Verizon Communications Inc. (VZ) is a leading American telecommunications company that provides a broad portfolio of services, including wireless communications, broadband, fiber networks, and enterprise solutions. Headquartered in New York City, the company plays a critical role in both consumer and business connectivity across the U.S.

Verizon’s market capitalization currently stands at around $174.7 billion. With strong infrastructure assets and a diversified service offering, Verizon continues to invest heavily in next-generation networking and emerging technologies to maintain its competitive edge in the telecom sector. The company is expected to announce its fiscal Q3 earnings for 2025 before the market opens on Wednesday, Oct. 29.

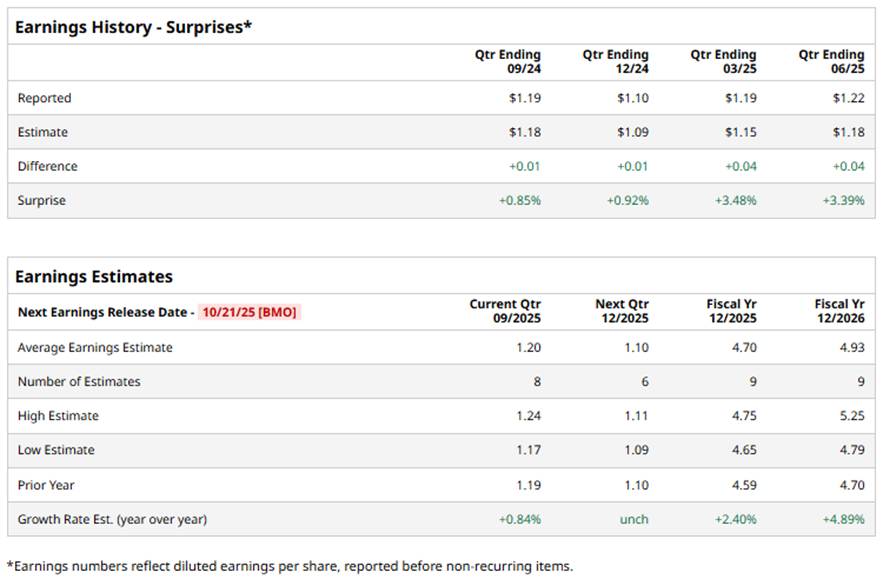

Ahead of this event, analysts project this telecom giant to report a profit of $1.20 per share, up marginally from $1.19 per share in the year-ago quarter. The company has exceeded Wall Street’s bottom-line estimates in each of the last four quarters.

For the full year, analysts expect Verizon to report EPS of $4.70, up 2.4% from $4.59 in fiscal 2024. Furthermore, its EPS is expected to grow 4.9% year-over-year (YoY) to $4.93 in fiscal 2026.

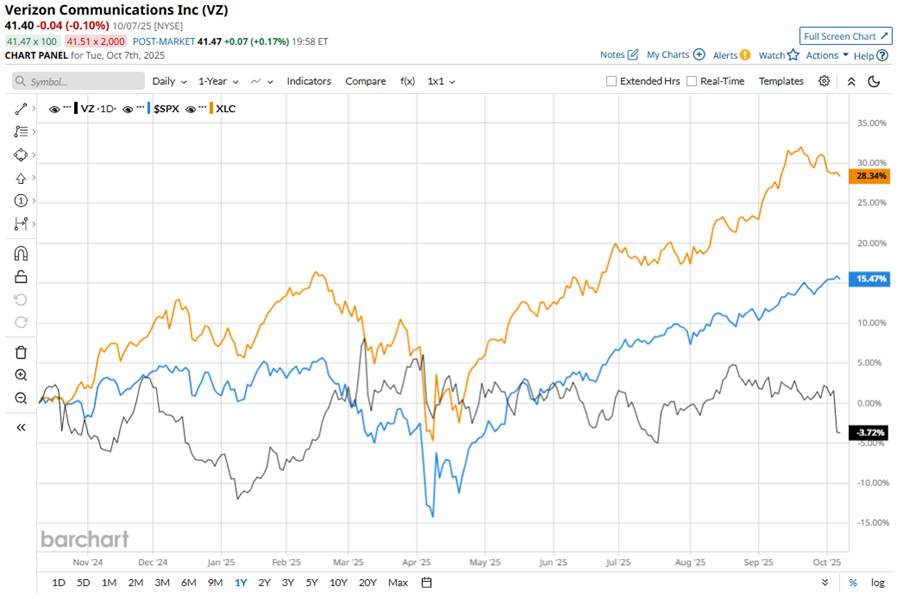

VZ stock has declined 5.6% over the past 52 weeks, underperforming both the S&P 500 Index’s ($SPX) 17.9% return and the Communication Services Select Sector SPDR ETF’s (XLC) 29.4% uptick over the same time frame.

Verizon’s shares have been under pressure lately for several reasons. One of the most immediate triggers was the abrupt CEO change. The announcement that former PayPal Holdings, Inc. (PYPL) CEO Dan Schulman would succeed Hans Vestberg rattled investors, who viewed the shift as signaling potential strategic upheaval and increased uncertainty.

Beyond leadership, investors are concerned about Verizon’s heavy debt burden and the ongoing high capital demands associated with maintaining competitiveness in 5G and fiber infrastructure.

Wall Street analysts are moderately optimistic about VZ stock, with a “Moderate Buy” rating overall. Among 30 analysts covering the stock, nine recommend a “Strong Buy,” three suggest a “Moderate Buy,” and the remaining 16 analysts are playing it safe with a “Hold.”

The mean price target for VZ is $48.29, which indicates 16.6% upside potential from the current levels.