With a market cap of $21.8 billion, Edison International (EIX) is one of the nation’s largest electric utility holding companies, providing clean and reliable energy through its subsidiaries. Through Southern California Edison and Edison Energy LLC, the company delivers electricity across a 50,000-square-mile area and offers global decarbonization and energy solutions to diverse customers.

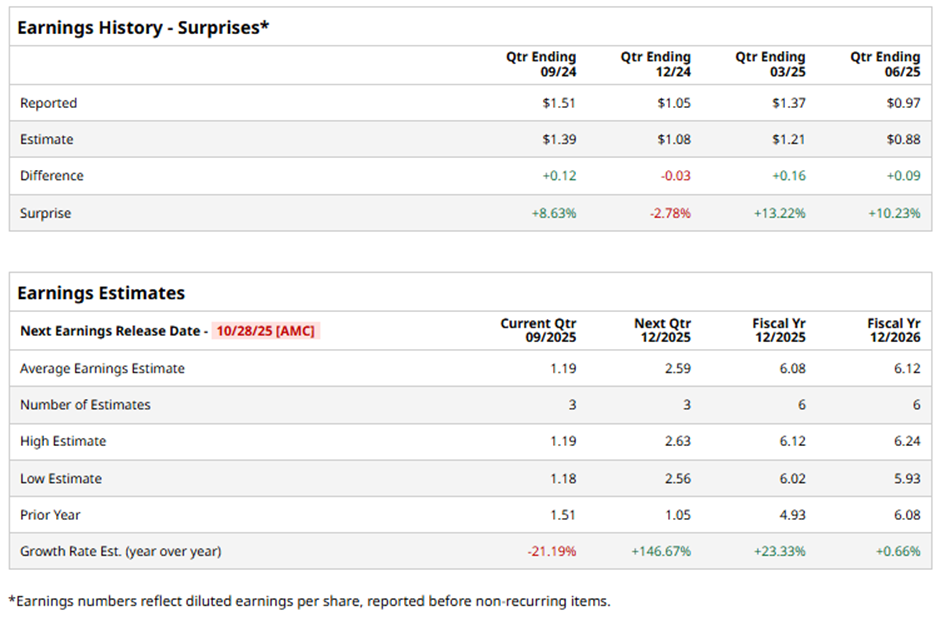

The Rosemead, California-based company is expected to unveil its fiscal Q3 2025 results after the market closes on Tuesday, Oct. 28. Before the event, analysts anticipate Edison to report an adjusted EPS of $1.19, down 21.2% from $1.51 in the year-ago quarter. It has surpassed Wall Street's bottom-line estimates in three of the past four quarters while missing on another occasion.

For fiscal 2025, analysts expect the electric power provider to report adjusted EPS of $6.08, up 23.3% from $4.93 in fiscal 2024.

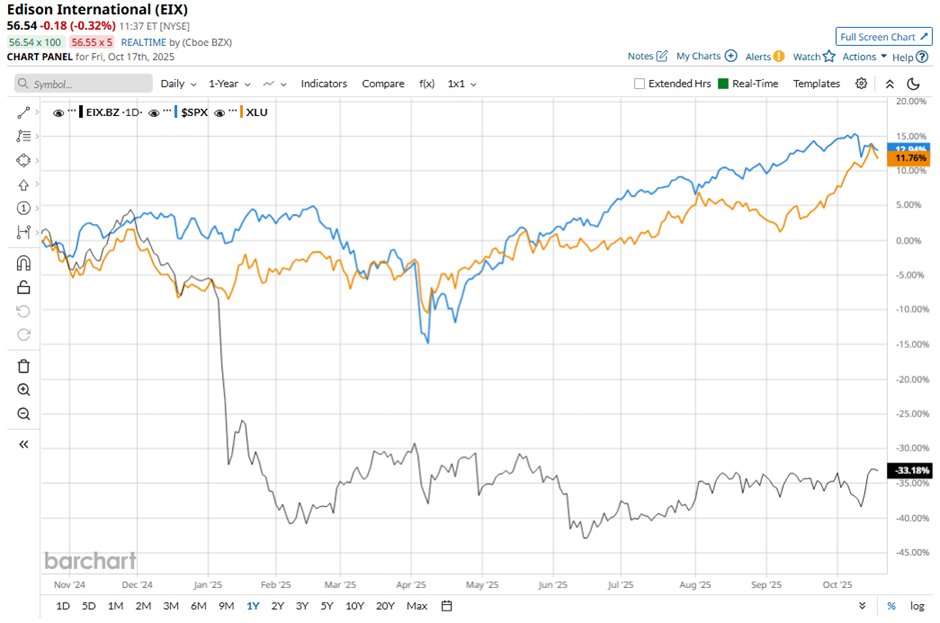

EIX stock has dropped 33.4% over the past 52 weeks, lagging behind both the S&P 500 Index's ($SPX) 13.3% gain and the Utilities Select Sector SPDR Fund's (XLU) 12.2% increase over the same period.

Shares of Edison International rose 1.9% following its Q2 2025 results on Jul. 31 because the company’s adjusted EPS of $0.97 and revenue of $4.54 billion also exceeded forecasts. Investors reacted positively despite a profit decline to $343 million ($0.89 per share) from $385 million ($1.14 per share) the prior year, as the company reaffirmed its 2025 adjusted EPS guidance of $5.94 - $6.34.

Confidence was further supported by Edison’s plans to invest $6.2 billion in wildfire prevention and launch a compensation program, signaling proactive risk management amid ongoing wildfire-related challenges.

Analysts' consensus rating on EIX stock is cautiously optimistic, with an overall "Moderate Buy" rating. Out of 17 analysts covering the stock, opinions include 10 "Strong Buys," six "Holds," and one "Strong Sell." The average analyst price target for Edison International is $65.97, indicating a potential upside of 16.7% from the current levels.