The State Board of Administration (SBA) of the Florida Retirement System (FRS) has backed Tesla Inc. (NASDAQ:TSLA) CEO Elon Musk's new compensation award. The agency is responsible for managing and investing on behalf of the FRS Trust Fund and owns over $1 billion in Tesla shares. It also manages over $280 billion in total assets.

A Bold, Performance-Driven Incentive Structure, Says SBA

In an SEC filing on Monday, the agency called the compensation award a "bold, performance-driven incentive structure" with no guarantees of compensation for Musk.

"If Tesla meets all metrics within this plan, investors will benefit from incremental value creation of $7.5 trillion," the agency said in the filing, adding that the created value for shareholders outweighs any dilution as well as the "incremental equity award to Elon Musk for each tranche of compensation."

Musk Only Benefited When Shareholders Benefited First

Defending against the criticism of the package, the agency cited International Shareholder Services (ISS) and Glass Lewis' opposition to the award. "The 2018 award, which ISS and Glass Lewis have criticized, required Tesla to grow from roughly $50 billion to $650 billion in market cap," the SBA said, adding that the milestone was achieved by Tesla in four years.

"Far from a windfall, these awards functioned as pure pay-for-performance mechanisms: Musk only benefited when shareholders benefited first," the agency said in the filing.

Elon Musk Says "Much Appreciated"

Taking to the social media platform X on Monday, Musk thanked the SBA for its support of the pay package. "Much appreciated!" Musk wrote in a post, quoting the update shared by Tesla's official handle.

Musk has been hitting back at critics for opposing the pay package, with the CEO touting Tesla as being worth more than its automotive competitors. Tesla's current market capitalization stands at approximately $1.4 trillion. The CEO also hit out at proxy advisors, calling them "corporate terrorists" during Tesla's third-quarter earnings call last week.

Mixed Reactions To Elon Musk’s Pay Packet

The trillion-dollar pay packet has been met with mixed reactions from the market, with ARK Invest CEO Cathie Wood expressing her support for the pay packet and predicting a decisive victory for the award during November 6's shareholder meeting.

TV host Jim Cramer also expressed support for the package, calling Musk "actually worth" the mega compensation award. Meanwhile, Gerber Kawasaki's co-founder Ross Gerber has criticized the package, calling it "insanity," and questioned the independence of the board from Musk's influence.

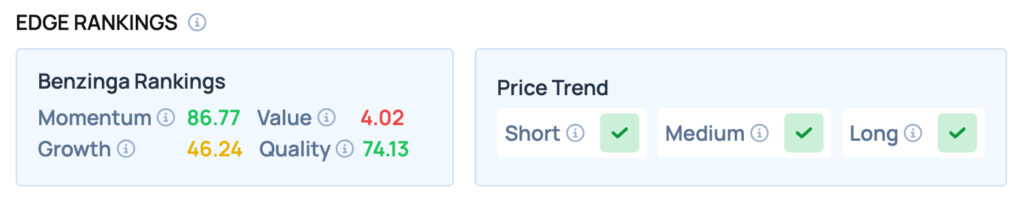

Tesla scores well on Momentum and Quality metrics, while offering satisfactory Growth, but poor Value. Tesla also has a favorable price trend in the Short, Medium and Long term. For more such insights, sign up for Benzinga Edge Stock Rankings today!

Check out more of Benzinga’s Future Of Mobility coverage by following this link.

Read Next:

Photo courtesy: Shutterstock