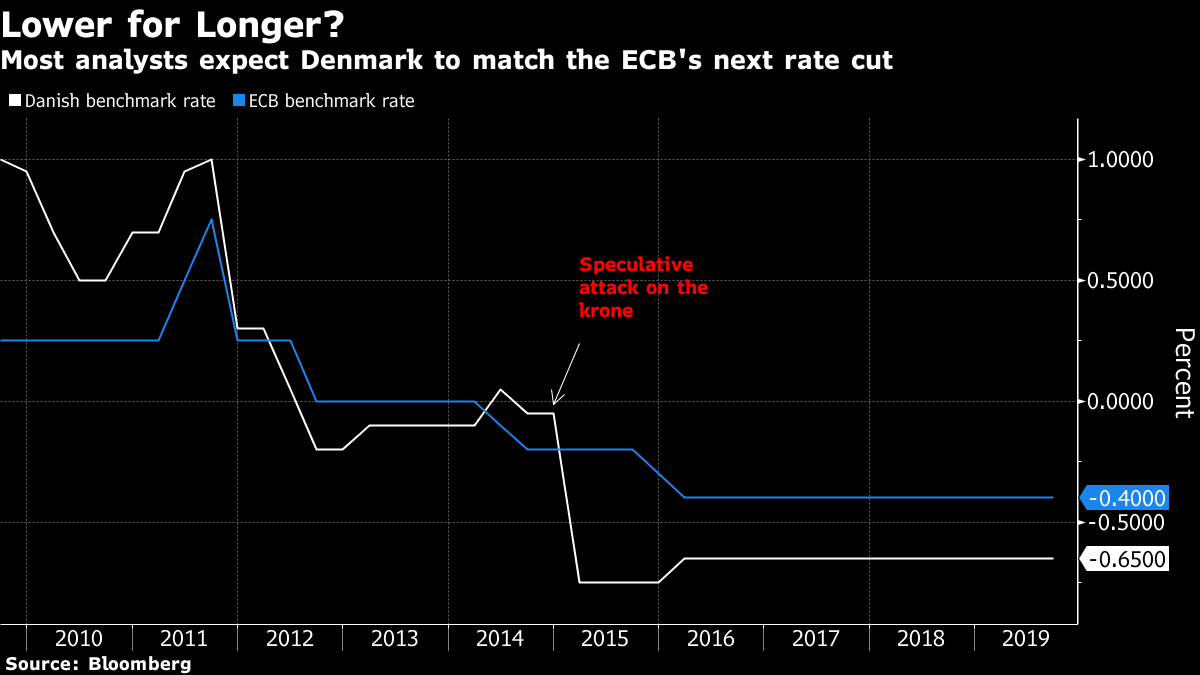

With the European Central Bank widely expected to cut rates on Thursday, policy makers further north are bracing for a replay of extremes last seen in 2015, when their currency was under a speculative attack.

In Denmark, the central bank will probably cut its benchmark rate for the first time in 4 1/2 years. Of the five economists contacted by Bloomberg, four predict a 10 basis-point reduction to minus 0.75%, matching a record low. One says both the ECB and Danish policy makers will need to resort to 20 basis points.

“What we can say for sure is that negative rates are likely to stay for even longer,” said Helge Pedersen, chief economist at Nordea in Copenhagen.

Forecasts:

The Danish central bank’s purpose in life is to defend the krone’s peg to the euro. It doesn’t hold scheduled meetings, but tends to follow the ECB’s every move to avoid currency swings. In recent years, demand for Denmark’s AAA-rated assets has forced policy makers in Copenhagen to keep their deposit rate 25 basis points lower than the ECB’s, a spread that economists expect the Danes to maintain on Thursday.

Denmark has already spent seven years below zero, marking a record in the world of negative benchmark rates. At least one major bank in the country is girding for another eight years of the same. That’s created an outcry in the finance sector, where the blow dealt to traditional revenue streams has forced the industry to rethink its business model.

Denmark’s fixed-rate policy

The central bank defends a 2.25% band around an exchange rate of 7.46038 against the euro, although in practice it sticks to a much narrower range. It intervenes in the currency market by buying or selling kroner and it adjusts the deposit rate to protect the krone’s peg.

In the euro zone, there’s speculation that the ECB might introduce so-called tiering. The model shields commercial banks by creating a separate central-bank account for them at a higher rate than the benchmark. That way, the industry can park excess cash without losing as much money, and the ECB can concentrate its policy on the rest of the economy.

Read More About the ECB’s Plans:

The European Central Bank is about to turn the screws again on financial institutions by diving even deeper into negative interest rates. Lenders including Deutsche Bank AG and UBS Group AG are bracing for another blow to their profitability after five years of sub-zero monetary policy. While the ECB’s strategy is to boost growth and inflation by lowering borrowing costs for companies and households, squeezing banks too much could hamper their ability to supply the credit that fuels the economy. Click here to read more.

Denmark already uses tiering, with a current-account facility allowing the country’s banks to deposit a total of almost $5 billion at 0%. Lars Rohde, the central bank governor, has said he doesn’t want to expand the account. His concern is that to do so would undermine the effect of the negative benchmark rate, and force him to target an even lower deposit rate. But that view may change if the ECB resorts to tiering.

“It will be important for the Danish central bank to assess how much the tiered system will reduce the impact on the rate cut,” said Jens Naervig Pedersen, senior analyst at Danske Bank.

Pedersen at Nordea says that an expanded tiering model in Denmark “could reduce the impact of the rate cut on the real economy. On the other hand it would also legitimize keeping negative rates for even longer.”

To contact the reporters on this story: Morten Buttler in Copenhagen at mbuttler@bloomberg.net;Nick Rigillo in Copenhagen at nrigillo@bloomberg.net

To contact the editors responsible for this story: Tasneem Hanfi Brögger at tbrogger@bloomberg.net;Christian Wienberg at cwienberg@bloomberg.net

©2019 Bloomberg L.P.