I’ve been a Barchart user for many years, long before I started writing here. And over time, I’ve started to leverage more and more of the tools and data offered. For instance, I’m now scouting for good chart setups among the stocks reporting quarterly earnings in the next 7 days.

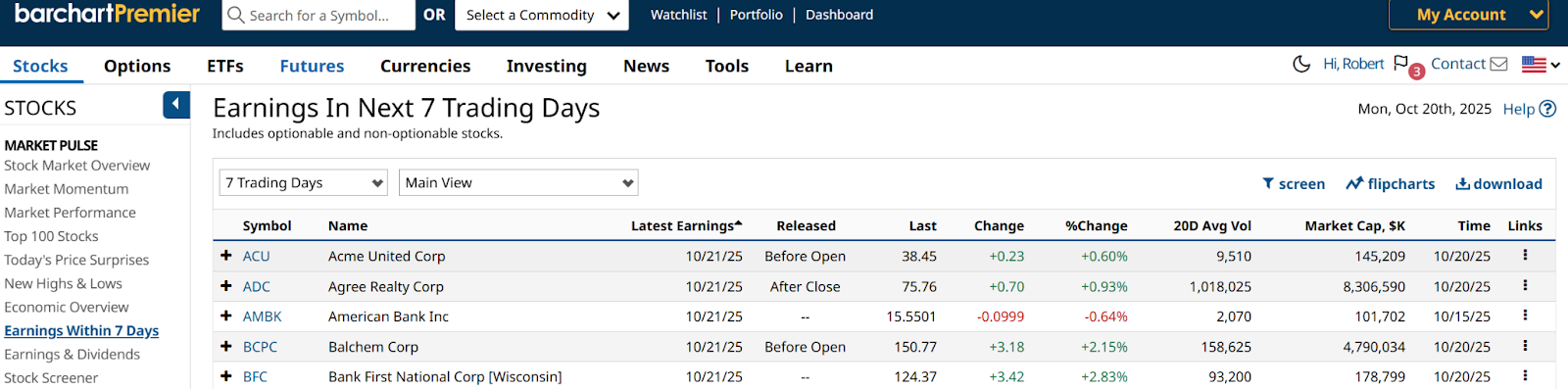

As is often the answer when I ask myself “I wonder if Barchart has a quick and easy way for me to find this out”...the answer is “yes.” This shows the screen and tabs I clicked on to get that list.

You see five stocks at the top. There are 1,500 more on this list! Welcome to earnings season!

My goal was to whittle this list down to a focused group of candidates. Not for long-term investing purposes, but to see if I could take advantage of something I did not pay attention to back when I was managing other people’s money with a longer-term, strategic focus.

Specifically, I’m scouting for the potential that some of the 1,500 names on this list appear to be in prime condition, chart-wise, for their stock prices to pop when earnings are announced.

I am taking small position sizes (very small, in fact!). That’s what my risk manager brain does to accommodate what I think is a modern market reality:

No matter how much we may want to be “long-term investors,” algorithmic trading, indexation, and the massive influx of individual investors operating on their own combine to make this a trader-tilted market.

As I see it, risk management is not simply about using cash versus stock exposure, or hedging with option collars or inverse ETFs. It is also about position size and willingness to be “tactical.” That is, to try to supplement my core investing work by pursuing short-term gains with small amounts of capital.

At first, I started doing this here and there. Now, it is a bigger part of my daily routine. And with earnings season upon us, I’m looking for as many reasonable setups as I can find, knowing that even if these stocks blow it on earnings day, my dollar losses will be limited. Because my position sizes are small.

That said, this might also be a hunting ground for good longer-term prospects. In the time I’ve been doing this, I’ve discovered several stocks that I never would have. Solid businesses that are not household names, but could be in time. At the least, they might represent a way to earn some profit while the market is determining if they are “players” or flashes in the pan.

