/Edwards%20Lifesciences%20Corp%20Irvine%2C%20Ca%20campus-by%20Steve%20Cukrov%20via%20Shutterstock.jpg)

With a market cap of $45.2 billion, Edwards Lifesciences Corporation (EW) is a global leader in innovative products and technologies for treating advanced cardiovascular diseases. The company specializes in transcatheter and surgical heart valve solutions, as well as critical care monitoring systems, serving patients across the United States, Europe, Japan, and worldwide.

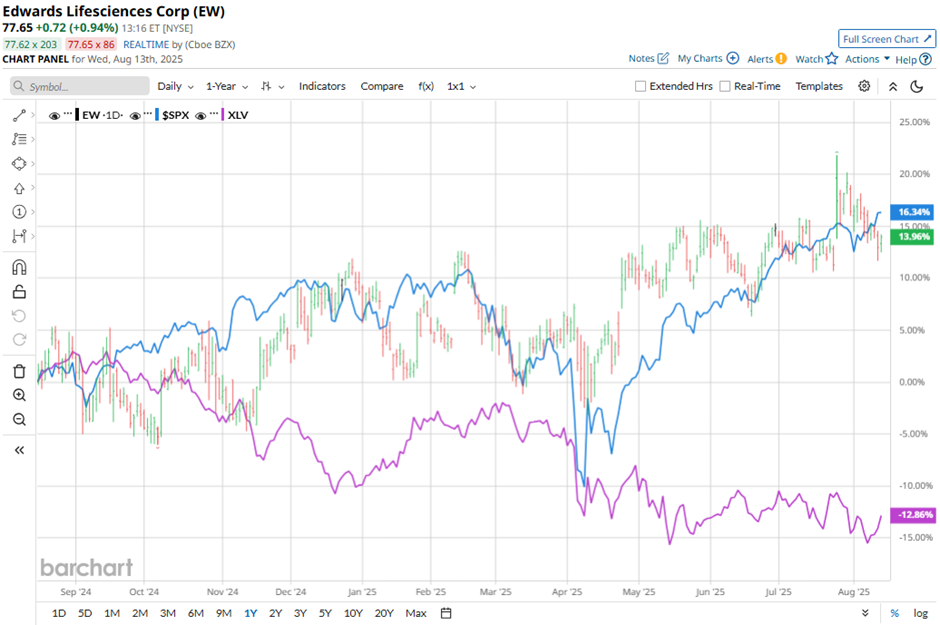

Shares of the Irvine, California-based company have underperformed the broader market over the past 52 weeks. EW stock has increased 17.1% over this time frame, while the broader S&P 500 Index ($SPX) has gained 18.7%. Moreover, shares of the company have risen 4.9% on a YTD basis, compared to SPX's 9.7% return.

Looking closer, Edwards Lifesciences stock has outpaced the Health Care Select Sector SPDR Fund's (XLV) 12.1% decrease over the past 52 weeks.

Shares of Edwards Lifesciences rose 5.5% following its Q2 2025 results on Jul. 24, with adjusted EPS of $0.67 and sales of $1.5 billion, both exceeding estimates and showing strong year-over-year growth. Segment strength was led by TAVR sales of $1.1 billion, TMTT sales of $134.5 million, and Surgical Structural Heart sales of $267 million. The company also raised its 2025 sales growth guidance to $5.90 billion - $6.10 billion and projected adjusted EPS at the high end of $2.40 - $2.50.

For the fiscal year ending in December 2025, analysts expect EW’s adjusted EPS to grow 2.9% year-over-year to $2.50. The company's earnings surprise history is promising. It topped or met the consensus estimates in the last four quarters.

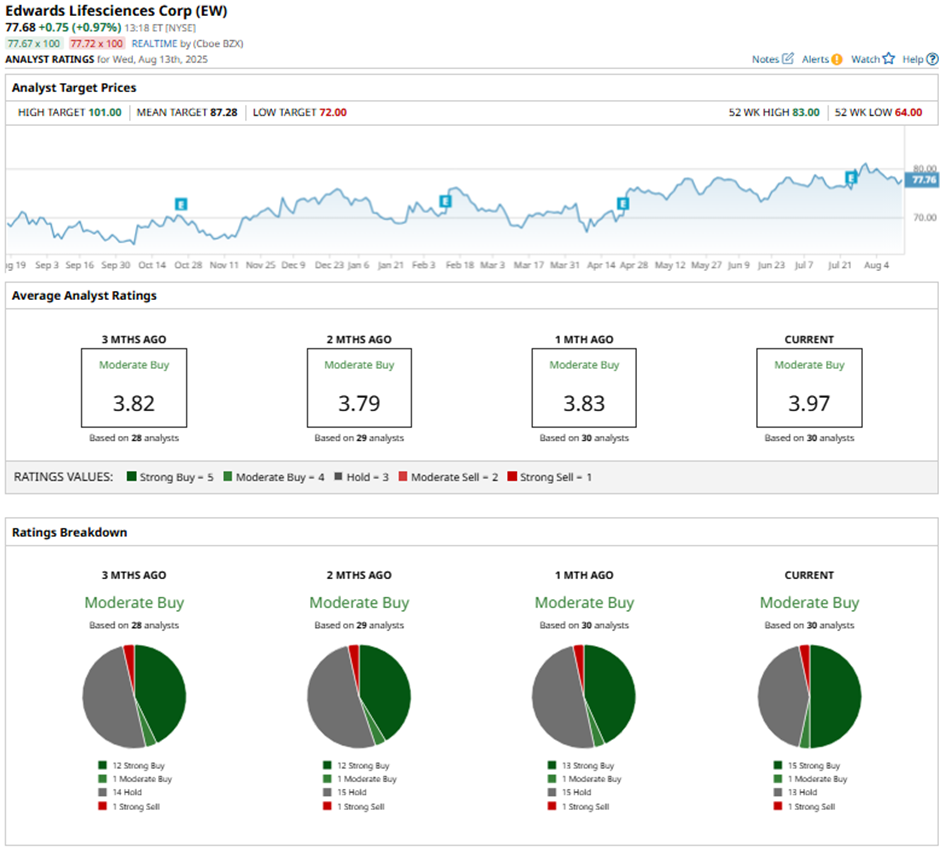

Among the 30 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 15 “Strong Buy” ratings, one “Moderate Buy,” 13 “Holds,” and one “Strong Sell.”

This configuration is more bullish than three months ago, with 12 “Strong Buy” ratings on the stock.

On Jul. 25, RBC Capital raised its price target on Edwards Lifesciences to $89 with an “Outperform” rating.

As of writing, the stock is trading below the mean price target of $87.28. The Street-high price target of $101 implies a modest potential upside of 30% from the current price levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.