/Vertex%20Pharmaceuticals%2C%20Inc_%20HQ%20in%20Boston-by%20Tada%20Images%20via%20Shuttershock.jpg)

With a market cap of $104.6 billion, Vertex Pharmaceuticals Incorporated (VRTX) is a biotechnology company focused on discovering, developing, and commercializing transformative therapies for serious diseases, with a primary focus on cystic fibrosis (CF). The company also advances treatments for sickle cell disease, beta thalassemia, APOL1-mediated kidney disease, type 1 diabetes, and other conditions.

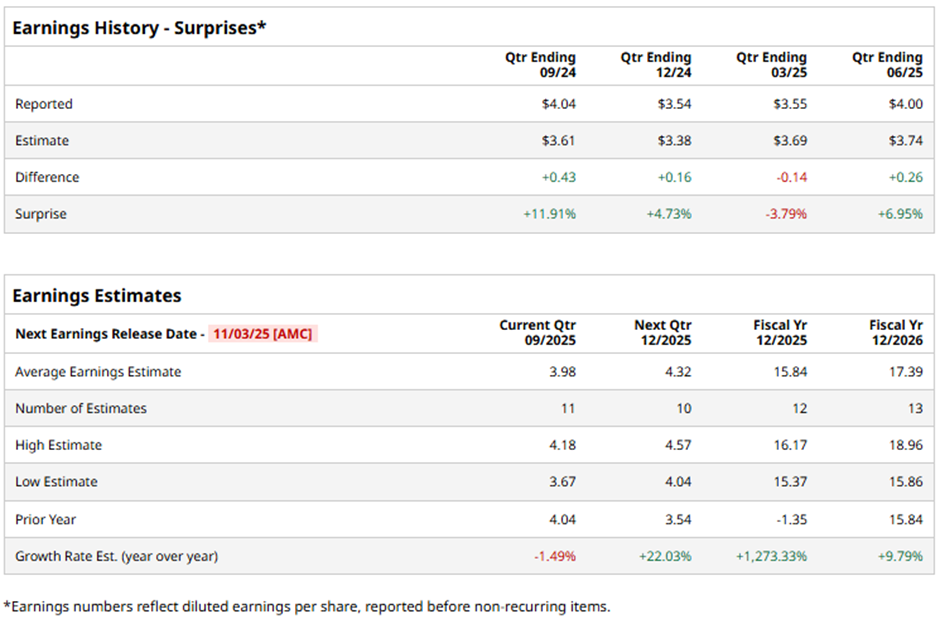

The Boston, Massachusetts-based company is slated to announce its fiscal Q3 2025 results after the market closes on Monday, Nov. 3. Ahead of the event, analysts expect Vertex Pharmaceuticals to report an adjusted EPS of $3.98, down 1.5% from $4.04 in the year-ago quarter. It has surpassed Wall Street's bottom-line estimates in three of the past four quarterly reports while missing on another occasion.

For fiscal 2025, analysts predict the drugmaker to report adjusted EPS of $15.84, a significant surge from a loss of $1.35 per share in fiscal 2024.

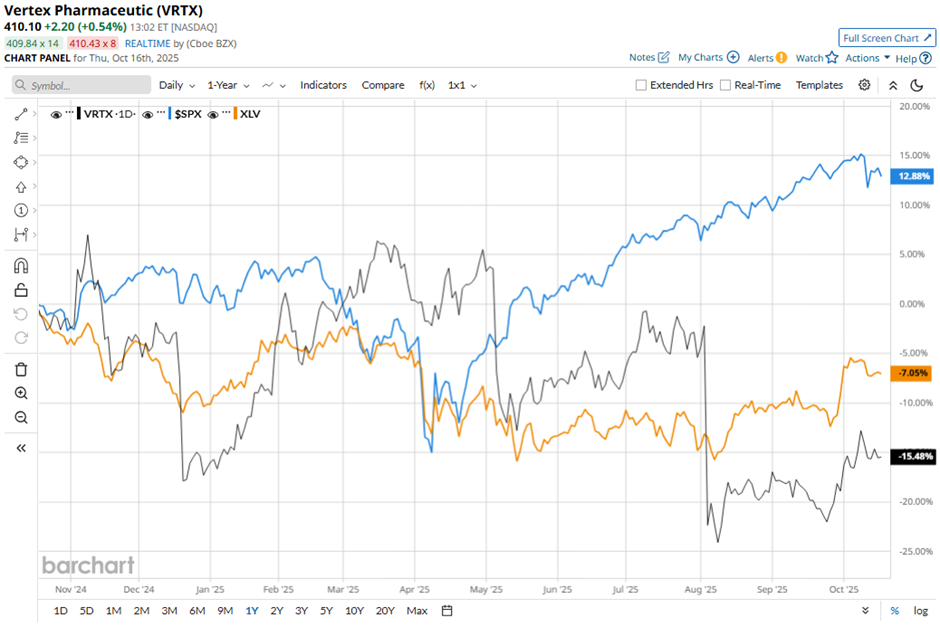

Shares of Vertex Pharmaceuticals have fallen 15.6% over the past 52 weeks, lagging behind both the S&P 500 Index's ($SPX) 13.9% increase and the Health Care Select Sector SPDR Fund's (XLV) 6.8% decline over the same period.

Despite reporting better-than-expected Q2 2025 adjusted EPS of $4.52 and revenue of $2.96 billion on Aug. 4, Vertex’s shares tumbled 20.6% the next day after the company halted development of its non-opioid painkiller VX-993 due to a failed mid-stage trial showing no statistically significant pain relief (74.5 vs. 50.2 for placebo). Vertex also scrapped plans to expand Journavx into nerve pain treatment following FDA discussions, raising doubts about its diversification beyond cystic fibrosis drugs.

Analysts' consensus rating on VRTX stock is cautiously optimistic, with an overall "Moderate Buy" rating. Among 33 analysts covering the stock, 18 recommend a "Strong Buy,” one has a "Moderate Buy" rating, 13 give a "Hold" rating, and one has a "Strong Sell.” The average analyst price target for Vertex Pharmaceuticals is $491.52, indicating a potential upside of 19.9% from the current levels.