/Wynn%20Resorts%20Ltd_%20%20vegas%20hotel%20by-%20Jonathan%20Weiss%20via%20Shutterstock.jpg)

Las Vegas, Nevada-based Wynn Resorts, Limited (WYNN) is a luxury hotel-casino operator known for its high-end integrated resorts. Valued at a market cap of $12.3 billion, the company is distinguished by its upscale amenities, including fine dining, luxury spas, designer retail, convention spaces, entertainment, and its reputation for exceptional guest service and aesthetic design. It is expected to announce its fiscal Q3 earnings for 2025 after the market closes on Thursday, Nov. 6.

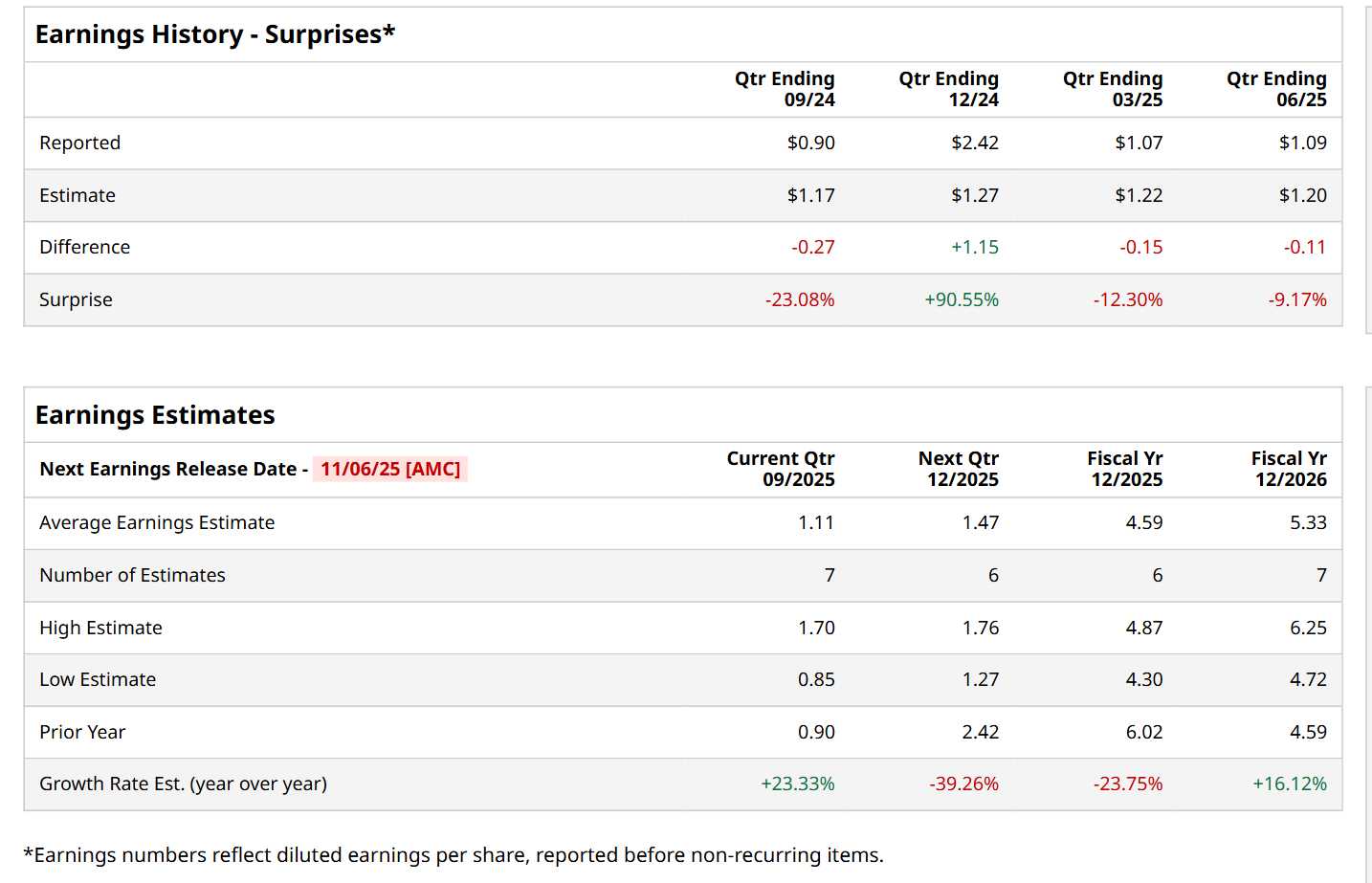

Before this event, analysts expect this high-end resorts operator to report a profit of $1.11 per share, up 23.3% from $0.90 per share in the year-ago quarter. The company has missed Wall Street’s bottom-line estimates in three of the last four quarters, while surpassing on another occasion. Its earnings of $1.09 per share in the previous quarter fell short of the consensus estimates by 9.2%.

