Elliott Management's $2 billion stake in Workday (WDAY) signals confidence in the enterprise software company's artificial intelligence (AI)-driven transformation strategy. The activist investor praised Workday's leadership and expressed support for the multi-year plan outlined at the company's recent Financial Analyst Day, suggesting potential for long-term value creation.

Workday's aggressive AI expansion provides compelling reasons for Elliott's optimism. The company recently completed a $1.1 billion acquisition of AI firm Sana, marking its third AI-related deal in two months. This acquisition creates a new "front door for work" experience, integrating knowledge, data, and action capabilities across Workday's 75 million user base.

The company's comprehensive AI strategy extends beyond acquisitions. Workday announced multiple AI initiatives, including the Agent System of Record for managing both human and AI workforces, new Illuminate agents for HR and finance processes, and the Workday Data Cloud for zero-copy data sharing with platforms such as Snowflake (SNOW) and Databricks.

The new Workday Build developer platform democratizes AI creation, allowing customers to build custom agents using Workday's rich people and financial data. However, investors should consider the competitive landscape. The HR software sector faces intensifying competition as rivals pursue similar AI strategies through acquisitions and platform enhancements.

Workday's premium valuation means execution risk is significant as the company must deliver measurable returns from its substantial AI investments. Elliott's track record of value creation through operational improvements and strategic repositioning adds credibility to the investment thesis.

For investors seeking exposure to enterprise AI transformation, Workday's comprehensive platform approach, combined with Elliott's backing, creates a compelling case. However, success depends on effectively monetizing these AI capabilities in an increasingly crowded market.

Is Workday Stock a Good Buy Right Now?

Workday is aggressively positioning itself as the dominant enterprise AI platform for managing people, money, and agents, despite widespread market skepticism about the future of SaaS companies in the AI era.

Workday’s AI strategy centers on three key pillars: first-party enterprise agents, an Agent System of Record for secure enterprise onboarding, and a low-code development platform through its Flowise acquisition. This approach has generated impressive early results, with AI solutions doubling year-over-year (YoY), and some products, such as Evisort, growing 100% quarter-over-quarter (QoQ).

The company's competitive moat stems from its position as a system of record for 11,000 customers with 97% retention rates. It manages data for 75 million users across one trillion annual transactions, giving it access to clean, contextual business data that AI models require to deliver meaningful enterprise value, rather than generic task automation.

Recent strategic acquisitions, including HiredScore, Evisort, Paradox, and Flowise, demonstrate Workday's commitment to building comprehensive AI capabilities across the entire talent lifecycle.

While seat-based growth faces headwinds from post-pandemic rightsizing, Eschenbach maintains this reflects temporary overcapacity rather than structural AI displacement. The company's international expansion, federal government initiatives, and focus on medium-sized enterprises through Workday GO provide additional growth vectors beyond traditional seat expansion.

Workday's platform strategy positions it uniquely among enterprise software vendors as both an applications and platform company, enabling partners to build solutions while maintaining the security and governance enterprises demand for their most sensitive people and financial data.

