/Teradyne%2C%20Inc_%20logo%20o%20building-by%20Michael%20Vi%20via%20Shutterstock.jpg)

Valued at around $23.2 billion by market capitalization, Massachusetts-based Teradyne, Inc. (TER) designs and manufactures automated test equipment and robotics systems for semiconductor, electronics, and industrial applications. The company’s test solutions ensure product quality, while its collaborative and mobile robots assist manufacturing and warehouse operations across businesses of all sizes.

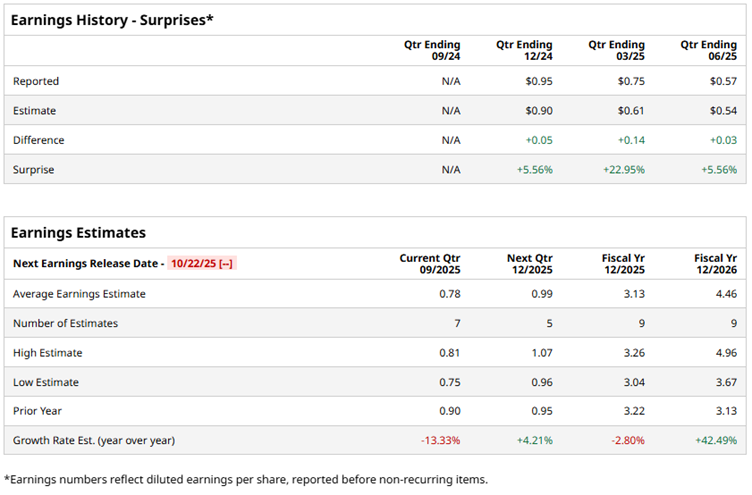

Having reported its fiscal 2025 second-quarter results in July, the company is now preparing to roll out its third-quarter earnings soon. And ahead of this event, analysts are looking for Teradyne to post earnings of $0.78 per share in the upcoming report, representing a 13.3% decline from the $0.90 per share it earned in the same quarter last year.

Even so, the company has a strong track record of outperforming, having topped Wall Street’s profit estimates for three straight quarters. Looking further out, for the full year, earnings is expected to dip 2.8% to $3.13 per share from $3.22 in fiscal 2024, but fiscal 2026 is projected to mark a major turnaround, with EPS anticipated to jump 42.5% to $4.46 per share.

Over the past year, Teradyne’s stock has advanced 13.8%, a respectable climb, though it has trailed the broader S&P 500 Index ($SPX), which is up 17.1%, and lagged even further behind the Technology Select Sector SPDR Fund (XLK), which has surged an impressive 28%.

On Jul. 29, Teradyne delivered a stronger-than-expected second-quarter earnings report, sparking an 18.9% jump in its shares during the very next trading session. While revenue slipped 10.7% YOY to $651.8 million, the figure still edged past consensus expectations. The bottom line reflected a similar trend.

Adjusted EPS of $0.57 for the quarter fell 33.7% from the prior year, yet managed to beat Wall Street’s forecast by 5.6%. The Semiconductor Test Group was the key bright spot, driving results beyond expectations, with System-on-a-Chip (SOC) demand, particularly for artificial intelligence (AI) applications, emerging as the standout growth catalyst.

Wall Street remains cautiously bullish on the stock, with an overall “Moderate Buy” rating. Among 18 analysts covering the stock, nine recommend a "Strong Buy," one indicate a "Moderate Buy," six advise a “Hold,” one suggests “Moderate Sell,” and the remaining one has issued a “Strong Sell.” While the stock is trading premium to its mean price target of $121.56, the Street high target of $200 suggests that TER can still rally as much as 33.2% from here.

On the date of publication, Anushka Mukherjee did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.