Tesla Inc. (NASDAQ:TSLA) CEO Elon Musk has broken his silence on the opposition of proxy advisory firms Institutional Shareholder Services Inc. and Glass Lewis to his $1 trillion CEO compensation award.

Check out the current price of TSLA here.

ISS And Glass Lewis Are ‘Corporate Terrorists'

Taking to the social media platform X on Wednesday, following the earnings call, Musk expressed his thoughts on the proxy advisory firms in a post, saying that "the fundamental issue" was passive index firms controlling over half of all publicly-traded shares. These funds "outsource their shareholder vote" to the advisory firms," Musk said.

"ISS and Glass Lewis have no actual ownership themselves and often vote along random political lines unrelated to shareholder interests!" Musk said, calling it a "major problem" plaguing other companies as well.

He added that the advisory firms recommended against the re-election of Ira Ehrenpreis, a director at Tesla, for "insufficient gender diversity, but, at the same time, also recommend voting against re-electing Kathleen Wilson-Thompson!"

Speaking to investors and analysts during the earnings call on Wednesday, Musk referred to the firms as "corporate terrorists." He also added that the shareholder vote was about retaining control over the EV giant but reassured investors that the voting share wouldn't let Musk "be fired if I go insane," he said.

"They’ve made many terrible recommendations in the past. If those recommendations had been followed, they would have been extremely destructive to the future of the company," Musk said.

Tesla's Mixed Bag Earnings Call

The comments follow Tesla's Q3 earnings report, which was a mixed bag as the company reported $28.095 billion in revenue, beating the Wall Street consensus of $26.239 billion. However, Tesla missed Wall Street estimates of $0.54 EPS, reporting $0.50 instead, a fourth straight miss for Tesla.

Robyn Denholm Defends Musk's Pay Package

Meanwhile, Tesla Board Chair Robyn Denholm defended Musk's pay packet amid proxy advisors’ opposition in a letter addressed to the company's shareholders ahead of November's shareholder meeting, criticizing the firms' "one-size-fits-all" approach as "misguided" and that the approach isn't ideal for companies like Tesla, which challenge the status quo.

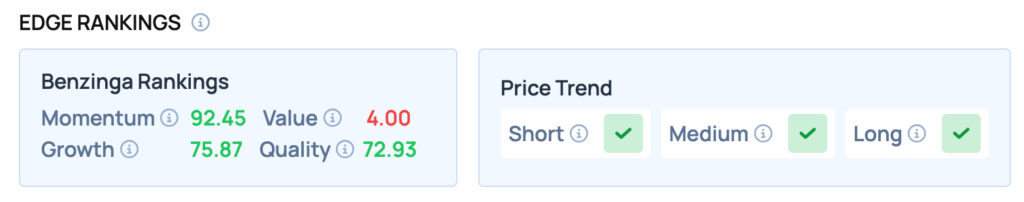

Tesla scores well on Momentum, Quality and Growth metrics, but offers poor Value. Tesla also offers a favorable price trend in the Short, Medium and Long term. For more such insights, sign up for Benzinga Edge Stock Rankings today!

Check out more of Benzinga’s Future Of Mobility coverage by following this link.

Read Next:

Photo Courtesy: Photo Agency on Shutterstock.com