/U_S_%20Bancorp_%20logo%20on%20building-by%20Sundry%20Photography%20via%20iStock.jpg)

Valued at a market cap of $76.9 billion, U.S. Bancorp (USB) is one of the largest U.S. regional banks, operating through its subsidiary U.S. Bank. With roots dating back to 1863, the bank offers a wide range of services spanning consumer and business banking, wealth and institutional services, corporate lending, and payment processing.

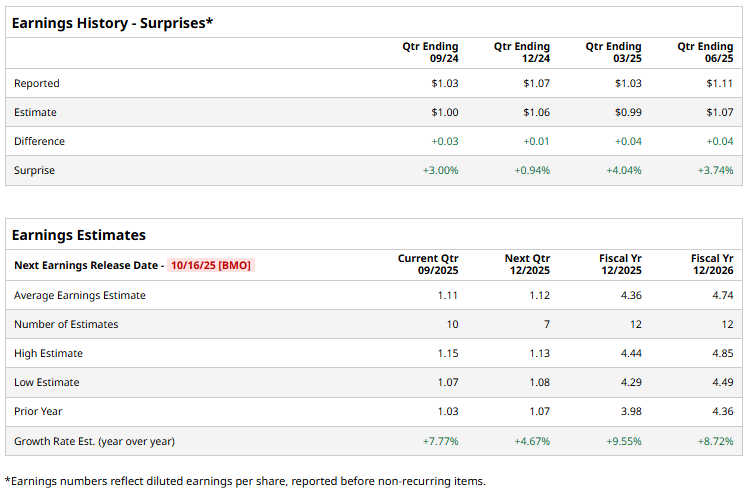

The Minneapolis, Minnesota-based bank is expected to announce its fiscal Q3 earnings before the market opens on Thursday, Oct. 16. Before this event, analysts project this financial services company to report a profit of $1.11 per share, up 7.7% from $1.03 per share in the year-ago quarter. The company has surpassed Wall Street’s bottom-line estimates in each of the last four quarters.

For the current year, analysts expect USB to report EPS of $4.36, up 9.6% from $3.98 in fiscal 2024. Furthermore, its EPS is expected to grow 8.7% year over year to $4.74 in fiscal 2026.

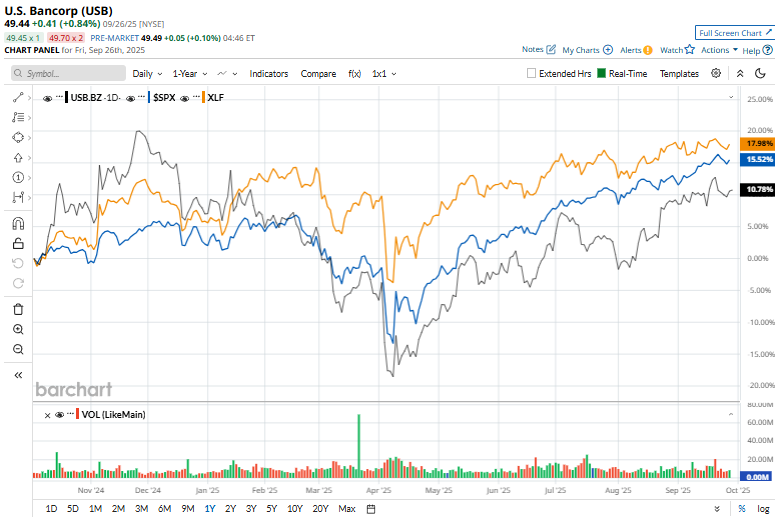

Shares of USB have surged 9.1% over the past year, trailing both the S&P 500 Index's ($SPX) 15.6% rise and the Financial Select Sector SPDR Fund’s (XLF) 19.6% return over the same time frame.

On Sept. 17, U.S. Bancorp lit up the markets after unveiling a cut to its prime lending rate, trimming it from 7.50% to 7.25% effective tomorrow, Sept. 18, 2025, across all U.S. Bank locations. The announcement ignited investor optimism, propelling USB shares more than 2% higher on the day.

Wall Street analysts are moderately optimistic about USB’s stock, with a "Moderate Buy" rating overall. Among 25 analysts covering the stock, 11 recommend "Strong Buy," two suggest “Moderate Buy,” 11 indicate “Hold,” and one recommends a “Strong Sell” rating. The mean price target for USB is $53.83, which indicates an 8.9% potential upside from the current levels.