Headquartered in Connecticut, EMCOR Group, Inc. (EME) is a leading specialty construction and facilities services company in the United States, providing comprehensive mechanical and electrical construction, industrial services, and building maintenance solutions. With a market cap of $31.3 billion, the company serves a diverse set of end markets, including commercial, industrial, healthcare, data centers, and infrastructure.

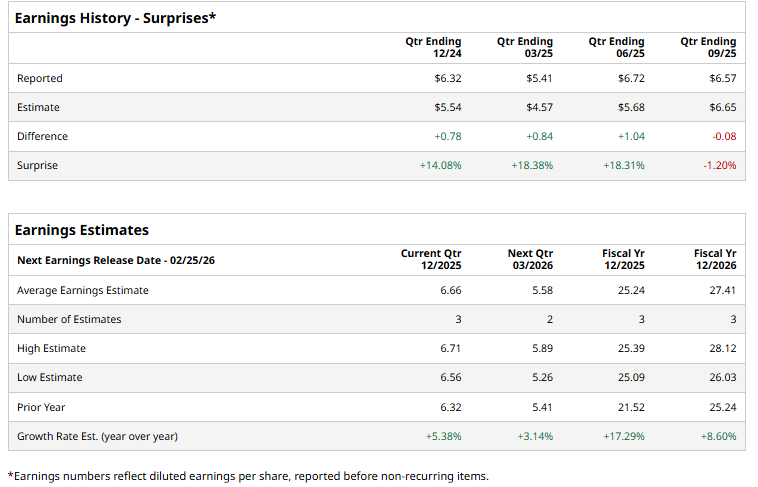

It is expected to announce its fiscal Q4 earnings for 2025 shortly. Ahead of this event, analysts expect the company to report a profit of $6.66 per share, up 5.4% from $6.32 per share in the year-ago quarter. The company has surpassed Wall Street’s bottom-line estimates in three of the past four quarters, while missing on another occasion.

For fiscal 2025, analysts expect EME to report EPS of $25.24, up 17.3% from $21.52 in fiscal 2024. Moreover, in FY2026, the company’s EPS is expected to improve 8.6% annually to $27.41.

EME stock has gained 35.8% over the past 52 weeks, outperforming the Industrial Select Sector SPDR Fund’s (XLI) 18.7% surge and the S&P 500 Index’s ($SPX) 13.3% uptick during the same time frame.

On Jan. 2, EMCOR Group shares rose 3.8% after the company announced a sizable increase in its quarterly dividend, raising the payout to $0.40 per share from $0.25, a move that underscored management’s confidence in its financial strength and was welcomed positively by investors.

Wall Street analysts are moderately bullish about EME’s stock, with a “Moderate Buy” rating overall. Among 10 analysts covering the stock, six recommend “Strong Buy” and four suggest a “Hold.” Its mean average price target of $721 implies an upswing potential of 4.8% from the current market prices.