It’s generally true that our parents are in much better financial situations than our generation is. However, more than four million U.S. adults still provide financial support to their parents. According to the Census Bureau, adult children provided $17.6 billion in support for their parents in 2020.

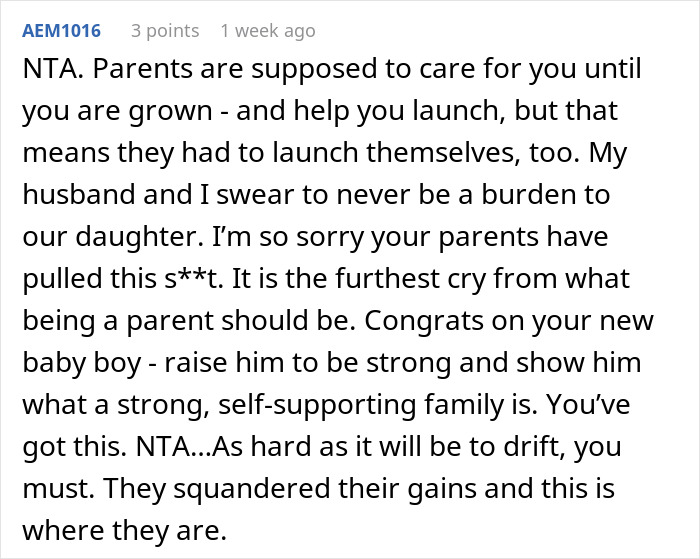

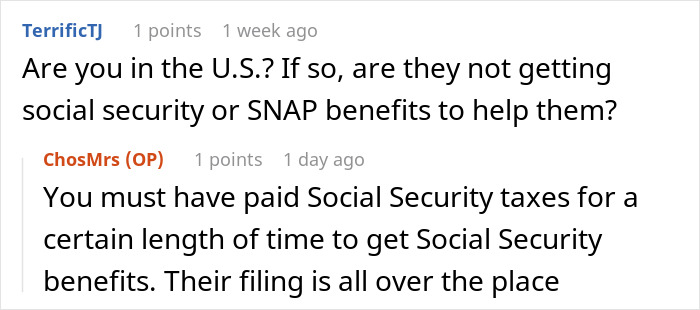

This woman did the same for her parents, but once she had her own family and started having kids, it just became unfeasible. Irked by thoughts that she’s being selfish and the unending phone calls asking for money, she decided to ask for opinions online. Was she right to fund her parents’ retirement when they spent their whole lives squandering any savings away?

These parents expected their 32-year-old daughter to support them after retirement

Image credits: freepik (not the actual photo)

Yet she refused, saying she had her own family and kids to take care of

Image credits: pexels (not the actual photo)

Image credits: ChosMrs

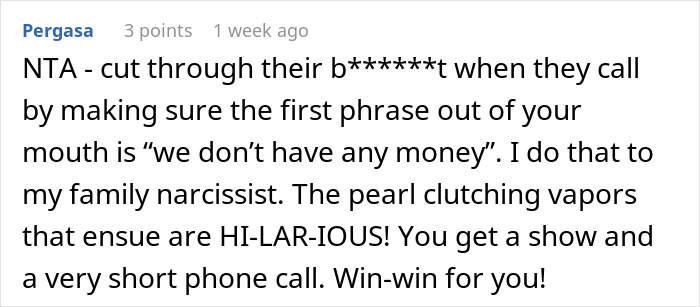

Some adult children even get into debt when they have to financially support their retired parents

Image credits: pexels (not the actual photo)

People tend to criticize the notion that people should have kids to have someone take care of them in old age. Yet the reality today is exactly that: almost half of American adults are providing financial support for their parents or expecting to do so in the near future.

According to a recent survey by LendingTree, 23% of Americans are currently financially supporting their parents or in-laws. 23% expect to soon be involved in their parents’ or in-laws’ financial well-being.

Americans are helping their older parents with basic everyday expenses like:

- buying groceries (69%),

- other personal purchases (49%),

- housing (44%),

- utilities (43%),

- and medical bills (42%).

Like the daughter in this story, some adult children experience strains in their finances when they have to dedicate a portion of their earnings to their parents’ well-being. According to the research from LendingTree, 58% of those who provide their parents with financial support say they’re now in debt. 74% admit that it keeps them from reaching their financial goals.

