/EBay%20Inc_%20app%20by-BigTunaOnline%20via%20Shutterstock.jpg)

Valued at a market cap of $42.1 billion, eBay Inc. (EBAY) is an e-commerce company that operates a global online marketplace connecting millions of buyers and sellers. The San Jose, California-based company earns revenue from listing fees, commissions on sales, advertising, and value-added services. It is scheduled to announce its fiscal Q3 earnings for 2025 in the near future.

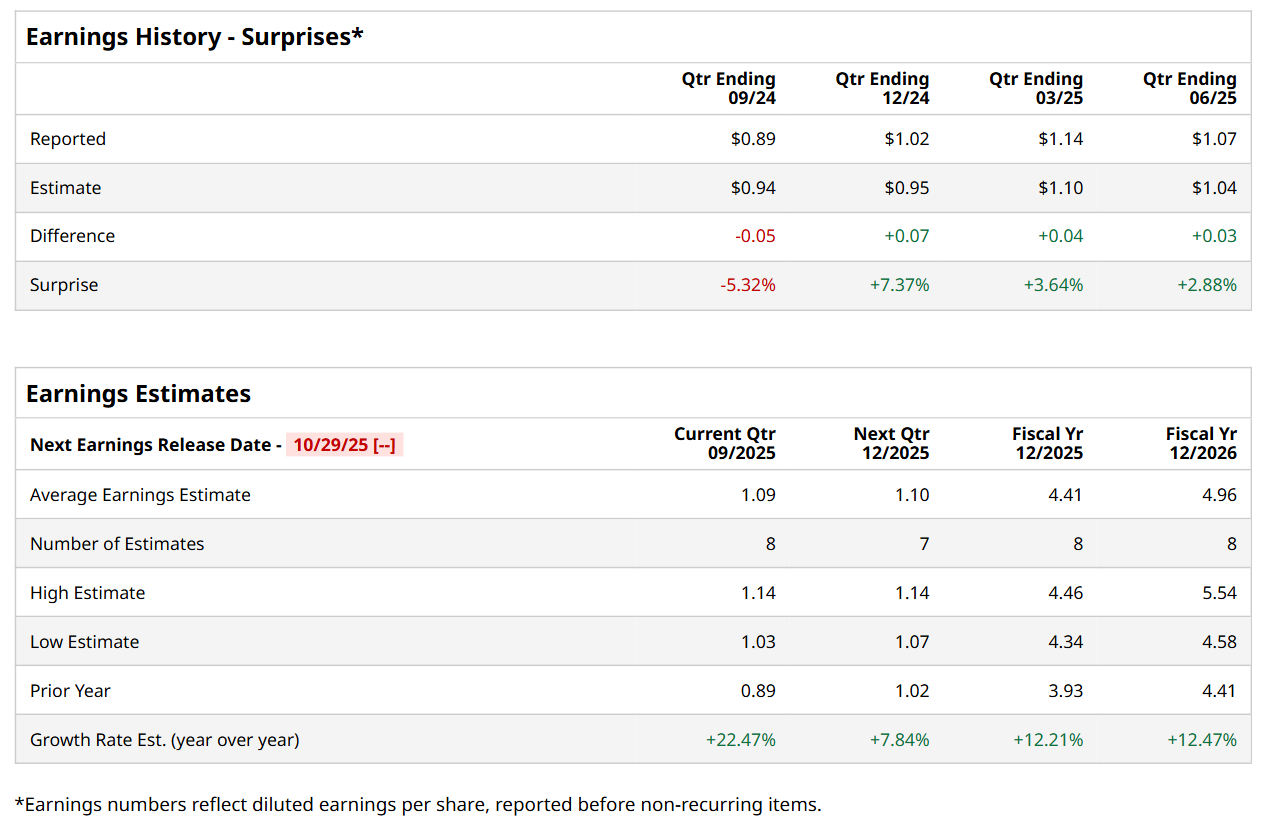

Ahead of this event, analysts expect this e-commerce company to report a profit of $1.09 per share, up 22.5% from $0.89 per share in the year-ago quarter. The company has surpassed Wall Street’s bottom-line estimates in three of the last four quarters, while missing on another occasion. In Q2, EBAY’s adjusted EPS of $1.37 exceeded the forecasted figure by 5.4%.

For fiscal 2025, analysts expect EBAY to report a profit of $4.41 per share, representing a 12.2% increase from $3.93 per share in fiscal 2024. Furthermore, its EPS is expected to grow 12.5% year-over-year to $4.96 in fiscal 2026.

EBAY has rallied 37.1% over the past 52 weeks, outpacing both the S&P 500 Index's ($SPX) 17.4% return and the Consumer Discretionary Select Sector SPDR Fund’s (XLY) 20% uptick over the same time frame.

EBAY delivered impressive Q2 results on Jul. 30, prompting its shares to surge 18.3% in the following trading session. The company’s revenue advanced 6.1% year-over-year to $2.7 billion, surpassing consensus estimates by 2.6%. Moreover, its total Gross Merchandise Volume (GMV) also grew almost 6% from the year-ago quarter to $19.5 billion, reflecting steady marketplace growth. Additionally, its bottom line also looked strong, with adjusted operating margin expanding by 50 basis points, fueling a notable 16.1% year-over-year rise in its adjusted EPS to $1.37, which came in 5.4% ahead of analyst expectations.

Wall Street analysts are moderately optimistic about EBAY’s stock, with a "Moderate Buy" rating overall. Among 33 analysts covering the stock, eight recommend "Strong Buy," two indicate "Moderate Buy," 21 suggest "Hold,” one advises a "Moderate Sell,” and one suggests a "Strong Sell” rating. While the company is trading above its mean price target of $90.13, its Street-high price target of $107 implies a 16.2% potential upside from the current levels.