3 Stocks to Watch This Week

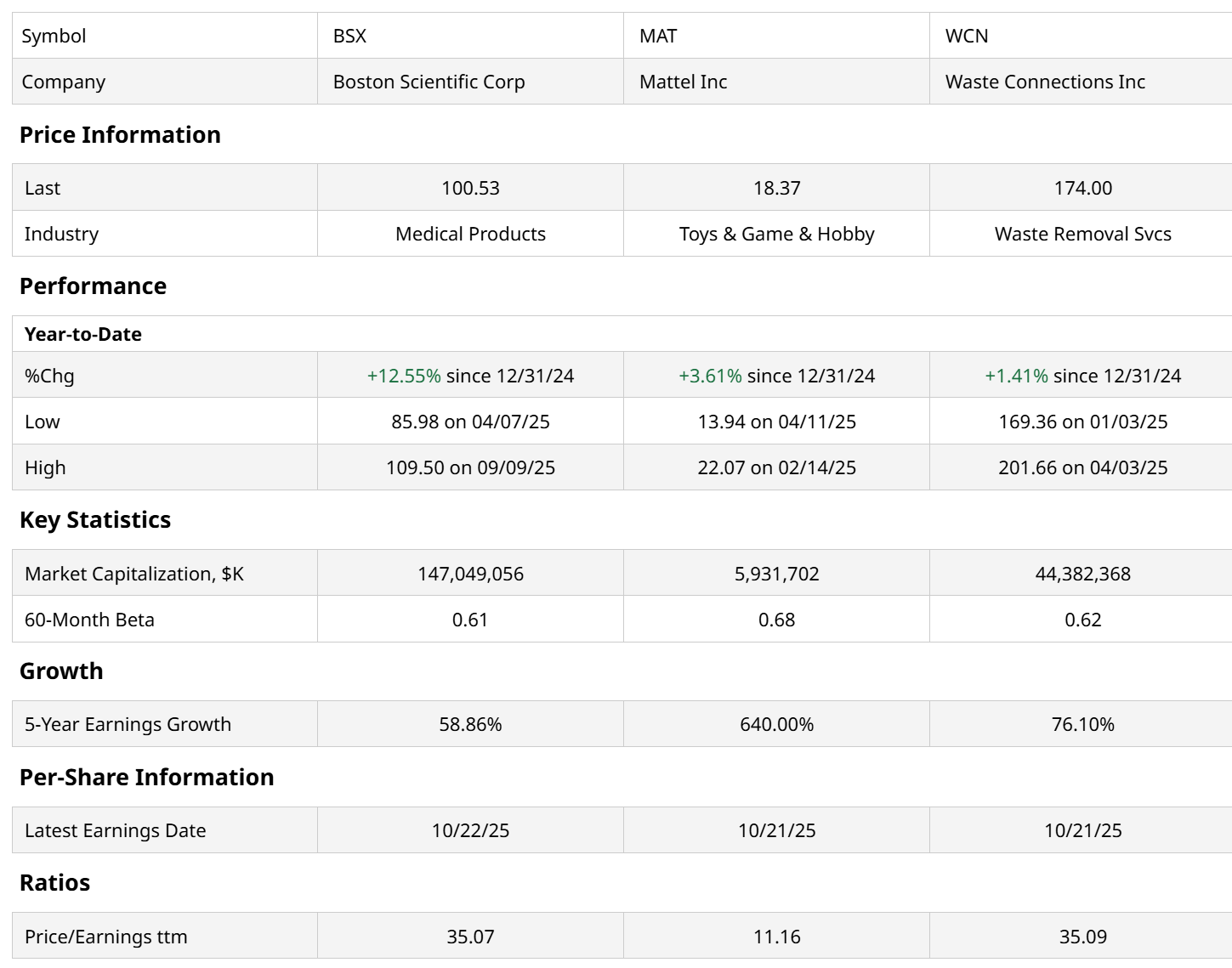

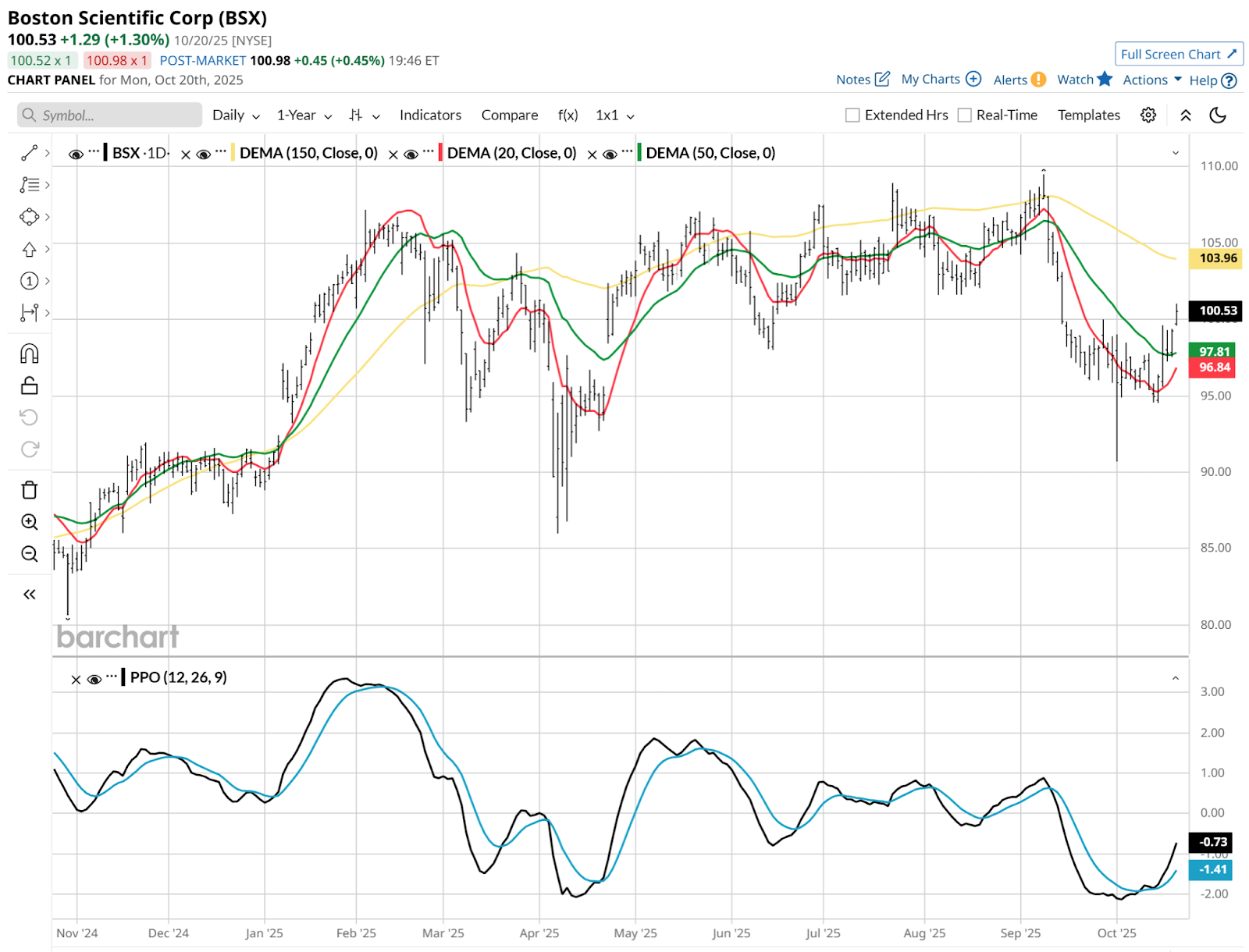

Here are three I landed on. I set a bar at $5 billion in market capitalization for this article, so as to tighten up the list. I ended up with Boston Scientific (BSX), Mattel (MAT), and Waste Connections (WCN).

Here are the charts. They have all recently sold off but are showing signs of renewed life. Earnings could be make or break for them, so I’m well aware of the risk here. Thus, the smaller position size.

As I see it, one of two extreme cases could occur (the third, a quiet market reaction to earnings, is no big deal). A stock can rally and I have the choice to “let it ride” or take a trading profit. Or, if it falls apart, I can sell it out or wait it out.

Either way, I have already accounted for the potential for any of these to lose as much as 25% before I’d consider it more than a token amount of lost capital. As noted above, that’s all part of risk management. And a part of stock-picking I think is underrated these days.

Why I Love Earnings Season (Finally!)

I used to despise the earnings season as a fund manager. All it did was make my existing positions riskier than they were in between quarterly announcements. One-day plunges were always a “thing” in stock investing, but never to the extent they have been during this decade.

But now? I love earnings season! Because I started doing this.

After about 40 years of charting, and with Barchart’s quick, easy, and useful tool kit, this is now part of my regular weekly workflow. Consider making it part of yours too.