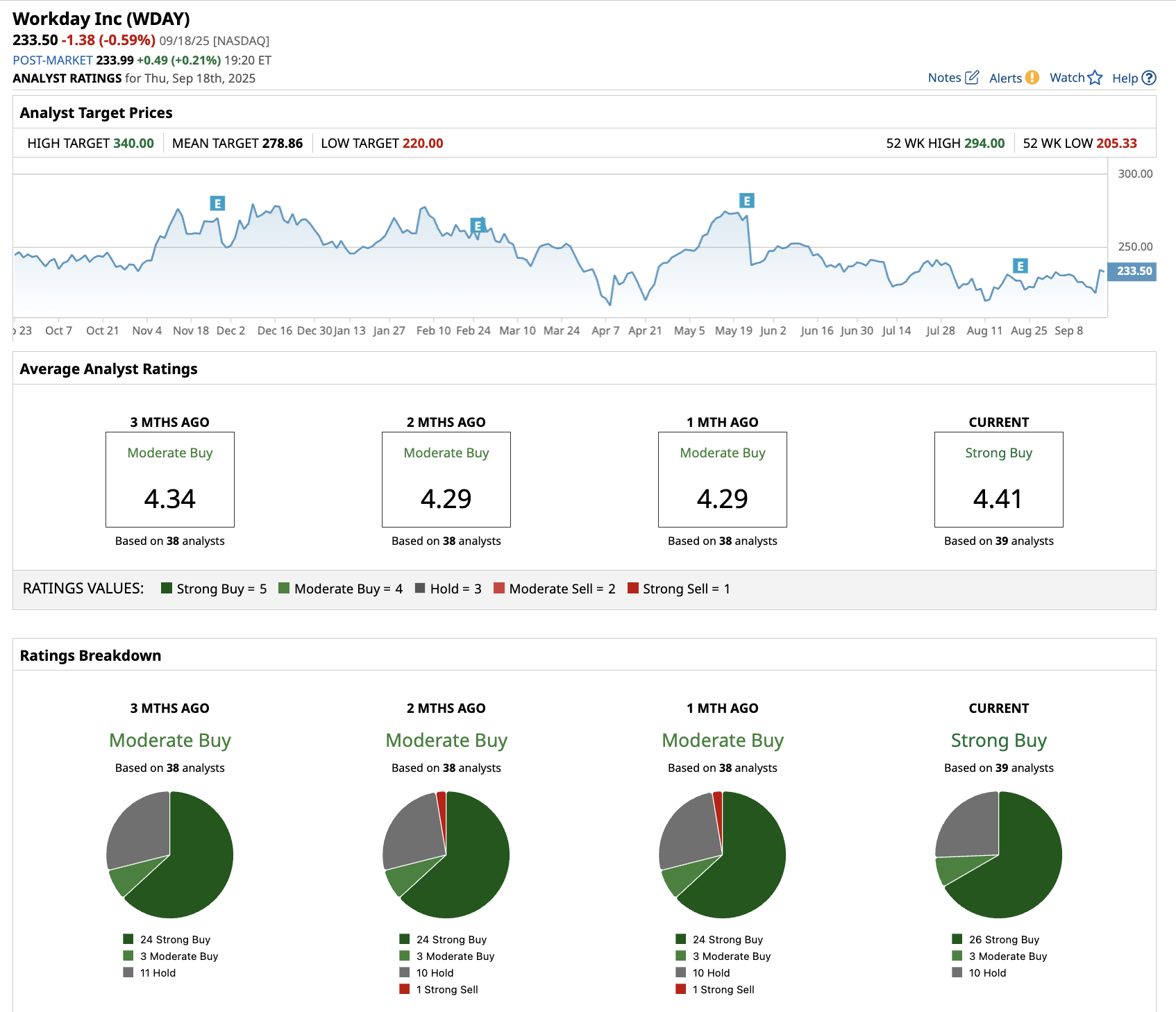

What Is the Target Price for WDAY Stock?

According to analyst estimates, Workday is forecast to increase sales from $8.44 billion in fiscal 2025 (ended in January) to $15.2 billion in fiscal 2030. In this period, adjusted earnings are forecast to expand from $7.30 per share to $16.24 per share.