In some cultures, it’s expected to help parents financially when you’re an adult

Image credits: freepik (not the actual photo)

Different cultures have different attitudes towards financial assistance for family members. The author mentions that they’re from an Asian family, and some commenters observed that this is typical in many Asian households.

However, Europeans have similar attitudes as well. Research by Pew shows that Italians are the most likely to say that adult children should help out a parent financially if they need it. In fact, 87% of Italians believe so, while 76% of Americans and only 58% of Germans think the same. Similarly, most Italians (73%) also think that parents should financially support their adult children.

Ironically, Americans are the most likely to say that financial support for older parents should come from adult children and other family members. Only 24% believe that the government should take care of retired parents. In contrast, 58% of Italians and 48% of Germans think the same.

Experts advise individuals to start saving for retirement as soon as possible

Image credits: unsplash (not the actual photo)

In the U.S., 45% of adults aged 65+ agree that they themselves should be responsible for their financial well-being after retirement. The reality is that it’s never too early to start preparing for retirement so that you’re not a burden to your kids later in life.

Here are some things individuals should keep in mind if they want to be ready for retirement:

- Estimate how much you will need after retirement. According to some experts, people usually need 70%-90% of their pre-retirement income to live like they’re used to when they stop working.

- Take advantage of your employer’s retirement plan. Whether that’s a 401(k) or some kind of a simplified plan, familiarize yourself with it. Also, learn more about your spouse’s pension plan.

- Consider investing. Investments can contribute to retirement savings a great deal. This may require more financial knowledge and experience, but diversifying your retirement money can be beneficial.

- Don’t withdraw from retirement savings. A retirement savings account should remain untouched until your actual retirement, no matter how tempting it might be. The U.S. Department of Labor cautions that if a person withdraws their retirement money, they’ll lose principal and interest, and they may even lose tax benefits or be ordered to pay penalties.

- Consider opening an Individual Retirement Account (IRA). An IRA is a great choice for those whose employers don’t offer a 401(k), want more control over their investments, or for those who’ve maximized their 401(k) contributions.

“You can’t get a loan for retirement,” Chuck Simms CLU®, ChFC®, RICP® notes. “Your future is up to you. Here’s what it comes down to – you need to put money away and keep saving.”

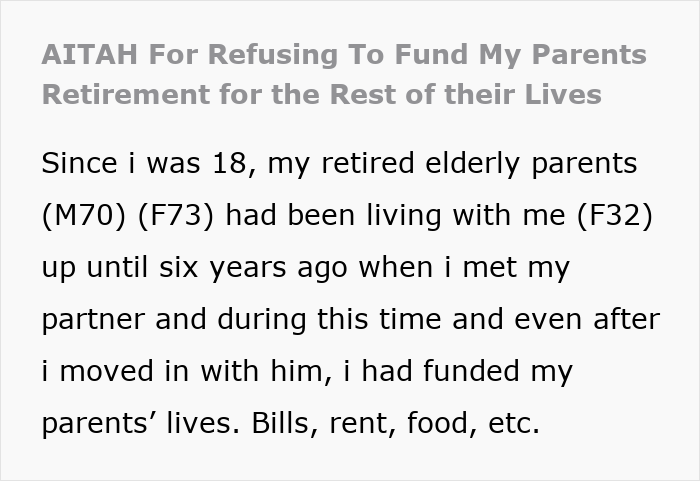

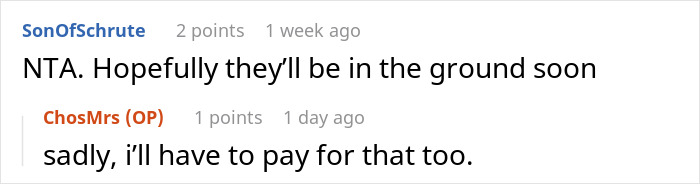

“The moment my folks got money, they went on an overseas vacation instead of [paying] rent”: She gave an example of how irresponsible the parents are

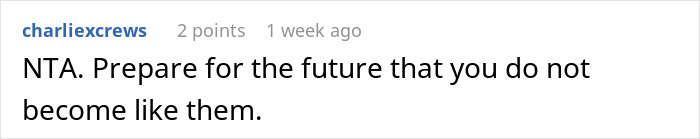

People in the comments sided with the daughter: “Blood doesn’t make the family. Love does”