/Yum%20Brands%20Inc_%20brands%20on%20phone%20by-%20T_Schneider%20via%20Shutterstock.jpg)

With a market cap of $41.1 billion, Yum! Brands, Inc. (YUM) is a leading global operator and franchisor of quick-service restaurants with well-known brands including KFC, Pizza Hut, Taco Bell, and The Habit Burger Grill. The company operates in over 150 countries, offering diverse food choices across chicken, pizza, Mexican-style, and chargrilled burger categories.

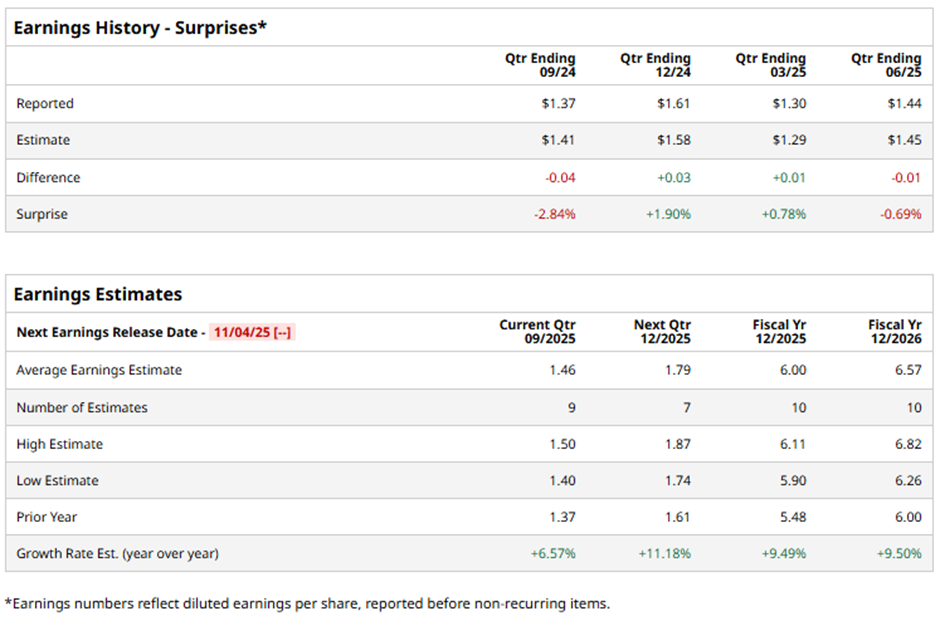

The Louisville, Kentucky-based company is expected to announce its Q3 2025 results soon. Ahead of this event, analysts predict Yum! Brands to report an adjusted EPS of $1.46, up 6.6% from $1.37 in the year-ago quarter. It has exceeded Wall Street's earnings estimates in two of the last four quarters while missing on two other occasions.

For fiscal 2025, analysts forecast the company to report an adjusted EPS of $6, a 9.5% rise from $5.48 in fiscal 2024. Moreover, adjusted EPS is anticipated to grow 9.5% year-over-year to $6.57 in fiscal 2026.

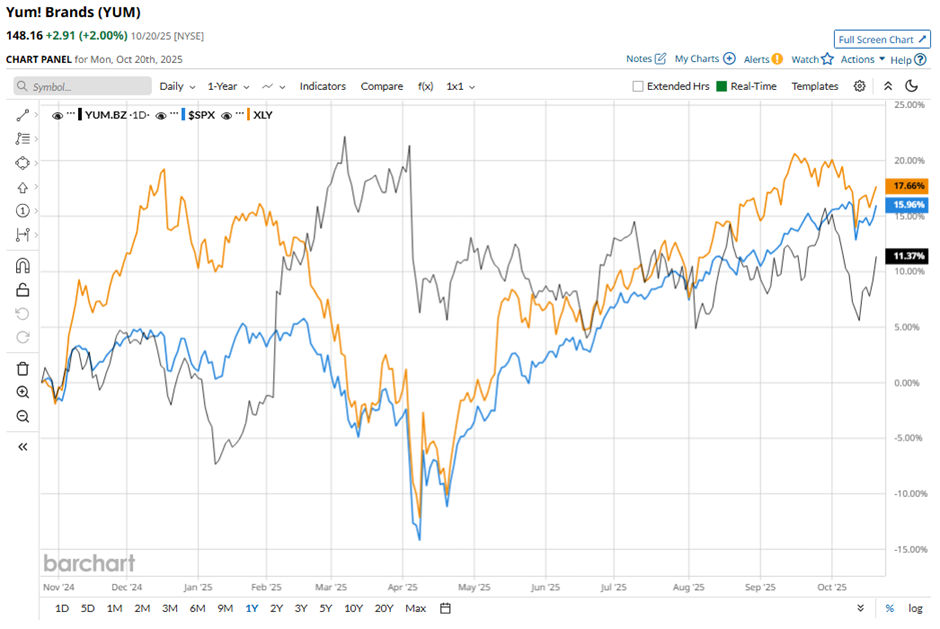

Shares of Yum! Brands have gained 10.3% over the past 52 weeks, underperforming both the S&P 500 Index's ($SPX) 14.8% return and the Consumer Discretionary Select Sector SPDR Fund's (XLY) 18.4% increase over the period.

Yum! Brands’ shares fell 5.1% on Aug. 5 after the company reported Q2 2025 adjusted EPS of $1.44, missing analyst estimates. Rising ingredient costs, higher advertising spending, and total expenses climbing 13% pressured margins, while worldwide same-store sales grew just 2%, short of the 2.37% forecast. Demand softness was most evident at Taco Bell, which contributes 38% of revenue, as U.S. same-store sales growth slowed to 4%.

Analysts' consensus view on YUM stock is cautiously optimistic, with an overall "Moderate Buy" rating. Among 29 analysts covering the stock, nine recommend "Strong Buy" and 20 indicate “Hold.” The average analyst price target for Yum! Brands is $160.08, indicating a potential upside of 8% from the current levels.