/Concept%20business%20illustration%20stock%20market%20finance%20diagram%20by%20alexaldo%20via%20Shutterstock.jpg)

Electronic Arts (EA) is a staple of the gaming industry. The company is known for making many popular, well-known games that it has been able to aggressively capitalize on. It popularized microtransactions in its industry, and its reputation has been tied to its profit-driven actions.

Regardless, the online gaming industry is plagued by anemic profits, so these “greedy” moves have actually propelled it into one of the stalwarts of the industry.

Unfortunately, you may no longer be able to get much exposure to it. The company has agreed to be acquired in an all-cash take-private deal valuing the company at about $55 billion, with shareholders set to receive $210 per share.

Saudi Arabia's Acquisition of EA

EA is being acquired by a buyer group led by Saudi Arabia’s Public Investment Fund (PIF), alongside Silver Lake and Jared Kushner's Affinity Partners. These are the same names that have been heavily investing in AI companies, and this massive gaming investment means they see more growth potential in this sector. It is one of the largest buyout attempts in history due to the headline value involved.

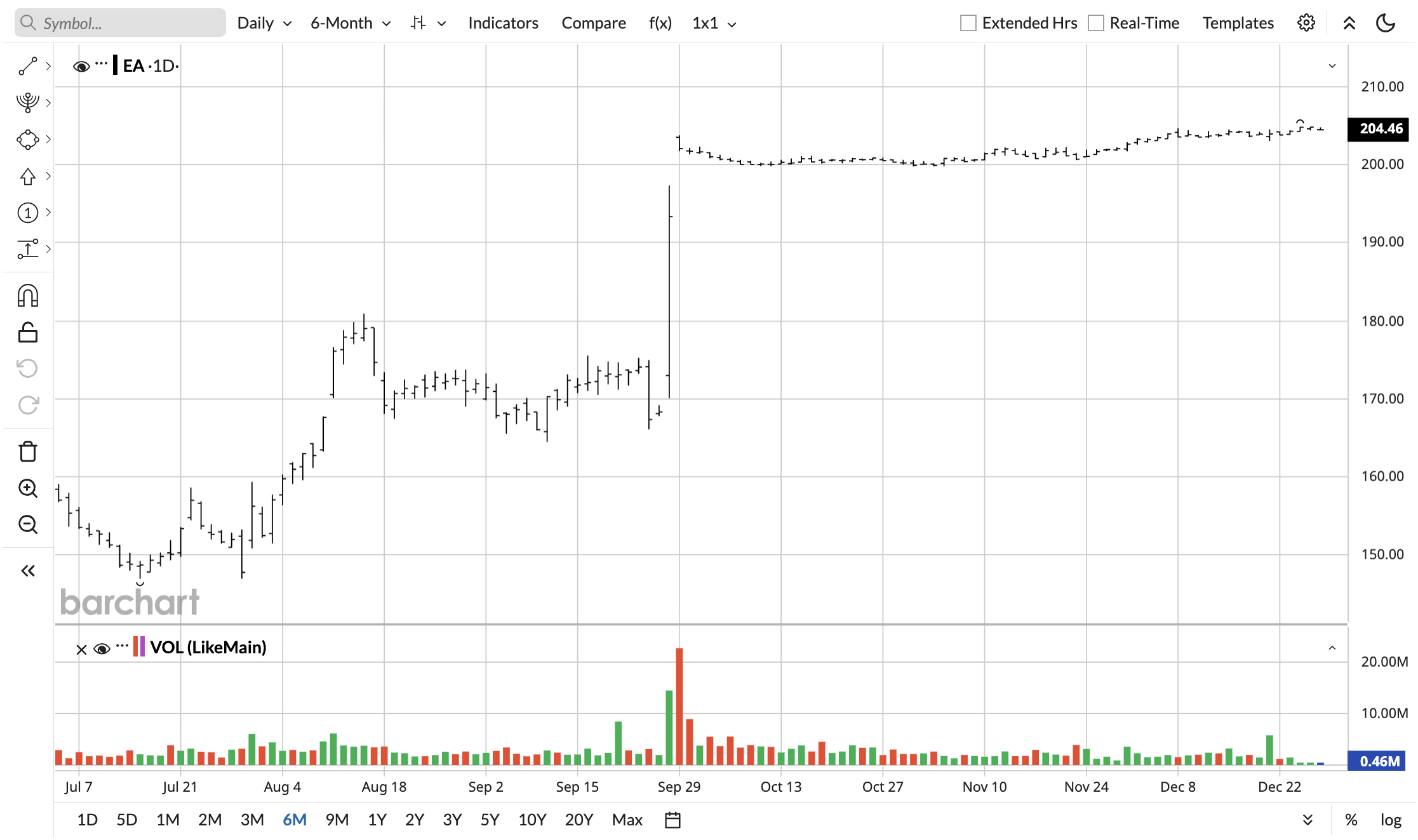

The stock jumped by 20% immediately after the deal and has been trading sideways since. EA's current price of $204.50 has turned it into a merger arbitrage opportunity.

Why the PIF Is Acquiring EA

EA is widely identified with major franchises, including Madden NFL, Battlefield, and The Sims, which is part of why it drew buyout interest in mainstream deal coverage.

In early 2025 reporting, EA also spotlighted large capital returns, covering a planned $1 billion accelerated share repurchase within a broader $5 billion authorization.

The profits and the number of popular franchises likely caught the attention of outsiders who wanted to take it off the public markets. The PIF is after anything trendy and flashy, so this fits perfectly.

For EA, it will reduce pressure from quarterly market scrutiny, whereas shareholders before the deal was announced secured at least a 20% profit.

All things considered, it appears to be a win-win. EA stock was already on a strong uptrend before the deal's announcement, so it was surprising that shareholders had already approved it. The biggest hurdle now is regulatory, which too seems likely to pass.

What Can You Do With EA Stock Now?

The market believes that the current prices sufficiently account for the risk involved if the deal does not go through. If you believe otherwise, you can buy the stock and make a nifty $5.50 profit per share if the deal does go through, or even more if you use margin.

If you do not believe that the deal will go through and either party will back out, you can go short on EA stock. It is likely to fall well below $200 if the deal does not go through.

Can the Deal Go Through?

Because the consortium includes Saudi Arabia’s PIF, many national security experts believe the deal is alarming because EA holds extensive player data, and the transaction would move EA from public-company disclosures to a “black box” privately held structure.

Moreover, CNBC reported about $36 billion of equity and $20 billion of debt financing arranged by J.P. Morgan. It is a leveraged buyout due to the large scale, and higher rates can pressure big debt packages. If closing takes longer than expected, the market can start widening the spread down from the current $204.5 level and close to $200 or less, depending on how long capital stays tied up.

I would go long on EA as the deal is likely to go through regardless.