reported its Q2 2025 results, initially boosting its stock by 7.2% before a sharp 14.2% decline in the following trading session. Revenue rose 20% year-over-year to $363.2 million, driven by strong demand in both the U.S. and Europe. Non-GAAP net income came in at $89.9 million, or $0.69 per share, exceeding analyst expectations. The company also shipped around 1.53 million microinverters and delivered a record 190.9 MWh of IQ Batteries.

Despite robust financials and the launch of its 4th-generation energy system, cautious Q3 guidance, paired with macroeconomic headwinds such as policy uncertainty and weak residential solar demand, dampened investor sentiment and triggered a sell-off.

For FY2025, which ends in December, analysts expect ENPH's EPS to improve 24.8% year-over-year to $1.26 per share. The company's earnings surprise history is mixed. It beat the consensus estimates in two of the last four quarters while missing on two other occasions.

Among the 31 analysts covering the stock, the consensus rating is a “Hold,” a step down from “Moderate Buy” rating three months ago. That’s based on eight “Strong Buy” ratings, one “Moderate Buy,” 10 “Holds,” two “Moderate Sells,” and 10 “Strong Sells.”

This configuration is more bearish than a month ago, with 12 “Strong Buy” ratings on the stock.

On Jul. 30, Johnson Rice downgraded its rating on Enphase Energy from “Buy” to “Accumulate,” signaling a more cautious stance amid shifting market dynamics. The downgrade was issued by analyst Martin Malloy, who also initiated a price target of $45 for the stock, marking the firm’s first formal valuation of Enphase.

The mean price target of $42.59 represents a premium of 35.5% to ENPH's current levels. The Street-high price target of $80 implies a solid potential upside of 154.5% from the current price levels.