On Monday, Sen. Elizabeth Warren (D-Mass.) called to break up Big Tech after a massive Amazon.com, Inc. (NASDAQ:AMZN) Web Services outage disrupted access to dozens of major platforms, including Amazon delivery services, Walt Disney Co. (NYSE:DIS) Disney+ and McDonald Corporation (NYSE:MCD) app.

Warren Says, ‘It's Time To Break Up Big Tech'

Following reports of widespread disruptions, Warren reposted a list of affected companies on X, formerly Twitter, writing, "If a company can break the entire internet, they are too big. Period. It's time to break up Big Tech."

Her remarks came after it was reported that Amazon's AWS outage had temporarily taken down major websites and apps such as Reddit Inc (NYSE:RDDT), Ring, Robinhood Markets, Inc (NASDAQ:HOOD), Snap Inc (NYSE:SNAP) Snapchat.

Government websites in the U.K., including Gov.uk and HM Revenue and Customs, also experienced outages.

Amazon did not immediately respond to Benzinga’s request for comments.

See Also: OpenAI's ChatGPT Makes Headway In Search, Threatening Google's Reign

AWS Confirms Cause Of Widespread Outage

Amazon confirmed that the disruption stemmed from a DNS resolution failure in its DynamoDB service at its Northern Virginia (US-East-1) data center—the company's largest.

The failure caused elevated error rates and latency across multiple services, including EC2, Lambda and RDS, affecting customers worldwide.

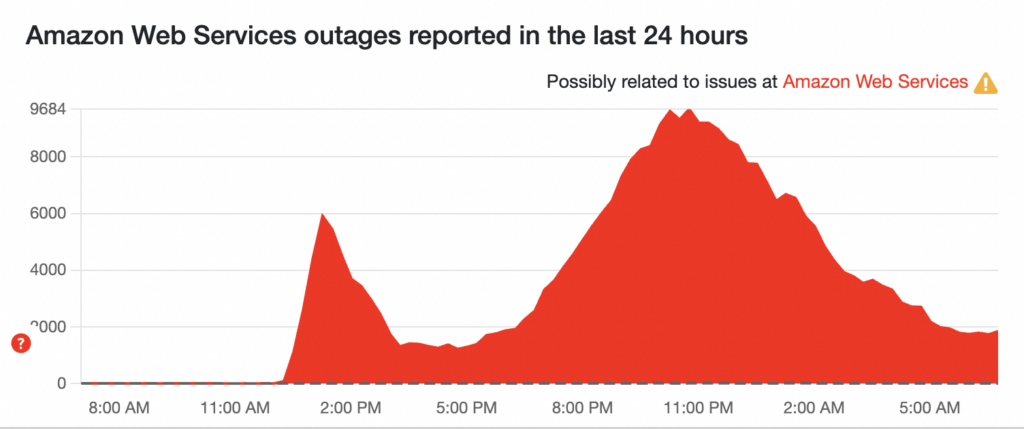

AWS engineers said they began restoring functionality within hours, with full service returning early Monday morning.

"Most requests are now succeeding," Amazon said in an update at 5:48 a.m. PDT.

At the time of writing, Downdetector showed that in the U.S. some users were still reporting AWS-related issues.

Outage Sparks Broader Antitrust Debate

Warren's comments came amid renewed debate over Big Tech's dominance. Earlier this year, a federal judge declined to force Alphabet Inc.'s (NASDAQ:GOOG) (NASDAQ:GOOGL) Google to divest Android or Chrome in an antitrust ruling.

The decision was criticized by Warren as a "slap on the wrist."

Price Action: Amazon shares rose 1.61% on Monday but are down 1.7% year to date, according to Benzinga Pro.

Benzinga's Edge Stock Rankings indicate that AMZN maintains a strong long-term price trend, though it shows weakness in the short and medium term. More detailed performance insights can be found here.

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Photo Courtesy: Bryan J. Scrafford on Shutterstock.com