Tesla Inc. (NASDAQ: TSLA) has reportedly urged the Trump administration's Environmental Protection Agency (EPA) not to repeal emissions standards dictating the auto industry, following the EPA's proposal to repeal the 2009 Endangerment Finding.

Check out the current price of TSLA here.

Tesla Says Repealing Emissions Standards Gives Automakers Free Rein

Repealing the standards would "give a pass to engine and vehicle manufacturers for all measurement, control, and reporting of GHG emissions for any highway engine and vehicle," the EV giant said in its comments sent to the government on Thursday.

Repealing the Finding would have a "highly disruptive and unlawful" effect on the automotive industry, the company said. Tesla also said that the EPA's proposal would reverse market stability and threaten the U.S.'s position as a leader in the global automotive industry.

A Major Stream Of Revenue Lost

The news comes as Tesla could lose a major revenue stream as the Trump administration earlier relaxed CAFE or Corporate Average Fuel Economy standards, which dictated how much distance a vehicle should cover on a gallon of fuel.

Violating the norms meant hefty fines for automakers, with Stellantis having recently paid over $190 million in fines for violating CAFE standards. To offset the fines, automakers purchased ZEV credits from companies like Tesla, which earned almost $2.8 billion in revenue. With relaxed norms, that revenue stream could be lost.

Tesla isn't the only company to feel the effect, with Rivian Automotive Inc. (NASDAQ: RIVN) also announcing $100 million lost in revenue due to the relaxation of CAFE standards, as it made ZEV credits effectively redundant.

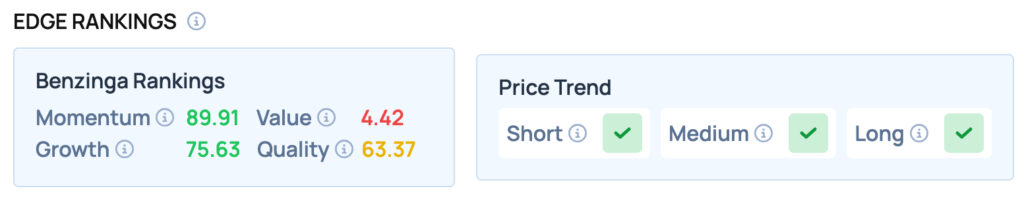

Tesla scores well on Momentum and Growth metrics, while offering satisfactory Quality, but poor Value. Tesla also offers a favorable price trend in the Short, Medium and Long term. For more such insights, sign up for Benzinga Edge Stock Rankings today!

Check out more of Benzinga's Future Of Mobility coverage by following this link.

Read Next:

Image via Imagn Images