For fiscal 2025, analysts expect WYNN to report a profit of $4.59 per share, down 23.8% from $6.02 per share in fiscal 2024. Nonetheless, its EPS is expected to grow by 16.1% year-over-year to $5.33 in fiscal 2026.

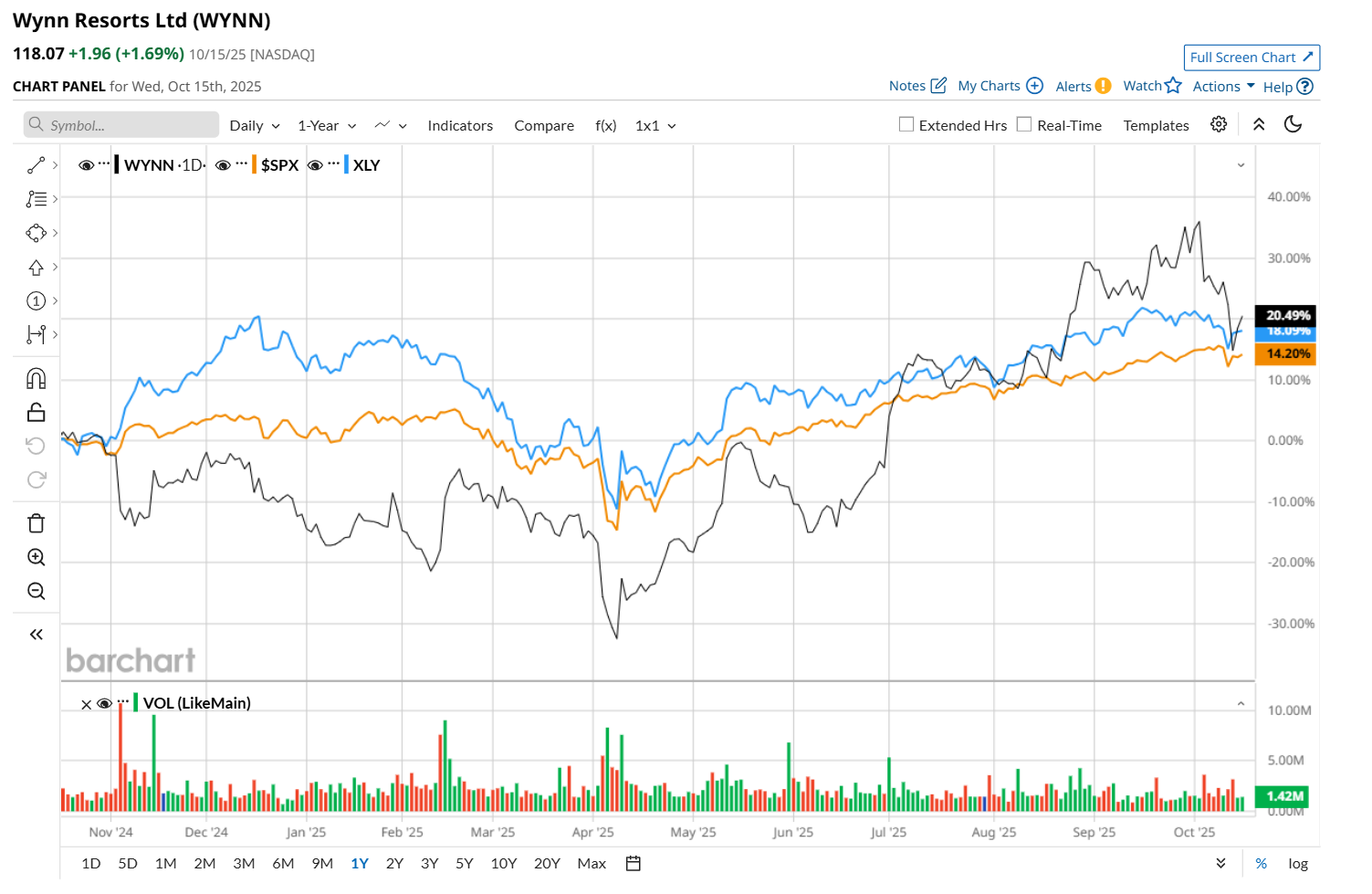

WYNN has surged 18.7% over the past 52 weeks, outpacing both the S&P 500 Index's ($SPX) 14.7% return and the Consumer Discretionary Select Sector SPDR Fund’s (XLY) 18.3% uptick over the same time frame.

On Oct. 3, shares of WYNN tumbled 7.3% after China released weaker-than-expected travel data during the Golden Week holiday. Adding to the pressure were concerns about an approaching tropical cyclone in Macau, which raised fears of potential disruptions to the company’s casino operations.

Wall Street analysts are highly optimistic about WYNN’s stock, with an overall "Strong Buy" rating. Among 16 analysts covering the stock, 13 recommend "Strong Buy," one indicates a "Moderate Buy,” and two suggest "Hold.” The mean price target for WYNN is $135.78, indicating a 15% potential upside from the current levels.