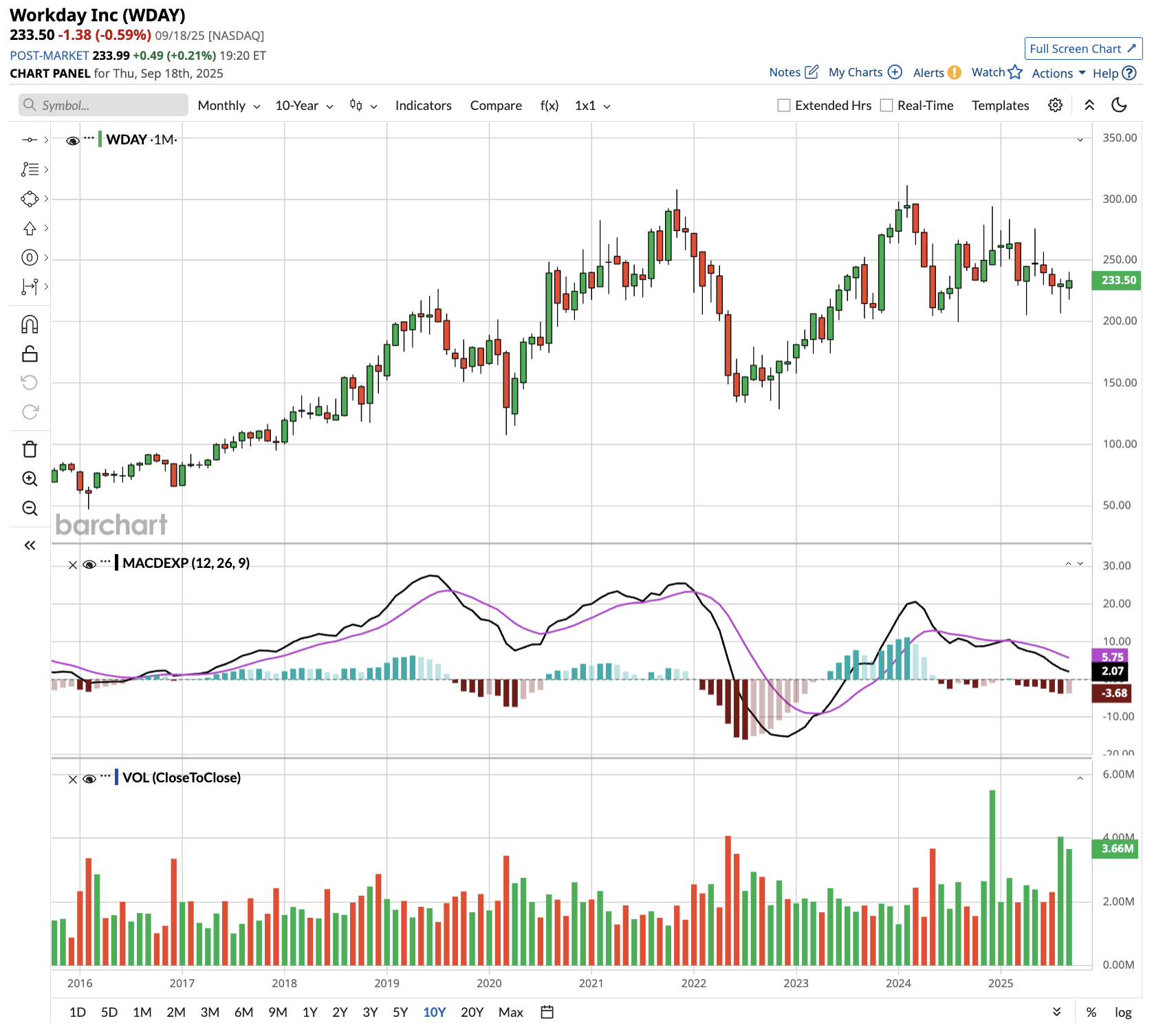

Workday stock trades at a forward price-to-earnings (P/E) multiple of 24.6 times, below its five-year average of 51 times. If Workday continues to trade at a similar multiple, it should be priced at $400 in early 2029, which is above the current price of $233.50.

Out of the 39 analysts covering WDAY stock, 26 recommend “Strong Buy,” three recommend “Moderate Buy,” and 10 recommend “Hold.” The average target WDAY stock price is $279, indicating a potential upside of 20%.